Welcome back dear subscribers! The competition is officially open for week 7 in Q2 2022. The updated leaderboard is available within the app. Get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Thanks for participating, and keep having fun!

Last week’s accuracy & precision

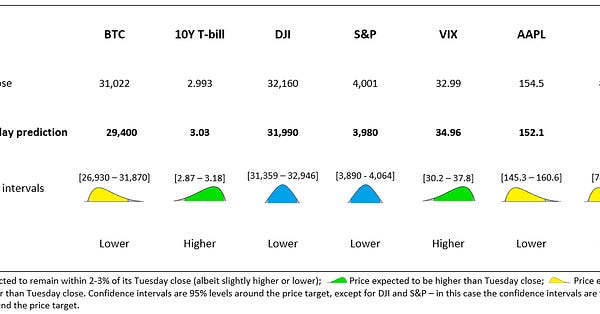

Last week was the 6th week in a row that the major market indices ended the week lower. At one point on Thursday, S&P and the Dow reached 52-week lows, before bouncing back on Friday - just enough to fall within 1% of our predictions. This bear market has been brutal thus far, driven by high volatility, but even in such volatile periods the BASON outperformed. Usually, higher volatility implies lower accuracy, but last week, despite the S&P swinging 6% and the Dow swinging 5% (not to mention the BTC and TSLA swings), we managed to deliver a prediction with 1% error for the two, and <2% for BTC and TSLA.

The direction being a miss here is slightly misleading - the S&P and the Dow finished lower for the week, but they were slightly higher than Tuesday’s close, which is our reference point. Either way, it was yet another good week in terms of accuracy for the BASON.

Profits: biggest weekly gain in 2022

As usual, this translated to another profitable week, this one delivering the highest weekly profit in 2022. We traded the following:

We traded 10 SPY 13/05 iron condors, ranging from 387/388 to 406/407 (10 contracts) for $490 immediate gain. We bought downside protection, one SPY 406 13/05 put for $10.68 per contract.

But we did buy DIA puts, on the clear sign of lower direction. We bought 1 DIA 13/05 put at 327 strike for $7.8 per contract.

As we mentioned on our Twitter feed (make sure to follow us on Twitter to know exactly when we close our positions so as to maximize gains), the puts generated a significant profit after Thursday’s sell-off. On that day, the SPY iron condor was breaching its lower boundary, so the hedges worked quite well.

The next day, as the markets started bouncing back, thus enabling us to profit from the iron condor as well, the puts reached their take-profit limits and were sold - the SPY put for $482 profit (sold at $15.5), and the DIA put for $480 profit (sold at $12.6). The iron condor was closed at $470 profit, making the total for the week $1432.

How does this translate into overall performance?

47.66% in 2022.

208% compounded gains since the start of the survey in May 2021.

That’s $30,828 for an initial $10,000 portfolio.

The S&P500 is still delivering a negative return throughout the observed period, of -4% since May 2021. And it is down -16% in 2022.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!