Quick summary:

The tenth week of the Q3 competition is up & running - click here to join the action.

Nvidia earnings underwhelmed, volatility fell, and PCE inflation matched expectations, with only a 0.7% end-of-month dip in stocks.

September seasonality points to higher risk of a pullback, though GDP revisions and steady inflation support a short-lived correction.

The week opened with a sharp fall in futures, just on time after Labor Day

This Friday’s August jobs report could cement a September Fed cut, with trade balance, factory orders, and Fed speakers also on deck.

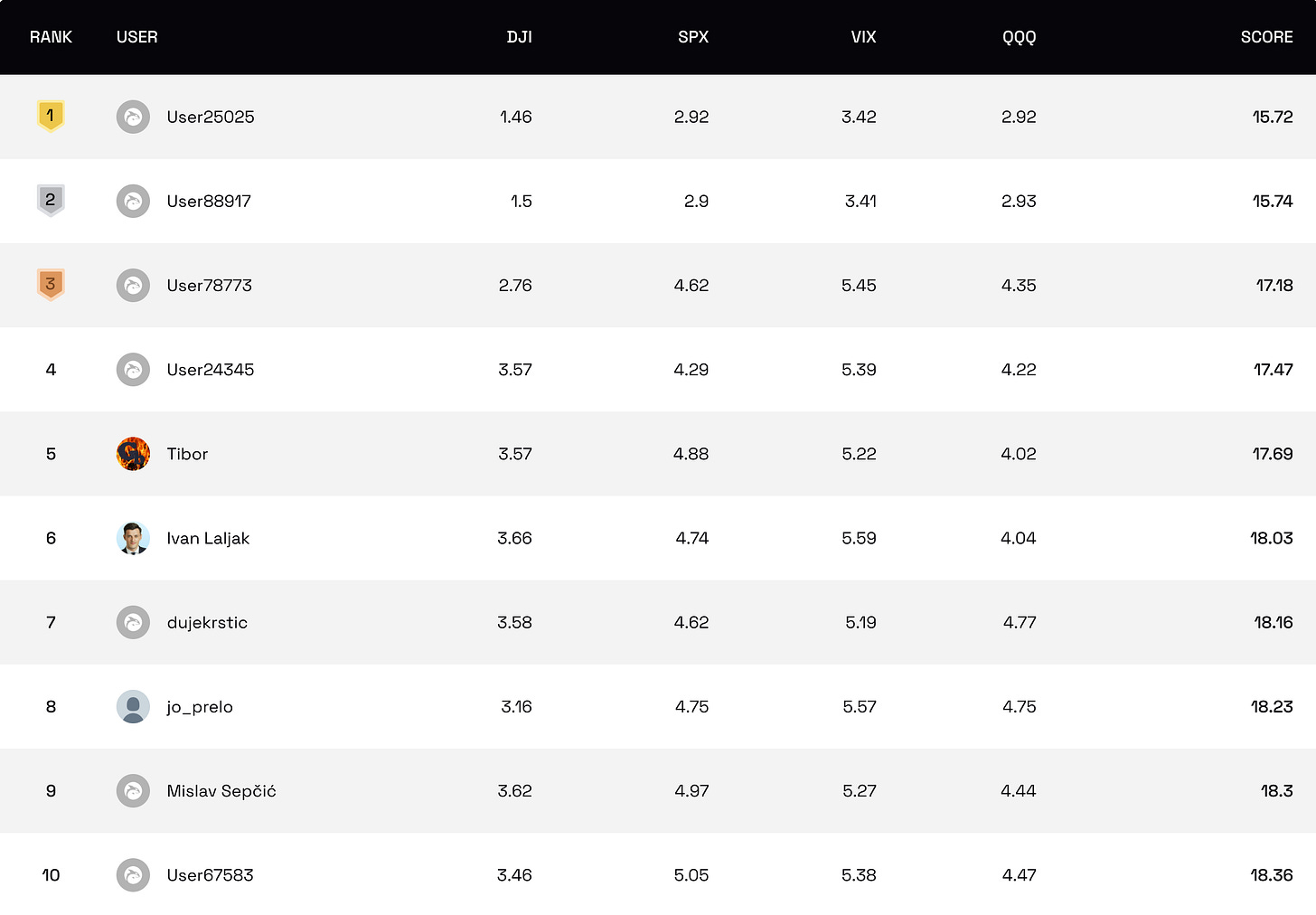

The competition

Seasonality meets policy risk. Friday’s jobs report may decide whether the Fed delivers its first cut this month.

Stay focused and keep climbing the ranks!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Nvidia’s much-hyped earnings failed to move the needle, and instead we saw a vol crush with option prices sliding lower across the board. The PCE inflation report came in right on expectations for both core and headline, leaving markets calm. The only real move was a small 0.7% selloff on month-end Friday.

As we head into September, seasonality becomes the focus. Historically, September and October tend to bring weakness, and with cuts for September nearly fully priced in, the odds of a pullback are higher. Still, growth data is improving as GDP was revised higher, inflation is steady, and the Fed meeting on September 17th should deliver a cut with an updated dot plot. Any correction here is likely to be short-lived and more of a buy-the-dip moment.

Gold remains the standout performer, supported not just by inflation hedging but by big shifts out of long-term bonds, which continue to suffer under high rates. Meanwhile, VIX sits at 15, with shorting vol still one of the most crowded trades, though it may pay better after we get through September’s seasonal chop.

Looking to this week, Friday’s August jobs report will be key for the Fed’s decision later this month. Powell has already pointed to labor market softness as a reason to cut, and any further weakness could lock that in. Before then, trade balance and factory orders will be released along with several Fed speakers who may shape expectations. After a strong August, stocks slipped slightly at the end of the month, and with seasonal weakness now in play, volatility could pick up. The broader outlook, however, remains tilted to the upside with rate cuts on the horizon.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.