Quick summary:

The Q1 competition is up & running - click here to join the action.

Last week's data affirmed the 'higher for longer' narrative: job growth came in below expectations, but unemployment went down, signaling a still strong and resilient labor market. On the same day, the Michigan consumer survey showed inflation expectations rising sharply to 4.3%, the highest level since November 2023, contributing to market volatility. And with GDP growth at 3%, interest rates are staying anchored at or above 4%.

Market action continues to be jumpy ever since the start of the year. Each week we get some strong pull-backs (typically news related), and gradual recoveries.

This week, Fed Chair Jerome Powell's testimony in front of Congress is on Tuesday and Wednesday, and the release of January's CPI is coming up on Wednesday, with PPI following up on Thursday. Should be another fun week to trade!

As we mentioned last week, inflation is becoming the crucial data point from now on, so we will wait for this week’s data to update the long term view. Don’t miss it in our paid section:

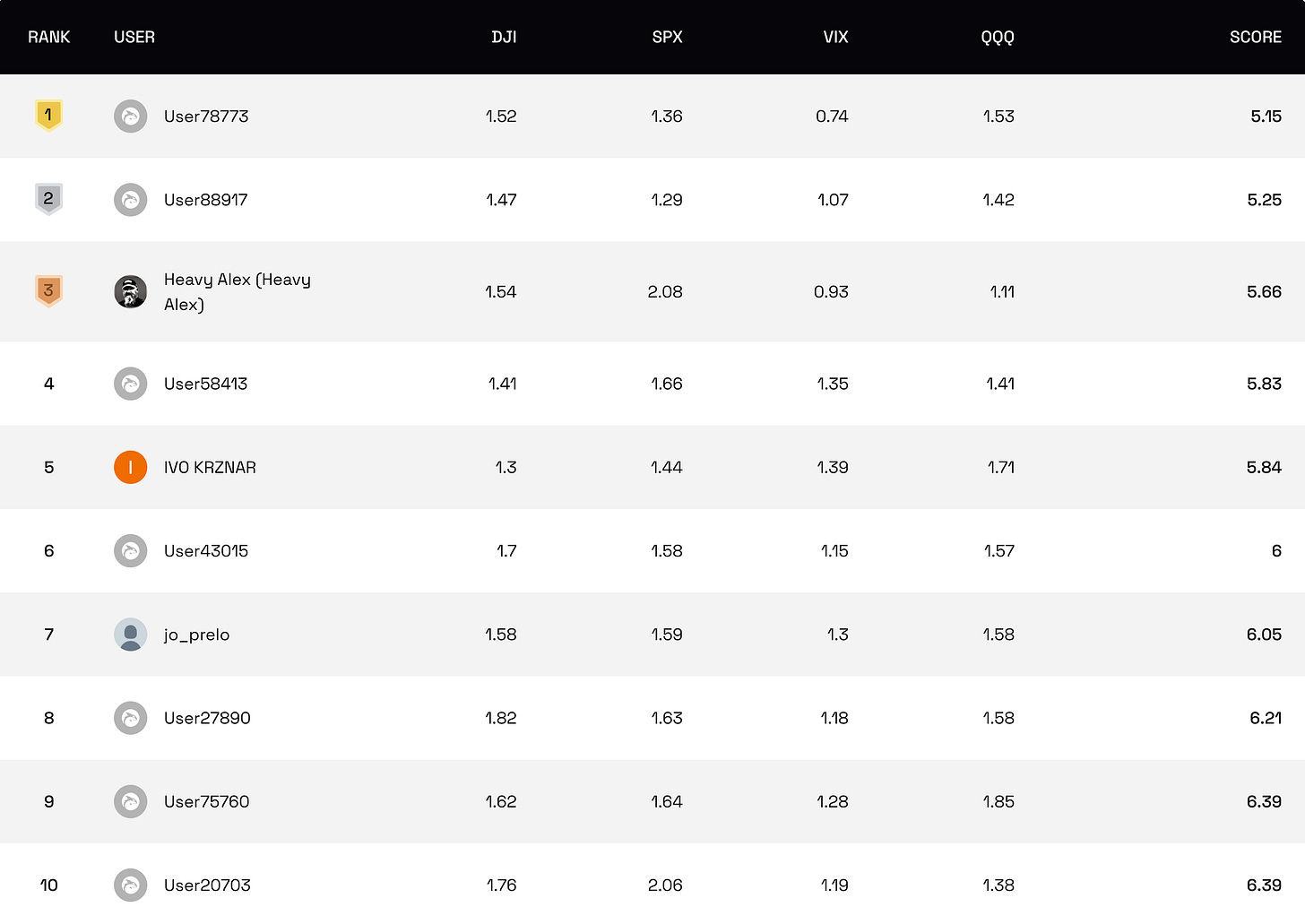

The competition

With January's CPI release and Jerome Powell's upcoming testimony on the horizon, let's get ready to solidify our positions and climb the leaderboard.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

The latest employment report revealed a mixed bag: 143,000 jobs added in January, below the 170,000 expected, but with a lower-than-anticipated unemployment rate at 4.0%. Additionally, wage growth outpaced expectations at 0.5% compared to the forecasted 0.3%, pressuring inflation further.

In tandem, the Michigan consumer survey reported a significant jump in year-ahead inflation expectations, rising from 3.3% to 4.3%, marking the highest level since November 2023. This surprising increase, combined with remarks on tariffs, led to a swift market sell-off on Friday.

And so the market continued its jumpy pattern the past two weeks. First there was the DeepSeek sell-off on Mon, 20th, then the tariff-induced sell-off on Mon, 27th - both of which were followed by strong recoveries the same or the next day and into the week. Then on Friday, another shocker, and a sell coming into the week. At least this week started off differently, but from a technical standpoint, that upper level of 6,100-6,120, seems to be a powerful resistance right now. A good inflation report on Wednesday is one thing that could potentially break it.

ORCA’s performance was good last week (+1.3%), despite the jumpiness, but it was a difficult week to trade in.

This week, Federal Reserve Chair Jerome Powell's upcoming testimony to Congress on Tuesday and Wednesday is set to address the central bank's current stance on interest rates amidst the backdrop of recent data pointing towards sustained inflationary pressures. Other economic data to watch includes wholesale, import, and export pricing, along with U.S. retail sales data scheduled for release on Friday, providing a broader view of economic dynamics and consumer activity. Finally, more earnings are coming up. Still not NVDA though, that’s coming up towards the end of the month.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.