We predicted markets for 8 weeks - here are the results

For the past 8 weeks, from May 3rd to June 25th, we have been running a prediction competition via Twitter, where we asked traders and other stock market enthusiasts to give their predictions on the weekly movements of the following six indicators: Bitcoin, 10-Year T-bill yield, the Dow, S&P500, the price of WTI crude oil, and Dogecoin. The survey (available here via our app) was open for only 24 hours each week (from Tuesday 8am EST to Wednesday 8am EST), and the users were asked to predict the value of the aforementioned six indicators for the end of trading day Friday (4pm EST) of the same week.

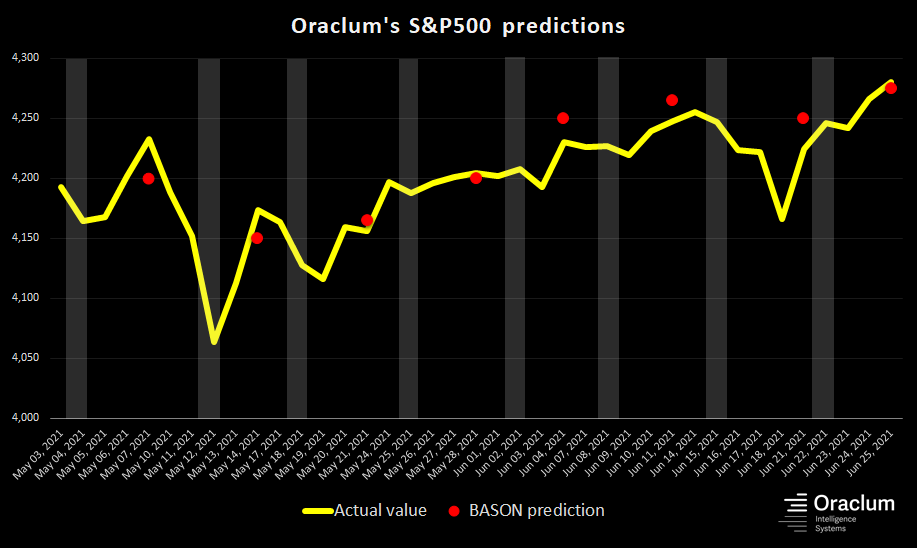

Here are the results. The yellow lines are the actual values and the red dots the predicted values. The shaded areas are the days when the predictions were being made.

As we’ve concluded last time, these are highly encouraging. Whether the indices were going up, down, or trading sideways for the week, our BASON method managed to capture not only the direction but also the magnitude of the move. It has correctly anticipated where the market will be in each of the 8 weeks for which we have been polling.

The table below gives a more detailed insight into the precision of our predictions. If you have been following regularly (don’t forget to subscribe!), you got a weekly update of how the method has been performing. If you were a regular survey competitor you got the insight of where the market was going to end up three days in advance. BASON continued to deliver accuracy within a single percentage point, much like it did for the first 4 weeks. You could have used this for a short-term investment strategy (see below), however only for the major indicators like the Dow or the S&P. It was also really good for oil prices and the 10-year T-bill yield, but much less accurate for the highly volatile cryptocurrencies Bitcoin and Dogecoin (although even this has improved by week 8). The only off week was week 7, where the predictions were one day too early. BASON estimated that the markets would bounce back by Friday, but it happened on Monday instead.

Potential investment strategy

How can one make a profit following these predictions?

Each week our predictions seem to fall within a very narrow 97-98% confidence interval (in most cases even in 99% intervals), even when they are a day too early as it happened in week 7.

A possible investment strategy, for those that wish to give it a shot (see disclaimer below), is to engage in a neutral options strategy expiring in the same week, where the confidence intervals act as upper and lower boundaries of the spread.

Let’s say you had applied one of the neutral strategies (e.g. iron condor) each week betting on the SPY (the S&P ETF), buying options with a Friday expiry. If you bought 20 calls and 20 puts at strike prices that were the 95%-ish confidence intervals of the prediction, and then sold 20 calls and 20 puts at strike prices at 98%-ish intervals, you would have made around $400 each week, while being exposed to a potential loss of around $600. Each week would have been profitable, even week 7 where the prediction was made a day too early.

Having said that, keep in mind that this is still a project in its infancy, still in its testing phase, and it will take at least a few more months of consistent performance to make it into a more confident market prediction tool. Hence the disclaimer.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Awarding the winners of the competition

The rules of the competition specify that each month we will award the top three performers with a $100 each. Our leaderboard within the survey app is once again ranking the best performers. Most of our users choose to be anonymous and we respect that. We only really need an email to get in touch and pay out the prize.

Congratulations to the top 3 players, each of which will receive a wire transfer of $100 during the following week.

Methodology

A quick recap of our prediction method, called the BASON(Bayesian Adjusted Social Network Survey) (watch a video of it here, or read more here, here, here or here). We poll people on Twitter (or Facebook), asking them what they think the prices of the aforementioned indicators will be by the end of the week, and what their friends think. We aim to find the best observers of their environments and through their responses and the responses of their friends estimate the group bias of each individual prediction. We then place a weight on each individual’s predictions based on their group’s bias and draw patterns of behavior. This methodology has enabled us to accurately predict not only election outcomes (like Brexit, Trump in 2016 or Biden in 2020), but also consumer sentiment and demand, market trends, optimal pricing, and even the economic consequences of the COVID-19 pandemic.

Thanks for following our newsletter, and don’t forget to follow us on Twitter to stay informed about the weekly survey each Tuesday.

Note: No survey this week, we recommence on July 6th.