Quick summary:

New survey is up & running - click here.

Markets are getting quite jumpy lately. And so are we!

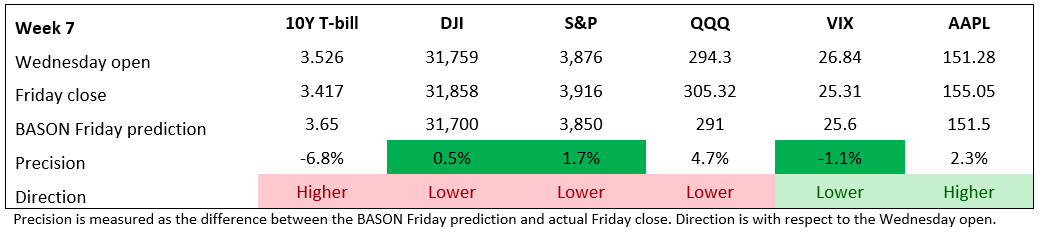

Last week, direction was poor, precision OK; very good for the VIX, poor for QQQ, mixed for SPX and DJI.

This week is FOMC week. On Wednesday we will see if the Fed continues to hike and by how much, or whether it pauses in light of the brewing banking crisis

The 2023 Q1 competition is now open for its eight week. That means next week is our final week of the quarter and your last chance for top 20 entry in Q1. Also, the battle for first place is getting heated. This was our 5th or 6th change at the top. It all comes down to the last two weeks. Good luck!

As you know, the competition has changed a bit (read about all the new features here) to give you all a greater chance of getting rewarded, both quarterly and at the end of each year by participating in our annual profits.

The survey is here:

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

Last week’s performance

After SVB’s failure two weeks ago, the social media sentiment was bracing for an imminent crash last week. However, markets remained very jumpy. The weekly pattern was actually noticeable already on Monday, after a low gap open and SPX trading close to 3800 at one point, followed by a few swings up and down for the rest of the day. This continued throughout the week. Tuesday had a strong open and close, Wednesday was mostly sideways, and then a big jump happened on Thursday, some of which got reversed on Friday. A very difficult trading environment. Exciting, no doubt. But difficult.

It was a very close call for us on Wednesday between an up move or a down move to finish the week. The signal was pulling slightly towards a down move for SPX and DJI so we went with it, despite a clear down signal for the VIX and an up signal for AAPL (both of which were correct).

Precision remained good, mostly because of Friday’s reversal, making the weekly trend more sideways, which is always good for the condor positions. But overall, it was still a losing week, unfortunately.

This week has the potential to get even more jumpy, especially after the FOMC announcement on Wednesday. The Fed is faced with a very difficult decision: keep raising rates to combat a still high 6% inflation, at the risk of potentially more bank failures and greater panic, or, pivot and pause with the rate hikes, maintain stability of the banking sector (for now), and risk getting inflation high again. Neither of the two scenarios are good in the long run for markets.

These are the scenarios:

(a) Fed raises 0bps - in other words, a pivot from “inflation fighting” to “saving the banks”. This was an unlikely scenario just two weeks ago, but a lot has changed since then. I estimate this to be a less likely scenario (p=20%). However, if it does happen, I expect a significant rally as the most likely outcome. Then again, a Fed that drops inflation fighting so quickly could also trigger a panic reaction among investors. I’d wait for confirmation during the speech before trading anything here.

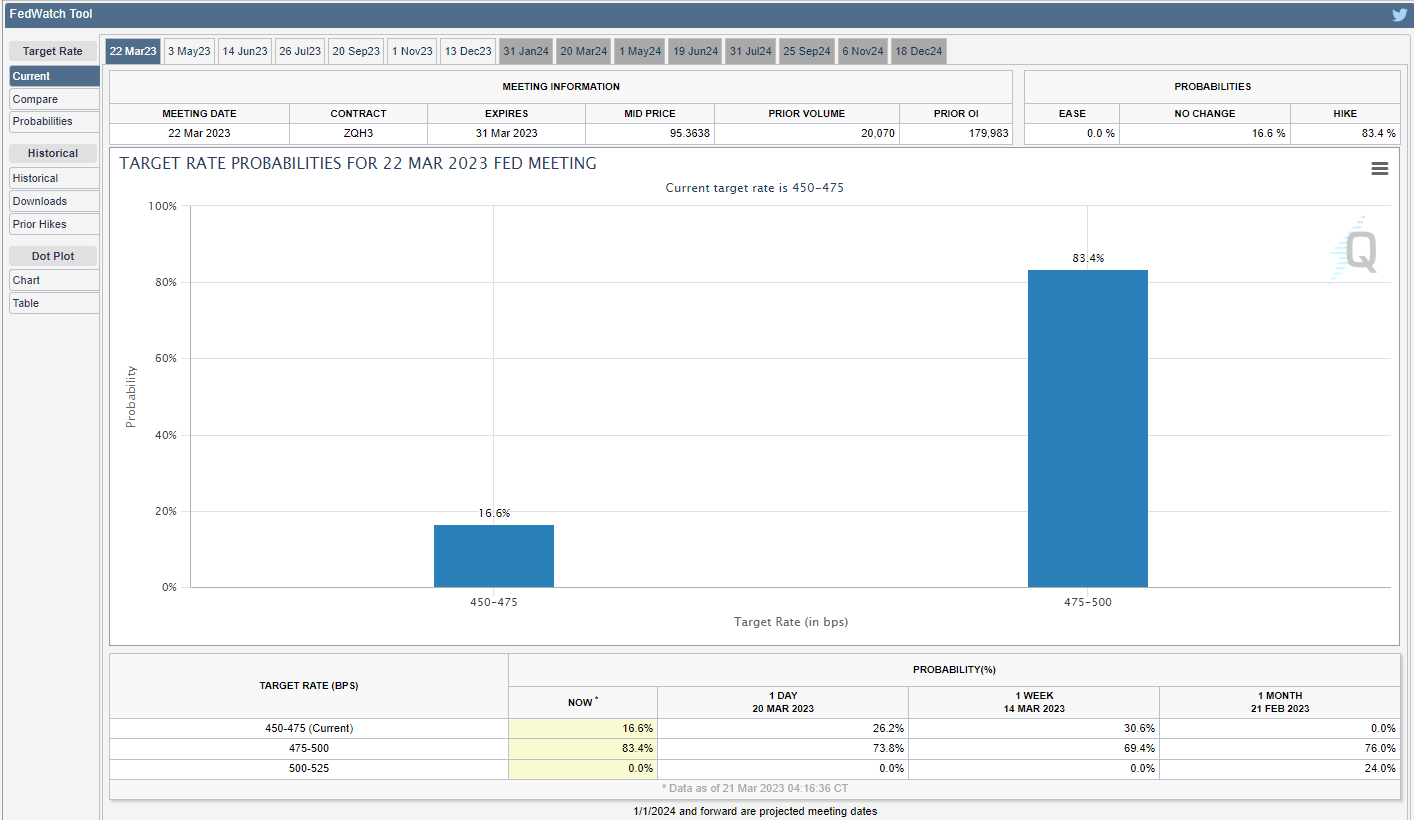

(b) Fed raises 25bps - this is the most likely scenario (see below) (p>75%), but the question here is whether Powell’s speech afterwards is hawkish or dovish. Powell could say they are sticking to more rate increases in order to get inflation under control, or he could say they are considering a pause in light of current events. Watch out for these keywords as they will trigger either a sell-off (former case) or a rally (latter).

(c) Fed raises 50bps - in the same week when SVB failed, two days prior Powell had a Congress testimony where he was expressing a possibility of a 50bps hike. The probability of this scenario jumped to over 60% at one point but was soon reversed after the trouble with banks became obvious. So this scenario is probably very unlikely (p<5%). If it does happen, I expect a sharp sell-off. No doubt there.

According to CME Group’s FedWatch tool the expectations are in favor of a 25bps hike:

It’s just a matter of whether Powell’s speech is hawkish (“we’re continuing to raise rates”, “tighter for longer”) or dovish (“we’re pausing/cutting soon”). Which one will it be? :)

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter!