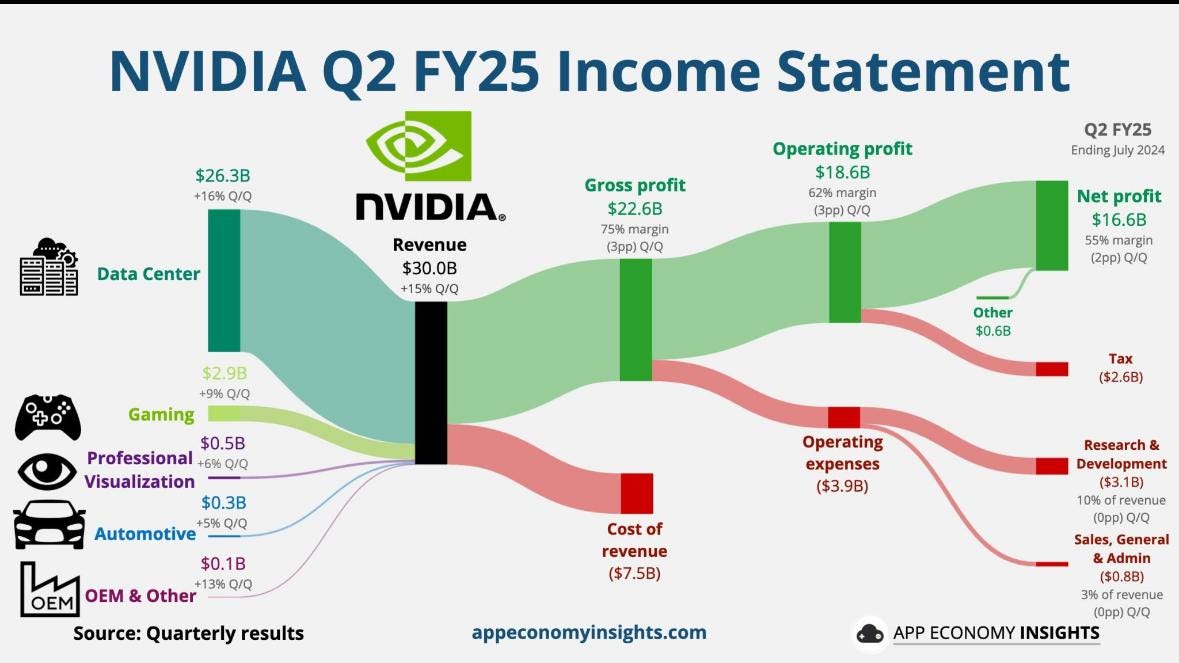

NVDA came and gone. The company produced one of the best earnings report ever. It beat all analyst expectations across the board. EPS came in higher ($0.68 vs $0.64 expected), revenues were higher ($30bn vs $28.7bn expected), with a stunning growth in revenues of 120% year-on-year, and 168% growth in profits y-o-y. It raised forward guidance for the upcoming quarters, and it even announced a $50bn stock buyback (always bullish news).

And yet, the stock sold off 8% the day after.

Why? Well, this quarterly earnings beat was *only* 5.6% higher than expectations, whereas in previous quarters NVDA beat analyst expectations by 10% or more each quarter.

Ridiculous? Absolutely.

Overreaction? I certainly thing so.

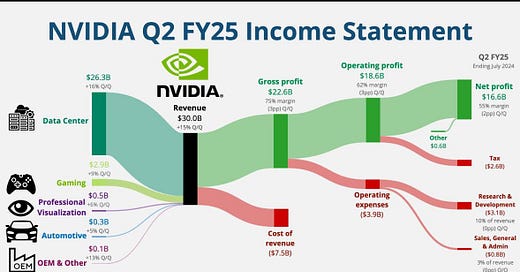

Just check out this info-graphic. Show me a company of that size and magnitude that has such incredible profitability:

But this time, interestingly, it didn’t pull the market down with it. Quite the contrary, the next day opened with a strong rally across the board, with NVDA being the only big name that was selling. It seems we got some rebalancing from NVDA back into all the other tech stocks. It was jumpy though, on both Thursday and Friday (killing BASON’s profits in the process), but the week ended with a strong end of month rally.

Why did we see a continuation of the bullish narrative? Because, once again, we got some very robust macroeconomic data this week.

Q2 revised GDP growth was at 3%, higher than expected and much higher than 1.6% in Q1. Similar for the new jobs number. And then yesterday we got another lower inflation print. PCE inflation (Fed’s preferred inflation gauge) came down to 2.5%.

The economy is still robust. The soft landing narrative reigns supreme.