The December grind up?

Watching for seasonality

Quick summary:

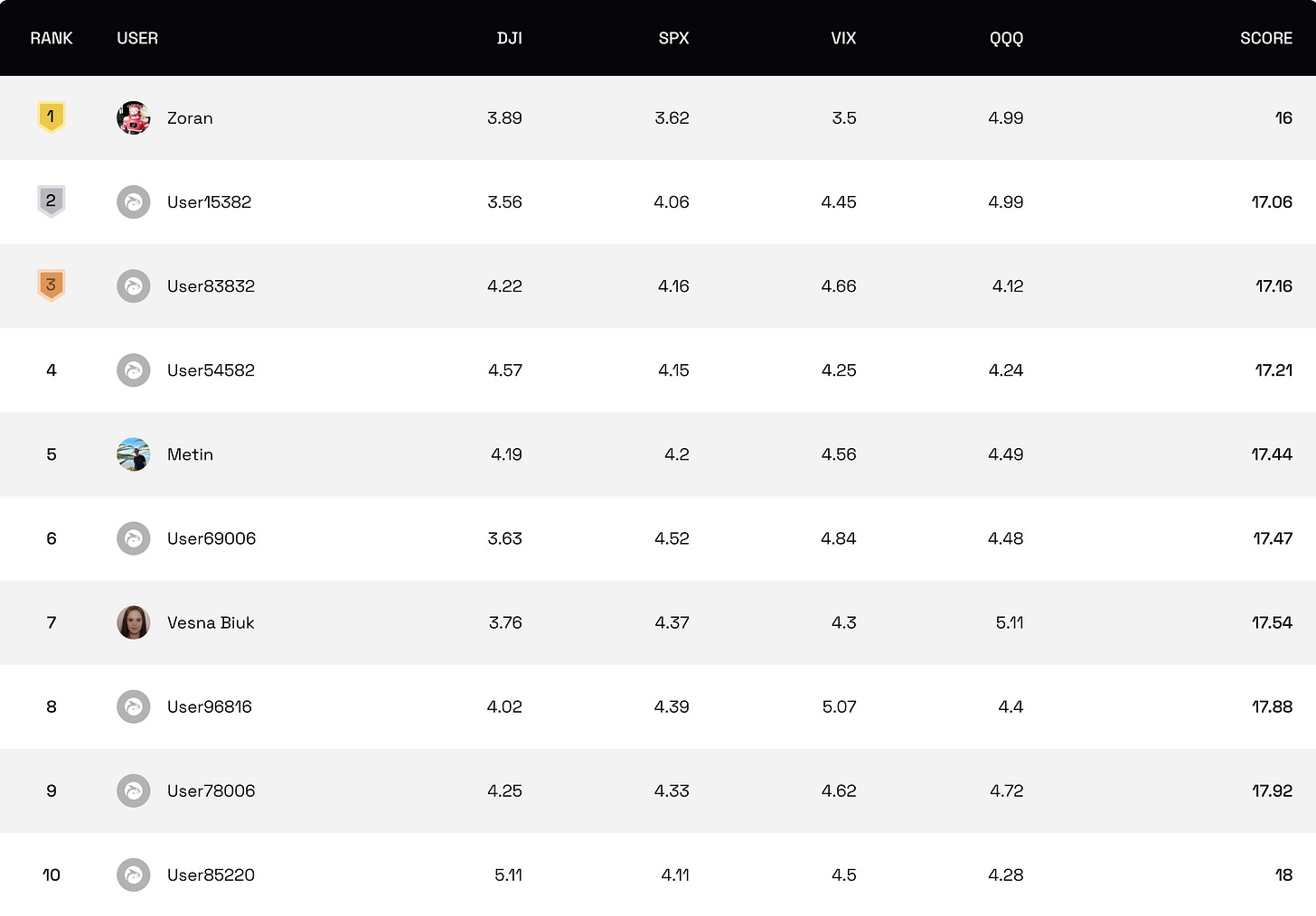

The 10th week of the Q4 competition is up and running - click here to join the action. After this week, two more weeks left before the competition ends!

The mid November weakness turned out to be profit taking, as we closed November with the VIX falling from 27 to 17 and support at 6,500 holding as markets climbed more than 3% in the final week.

Fed rate cut odds jumped from 30% to 87%, triggering strong buying with Friday and Monday marking the biggest two day net inflows in more than six months.

Seasonal strength and no major data before the December 10 FOMC meeting keep the setup supportive, with SPY levels at 685 and 690 guiding the next move toward 700.

Early Cyber Monday spending is tracking near 78 billion dollars and upcoming sentiment data, consumer credit, and the ADP report shape the lead up to the December 16 jobs release.

The competition

Rate cut odds jumped to 87% and the market reversed the mid November sell off which keeps the competition tight. With more consumer data coming, it’s a solid setup for anyone aiming higher.

Stay focused and keep climbing the ranks!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

The market action over the previous week confirmed that the mid November weakness was more about profit taking than a true correction. The VIX dropped from 27 to 17 in just a few days, which helped unwind the short term bearish pressure and kept the 6,500 support intact. The exaggerated fear from the prior Thursday never turned into real panic, and by Thanksgiving week the vol compression we expected took over. That move, combined with supportive flows, pushed markets up more than 3% and basically reversed everything that sold off since November 12.

The biggest shift came from the Fed outlook. Rate cut probabilities jumped from 30% a few weeks ago to 87%, removing the October scare and easing pressure across the board. Friday and Monday were the strongest two day net buying sessions in more than six months, with heavy short covering and new long buying in tech. With no major data before the December 10 FOMC meeting and with strong seasonal flows ahead, the set up favors a grind higher into December.

This week brings a fuller data calendar after the Thanksgiving rally, with attention shifting to consumers and the labor market. Early readings from Cyber Monday suggest online spending is tracking near the expected 78 billion dollars for the full five day period, giving a sense of how strong year end demand may be. Fresh consumer sentiment data later this week will show how confident households are feeling and the Fed’s consumer credit report will offer a clearer read on how much borrowing is picking up. Powell spoke on Monday evening and his tone now feeds directly into the setup for the December meeting, especially with rate cut expectations already much higher. The private sector ADP report will provide an early look at November hiring while we wait for the government’s delayed jobs report on December 16. Overall, the incoming data adds to the broader setup for December where supportive seasonality remains in play.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.