What a week. It started with fears of a “Black Monday” when we opened below 4,850 on SPX with another 5% sell-off. Then came out a piece of news that was, at the time, fake - that the Trump administration is considering a 90-day pause on tariffs - and sent SPX up from -5% to +3% in a matter of 15 minutes. As people realized this was not true, markets went down to -2% again.

This brief episode on Monday set the stage for the entire week. Tuesday gaped up, and then sold off again to end the day negative, and then on Wednesday, after China retaliated with an 84% tariff against the US, Trump announced a 90-day moratorium on tariffs to all countries except China who was hit with a 125% tariff.

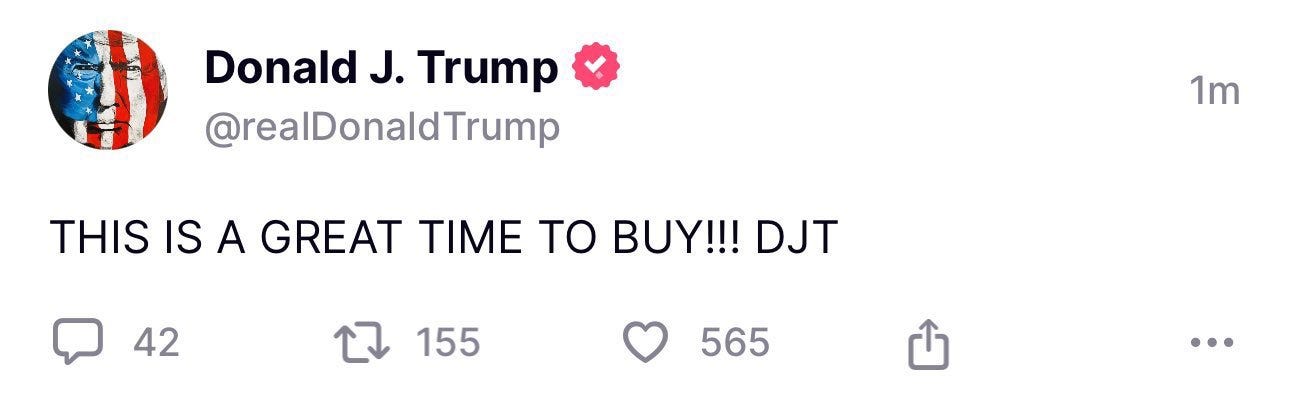

But not before he told us all to buy the dip (about 3hrs before the announcement):

Markets rallied and finished up 9.5% on the day!

And then the next day, a 6% sell-off. A bounce before the end of day to finish at -3.5%, and then a gradual grind up today.

What. A. Week.

Two months ago we said: welcome to trade wars. This is what happens during trade wars; sharp market contractions, followed by face-ripping rallies, with investors reacting with hubris or despair at every major news update. Not only is this a bear market, it’s an extremely volatile bear market, where the VIX keeps hovering above 40 for two weeks now. This means that hedging is still extremely expensive. Last time option prices have been this high was during the COVID panic.

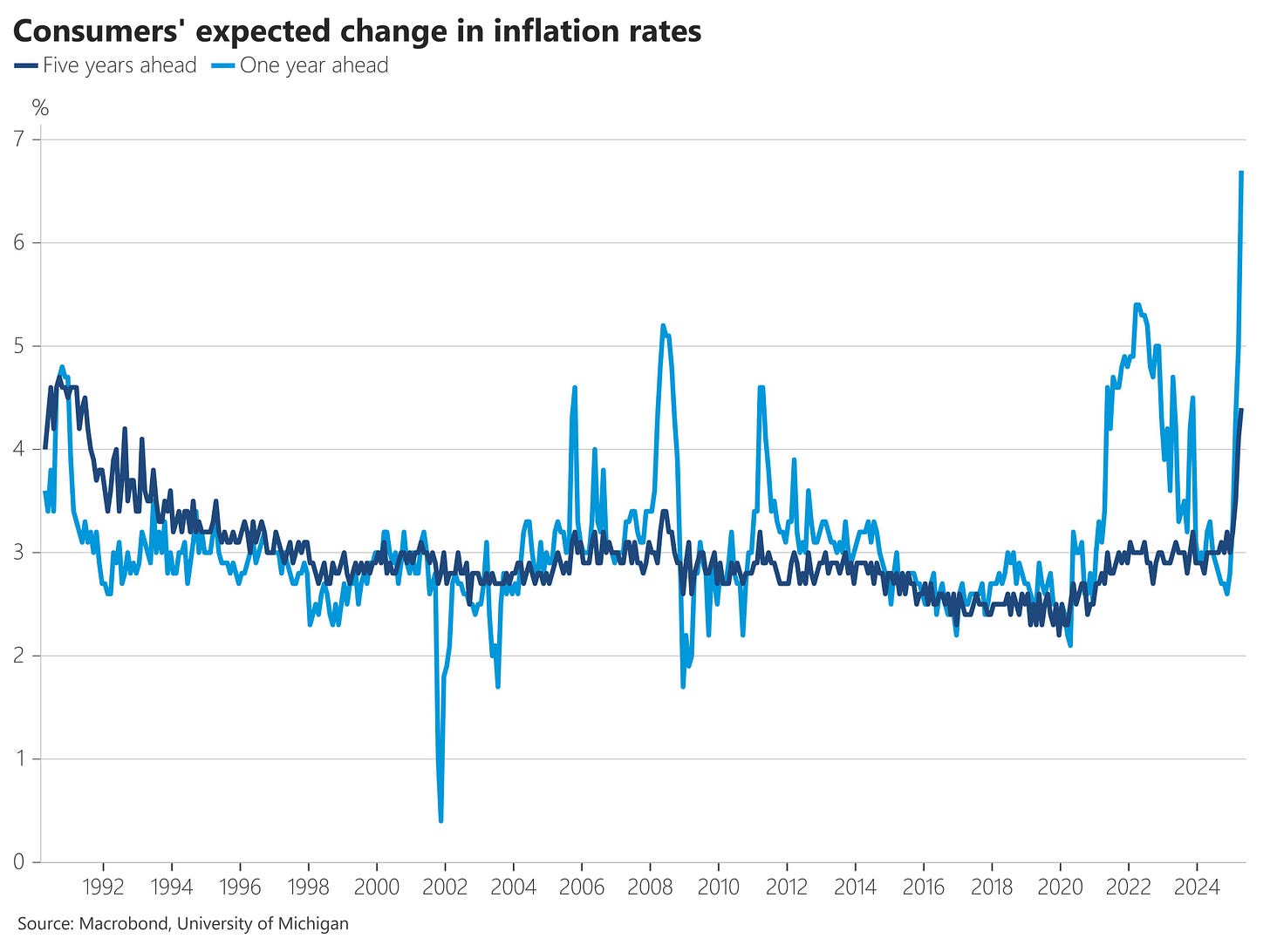

Among all this, inflation coming out lower than expected (both CPI and PPI) was not even digested. One thing that was noticed was the new Michigan consumer survey that came out on Friday:

Because of tariffs, inflation expectations of consumers one year from now are at a whopping 6.7%! Not even in 2021/22 where they this high. Doesn’t mean this will happen, but consumers are definitely worried that tariffs will push inflation up again.

However, it was the bond market and the decline of the US dollar that kept grabbing attention this week.

“…I would like to come back as the bond market. You can intimidate everybody.”

Why did Trump cave on Wed and postponed tariffs? The administration felt the pressure of the bond market. On Wed, as the Asian markets opened for trading, someone was unloading a large number of US Treasuries (I thought it might be China, some reports are now saying it was Japan), causing the 10Y yield to spike up to 4.5%. This triggered panic on domestic markets, and allegedly people from banking and finance circles close to the Treasury Secretary (like Jamie Dimon and Bill Ackman) pleaded that the administration take a pause on tariffs to calm the bond market.

In light of that, I wrote an article on Linkedin, summarized in a Twitter thread. I won’t repeat it here, but I do invite you to have a look as it provides important context of how and why the bond market is connected with the trade deficit. The conclusion was this:

…in the long run, if the US no longer wishes to be a debtor nation with huge current account deficits, and instead wants to turn this into a surplus, the we can no longer justify such huge capitalization on the US stock markets, nor can we expect such high demand for US debt.

That, in my opinion, is structurally a much much worse situation than having twin deficits and large public debts.

That’s the long-run view. Structural shifts are happening, and if tariffs are fully implemented and if the strategic goal of the US is to no longer run trade deficits with countries, then we can expect a big reevaluation in the market cap of America’s biggest companies, and lower demand for US Treasuries. That’s a big IF, given that this is in direct conflict with a huge number of US corporate and financial interests.

But that’s the long term view.

De-escalation anyone?

The short term view is perhaps a bit less complex. In terms of what’s next, from the whole realm of possibilities and unpredictable events, we feel that two scenarios stand out as the most likely options:

Gradual de-escalation. Trump administration’s 90-day moratorium buys time for bilateral negotiations with each individual major trading partner, with the best scenario outcome being that all tariffs are removed. It is easy to see that Trump would take every opportunity to declare victory whenever a new treaty is signed or agreed upon. To these deals, markets will react with optimism.

Escalation. With China in particular. Even though we have seen hints from both sides that they want to “make a deal”, there is a possibility that neither party caves, that both hold their ground, and we get an escalation of the trade war in which the US even de-lists Chinese companies from its stock markets (that too was raised as a possibility at one point). The escalation scenario would also imply that China could engage with the EU and create a free trading zone between the two of them, thus bypassing the US entirely. These scenarios would be very bad for US equities and bonds, echoing the long-term concerns we mentioned above.

How exactly would each of these unfold?