Quick summary:

New survey is up & running - click here.

5/6 indicators came within 0.5% of their predicted targets!

Last week, sideways trading all three days, but we kept another profitable week (up by 1%)

Earnings continue this week, VIX is still low, bigger moves await

The 2023 Q2 competition is open for its third week.

The survey is here:

More changes across the leaderboard. It takes a while to consolidate, we’re anxious to see who will rise on top soon!

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance

The chart below perfectly encapsulates the trading environment we’re in. Monday end of day rally; Tuesday gap up open, only to reverse quickly; Wed gap down followed by another gradual reversal; and then just as Thu was looking to be the same as Wed (low open was driven by the TSLA earnings miss), we get an end of day sell-off, followed by a low volume sideways Friday. How fun.

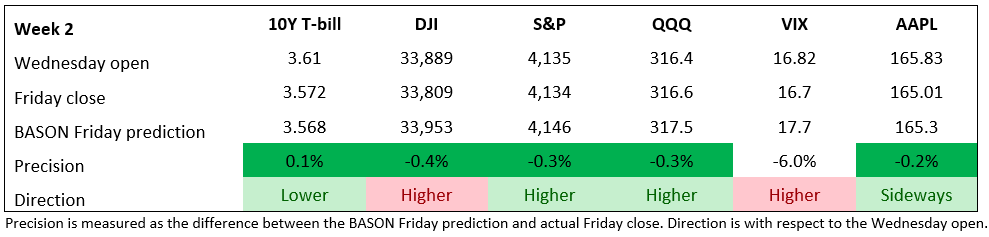

Not much to be done in these conditions. We were happy to see our predictions go really close (see table below), and particularly happy not to have lost money, ending the week with a 1% gain. Improvement is slow, gains are small, but it’s necessary to do it this way rather than our usual aggressiveness from last year. Patience is key.

Despite the swings, we came in really really close for each prediction. I can’t remember when we had 5 out of 6 indicators coming in so close, within 0.5% precision. Even with the directional trades not doing much, the precision was impressive.

Earnings week continues, and it’s a big one. Microsoft and Google are coming up today after close, Meta is Wed after close, and AMZN on Thursday. And then there’s the rest of the economy :)

It started off slow (read boring) on Monday, but it’s bound to pick up soon.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter!