Quick summary:

New survey is up & running - click here.

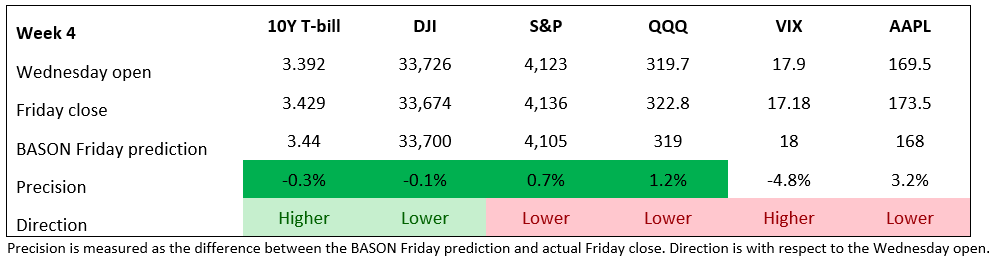

Another week with great accuracy and precision, especially after FOMC

The sell-offs on Wed and Thu were reversed on Friday, but for us, it was yet another profitable week

Still some earnings left to go, but more importantly, CPI and PPI get reported this week

The 2023 Q2 competition is open for its fifth week.

The survey is here:

It’s getting contested on our leaderboard once again. Top 5 are 1 point apart!

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance

Last week was exciting. Tuesday opened with a substantial sell-off (rare on the day *before* FOMC), recovered a bit going into FOMC and then notice the struggle after the announcement came out on Wednesday. These are 15-min candles, and for the first hour - after the expected 25bps hike and during Powell speech for the first half hour - each had a strong move in both directions, only to finish close to where it opened. A series of sell-offs came in the final hour, just as Powell was getting done.

This is when we entered, as per our prediction (see below), and closed for a 2% profit during Thursday’s intraday jumps (as our new signal helped us recognize the optimal exit point, before the end of day when AAPL earnings were coming out). Good call given that Friday’s rally erased all the short gains from the two days prior. Markets are, as you can see, still jumpy, still no clear winner between bears and bulls. But as we’ve adapted, it’s easier to handle the volatility. Our only regret is not recognizing this sooner.

So we ended up with good accuracy on the first four indicators, and even direction was great until the Friday reversal. All in all, a successful week!

This week, still more earnings to come (PYPL, PLTR, ABNB, DIS, TM, JD, etc.), but more importantly we will get to see CPI on Wed and PPI on Thu, both before markets open. Another exciting week is upon us!

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter!