Quick summary:

New survey, for Q4 competition, is up & running - click here.

Markets are jumpy for three weeks in a row. From Sep 25th to Oct 13th, SPX has gained only 0.2%, with high intraday volatility (range was from -2.5% to +1.4%)

These are weeks where the BASON can’t really perform well, but we did manage to pull out two minor positive weeks and only one minor negative - when markets trade sideways, our focus is capital preservation.

This week it’s mostly about earnings. The banks continue (BoA, GS, MS, BNY), and on Wed after close we get TSLA and NFLX. On Thursday we get jobless claims.

Our paid subscribers will get an insight into what can be expected of upcoming earnings and how this might shake markets in the near term.

The Q4 competition is live and well, so make sure you jump into the survey. Prizes are as last quarter, $5,000 distributed across the top 20 participants.

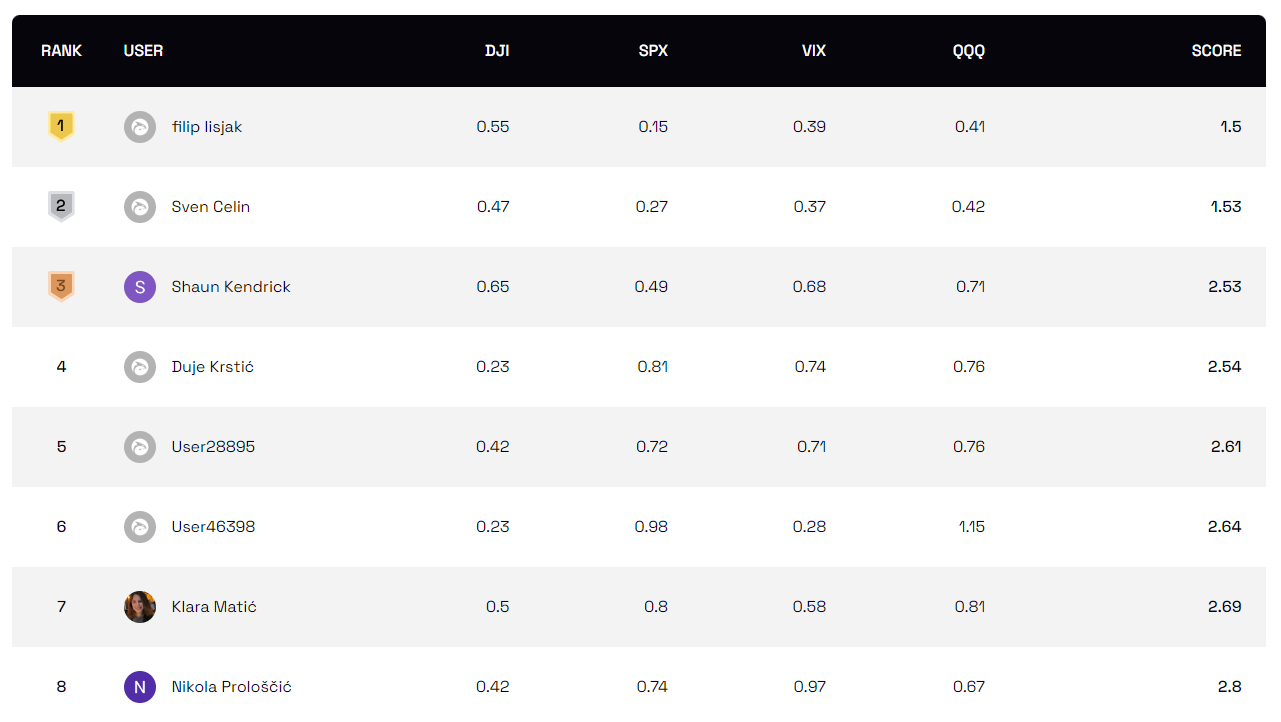

Some new names up on the leaderboard, always good to see. Opening precision from the top performers is very impressive after the first two weeks. Keep up the great work!

NOTE: For all those new to the whole thing, here is a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

After a few clear downtrends during August and September, the past three weeks have mostly been jumpy (kangaroo) sideways trading. It actually is quite similar to the final two weeks of August and first week of September - three weeks of short squeeze induced rallies, coupled with a few strong sell-off days. In other words, high intraday volatility, only to see the markets end up more or less where they started three weeks ago.

The same is happening right now. SPX is only 0.2% higher than its open on Monday, September 25th. And we had moves that pushed it down 2.5%, and up 1.4%. Very strong daily swings in either direction, very often fading the initial news-driven move of the day.

Look at last week for example. SPX opened -0.5% on Monday, most likely an immediate reaction to the Israel terrorist attack (pricing in the expected rise of oil prices), but ended up +0.6%. It rallied most of Tuesday as well. On Wednesday, it was moving down in anticipation of FOMC minutes, and after they came out, it rallied. Thursday’s CPI came in very much within expectations (slightly warmer), and there was really no reaction until a strong mid-day sell-off. Friday opened high on good bank earnings, only to see it completely reversed by the end of day.

In environments like these, for us it’s all about capital preservation. Lower risk exposure, lower trading size, keep it contained.

While the macro book is holding to its positions, the BASON suggested an up move for the week, expecting the rally to continue. We did enter just after FOMC minutes on Wednesday, and capitalized on that move a few hours after Thursday open, but were then forced to see most of those gains deplete following the sell-off. Some of it was made back during Friday open, but yet another push down made for a rather underwhelming week. We managed to secure a 0.85% gain, which is very good considering the context.

Earnings

Earnings are back in focus over the next few weeks (there is also FOMC on Nov 1st, and the quarterly refunding announcement from the Treasury on Oct 30th - we will pay particular attention to these. They will move markets for the rest of Q4).

But for now, it’s about earnings. Last week the big bank earnings came in really good, much better than expected, and this led to a strong open on Friday. By the end of the day it was reversed and ended up negative. Tough luck.

This week the rest of the banking sector reports earnings, and they will most likely mimic the good results from other banks, reported in the previous week. And then, on Wed after close, we get TSLA and NFLX. These two usually move markets strongly the next day. No reason to expect otherwise. The only question is which direction? We leave that up to you, dear readers. Good luck with the competition!

Finally, on Thursday before open we get the jobless claims. Another important indicator to keep in mind.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.