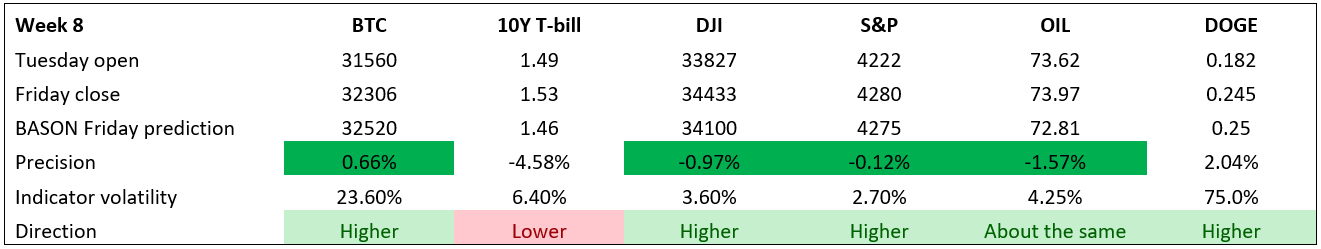

Week 8 results: back on track

The results for week 8 are in, and they are once again back to their very best. The S&P500 prediction was incredibly accurate (0.12% error), and this time even the cryptocurrencies have been called both in the right direction and within a very small margin of error. High weekly volatility of BTC and Dogecoin have typically lowered both the accuracy and the precision of our predictions. Last week saw an improvement in precision, but not accuracy, and this week has finally seen an improvement in both accuracy and precision. It seems that our methodology is starting to find a way to account for the noise of high volatility, but we’re not calling it a victory quite yet.

The only odd result this week was the 10-year T-bill which started soaring earlier today, and ended up higher instead of lower, as was our prediction.

This was our prediction sent out the other day to our subscribers:

There will be no survey next week, as we hold four surveys each month and award the winners by the end of the month. Next week we will therefore contact the winners and pay out the $100 prizes. We will also publish a detailed analysis of our 8-week performance thus far and propose an investment strategy that may be used here.

The week after next (starting on the 5th of July), we will be introducing the VIX to our group of 6 indicators and removing Dogecoin (we always maintain a fixed number of indicators to keep the surveys short). Given that VIX too tends to have unexpected weekly volatility it will be a difficult asset to predict, but we will learn as we go along and see where it takes us.

Thank you for following our newsletter, and don’t forget to follow us on Twitter to stay informed about the weekly survey each Tuesday.