This week was crazy as it gets. High volatility, big sell-offs, aggressive moves - all that while the Fed delivered a dud. So what did move markets this week? First the DeepSeek disturbance immediately on Monday (NVDA and semiconducters being hit the hardest), and then the Trump administration announcement of tariffs on Canada, Mexico and China - first announced on Thursday towards the end of day (pushed markets down abruptly only to bounce back immediately), and then crashed the rest of the market on Friday, even though the earlier rally was a reaction to a better than anticipated PCE inflation report.

The general feeling among investors was - trade war trading is back. Markets are more likely to experience exactly these types of unexpected aggressive downward moves, as reactions to the administration’s tariffs proposals (and who knows what else).

And yet, in such jumpy environments even if you’re short markets - like Orca was this week - it still might not be enough to turn a profit.

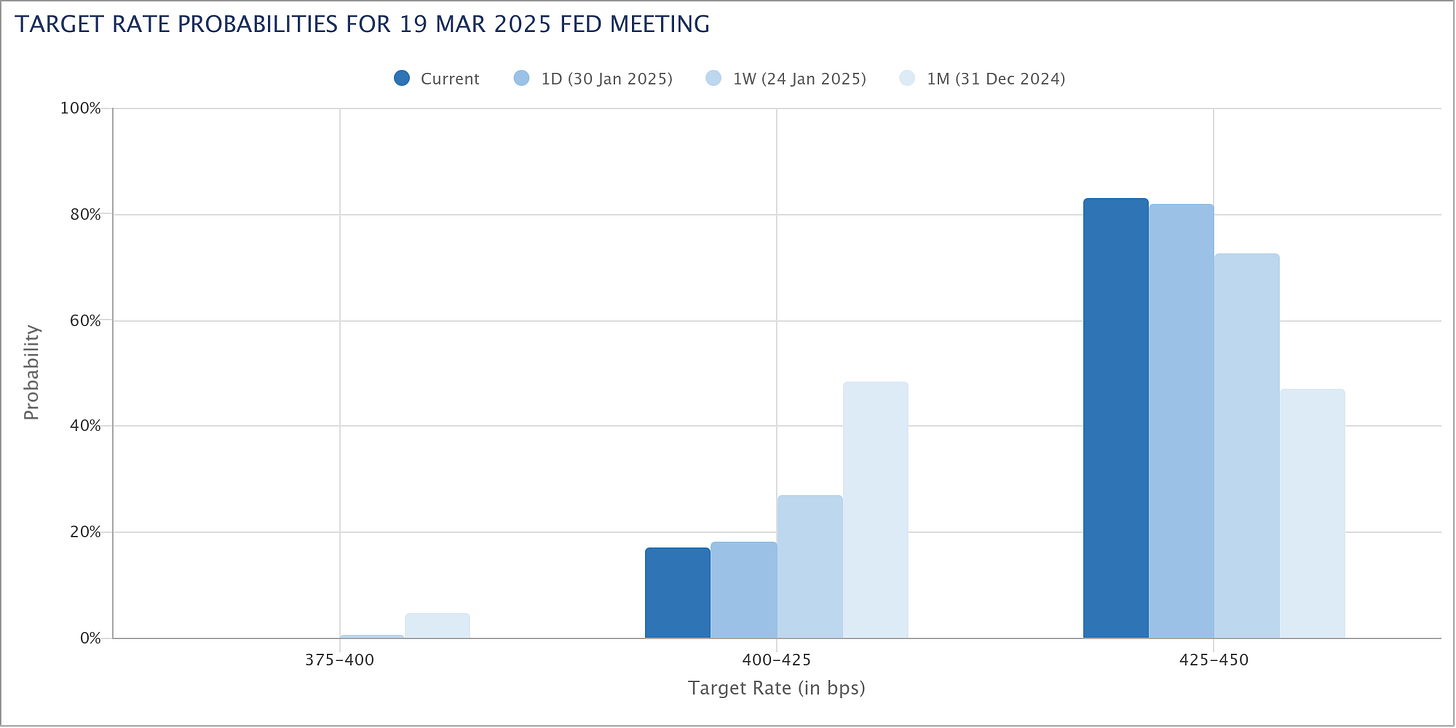

Effectively, Trump’s impact was much more important this week than the Fed’s signals. Markets showed a sign of relief on Wednesday, given that the Fed was not as hawkish as expected, and further rallied on Friday following a good PCE number (remember, we are back to tracking inflation progress to gauge interest rate expectations). On any other week, this would have been a clear uninterrupted move to the upside, with markets pricing in more rate cuts.

But higher for longer expectations remained, and the SOFR curve even tilted to the upside in the long run. Markets are still very much ahead of the Fed dot-plot there.

And then there’s the bond market.

Yields did go down the past two weeks (10Y went from 4.8% back to 4.5%), but we are now facing the first quarterly refinancing announcement (QRA) by the new Treasury Secretary Bessent. Once again, the Trump administration’s impact will be the key focus coming into next week, and once again, we should brace for impact.

Today, we dig into expectations of what we might get from the new QRA.

Recall that the QRA was a big market mover in 2022 and 2023, but its effect diminished in 2024, as the election year expectations priced in most of the Biden administration’s bond financing needs.