The final inflation print before the cut

S&P leaders also offering excitement this week

Quick summary:

The eleventh week of the Q3 competition is up & running - click here to join the action.

Markets swung sharply last week, with a 1.5% drop Tuesday followed by new all-time highs by Thursday, and then another drop on Friday.

The August jobs report showed only 22,000 new jobs and job openings fell below unemployed for the first time since 2021.

Equities wavered as Fed rate cuts are now expected, while the dollar fell, gold rose, and bond yields dropped.

August inflation data comes Thursday, PPI on Wed, while Apple, Nvidia, Meta, and Microsoft deliver key updates this week ahead of the Fed’s September 17 meeting.

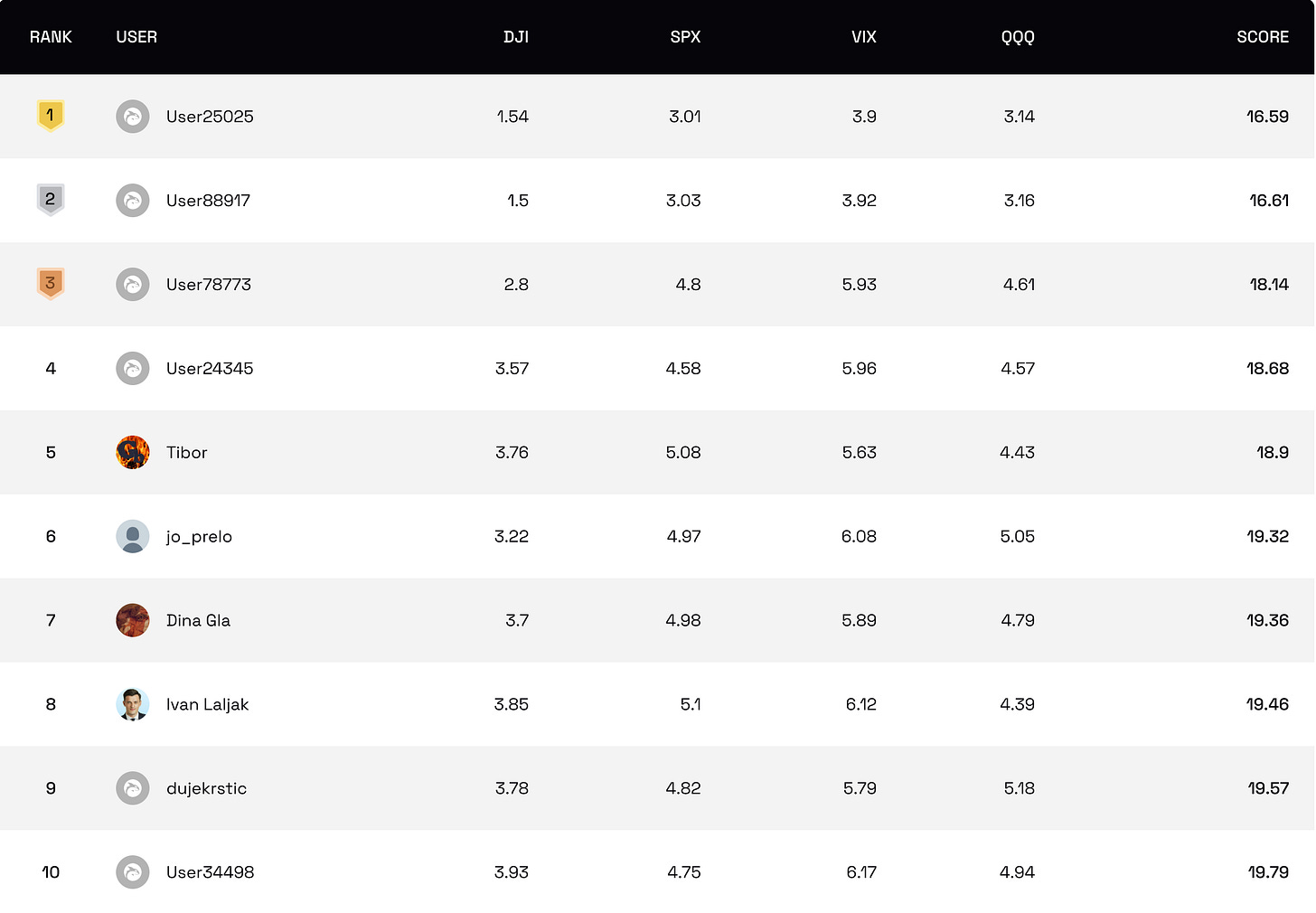

The competition

Inflation and big tech take the stage this week, setting the tone before the Fed’s September 17 meeting.

Stay focused and keep climbing the ranks!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

September wasted no time showing its usual volatility. Tuesday opened with a sharp 1.5% drop, only for markets to bounce back and reach new all-time highs by Thursday, another reminder that every dip keeps getting bought. Even Friday’s weak jobs report, which showed just 22,000 new jobs in August and downward revisions for June, couldn’t escape the pattern. The bigger concern was that job openings have now fallen below the number of unemployed for the first time since 2021, and most of the new positions added were part-time.

The immediate market reaction was mixed: equities briefly pushed higher on expectations of a Fed rate cut, but reality quickly set in. A cut driven by slowing growth isn’t exactly bullish. The rest of the market moved into classic recession mode with the dollar lower, gold higher, and bond yields falling as demand picked up. By the end of the week, equities gave back some gains, though the broader trend of quick dip-buying remained intact.

The next two weeks will be critical with inflation data, options expiration, and the Fed’s September 17th meeting all on deck. If pullbacks keep getting bought, the setup into October could look very similar to past years where seasonal weakness gave way to a strong year-end rally.

The August CPI due Thursday (and PPI before that on Wed) is the last key data point before the Fed’s decision. A lot of it is already priced in which is why it’s important to see the price action evolving from that point forward. A major uptick in inflation could be the reason we get our pullback.

The S&P leaders are active as well. Apple is set to unveil its new iPhone on Tuesday, while Nvidia, Meta, and Microsoft will be presenting at a major technology conference. With markets still navigating September seasonality, the way they respond to this mix of macro data and big tech updates will be important in shaping the path toward October.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.