Quick summary:

New survey is up & running - click here.

Last week’s performance was the exact opposite of the one before: missing direction and marginally falling outside our confidence intervals

Friday’s rally is what killed all of our positions, reaching a limited loss for the week

This week there are two labor market reports (Wed and Fri), and Fed Chairman Powell is testifying before Congress on Tue & Wed

The 2023 Q1 competition is now open for its sixth week, and entering the final month - March. Thank you all for joining us, and I hope you find the competition challenging and interesting. As you know, the competition has changed a bit (read about all the new features here) to give you all a greater chance of getting rewarded, both quarterly and at the end of each year by participating in our annual profits.

More changes to the leaderboard after last week’s surprising final day outcome, and margins are as tight as ever!

Keep it up and best of luck!

The survey is here:

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance

It was one of those weeks. Going smoothly on Wednesday and Thursday, and then something flipped on Friday (started on Thursday afternoon actually), leaving us wrong on both of our major predictions.

There was no fundamental catalyst for the mini-rally on Friday, no change in narrative or any new data that led the SPX to break its upper resistance (the two green lines, representing a short-term up trend from October lows) on that last day of the week.

There was, perhaps, (in hindsight as always) an implication of SPX failing to break through its major support twice last week (the red line, represents a year-long downtrend, from January 2022 - it used to be major resistance throughout 2022, and turned into major support ever since January 2023). It broke through on Thursday, enabling us to increase the stop-losses on the put positions, but it didn’t hold.

As you know, we don’t trade based on technical indicators, but it was reassuring to see that our condors were expected to stay within their major support and resistance levels (we would have profited if SPX stayed between 3920 and 4010), especially in a week which had no big news or events. They didn’t, they broke through on Friday, twice, and never came back. We had to endure a loss.

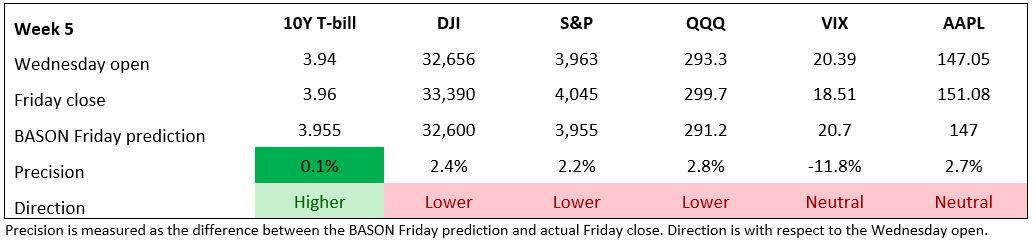

The markets ended up just outside those 2% confidence intervals last week, for most of our major indicators:

Even the VIX, which was projected to remain neutral, finished lower. Only the 10YT, once again, delivered excellent performance.

This week we have the labor market data coming out: private payroll growth and new job openings on Wednesday, followed by the official jobs report on Friday (expectation is about 200,000 new jobs added in February, a slowdown from January’s 517,000 new jobs). Also, Powell testifies before Congress on Tuesday and Wednesday. This testimony typically doesn’t move markets nearly as much as his other speeches, but let’s see what happens.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter!