Q2 overview

What a Q2 this has been!

It started with “Liberation day” in the first week of April, which culminated in a total 20% decline since February as the market’s ultimate reaction to tariffs. Just as we entered bear market territory, the reversal started. During May and June we kept climbing up, almost relentlessly, and finally broke the previous all time highs yesterday during the day.

April lows were down to 4,830 for the SPX. And yesterday we touched 6,187. That’s a 28% upside move. Rampant, V-shaped recovery.

In hindsight, this was the signal to buy:

We didn’t enjoy the all time highs too much to be honest. Again it went down to a single tweet. Trump tweeted about ending trade negotiations with Canada two hours before close reminding us of what we had to live with for the entire quarter - monitoring Trump’s tweets, basically. SPX went from +0.7% to -0.1% in one hour. See that light blue area? That was the previous all-time high. Just as it looked we would cement the move above, it all came down in an instant.

Still, the long term trend is clearly up. And it is notable that most of the catalysts since the beginning of this year, either up or down, were due to tariffs. It started with the 90-day moratorium back in April, a week after “Liberation Day”, and that infamous “THIS IS A GREAT TIME TO BUY!!!” tweet. It continued the push up following news of the administration backing off some of its most worrisome tariff proposals, and especially as the trade deal with China was announced in May (over-the-weekend move where SPX opened Monday gap-up 3%). Then in June we had some concerns over the Israel-Iran conflict, and its resolution this week (Monday) delivered the final catalyst that pushed us into new all time highs.

In our post from last Saturday we talked about this, but did not foresee such a quick resolution of the rangebound trading:

…I would be very careful in trading markets right now. Best idea is perhaps to wait it all out, not to engage in short-term moves for now. Expect if there is a VIX spike (see above).

You probably won’t miss much, unless there is really strong resolution of all uncertainties - tariffs, Middle East, etc. - in which case if would be good to get back in and keep squeezing up. But the probability of that is lower, in my opinion.

In other words, we expected the range to continue, rather than a squeeze up, so we got that one wrong. We did suggest a good VIX trade in case the war escalates, and that worked well. But overall, the view was too careful.

Overall in Q2, among the indices, NASDAQ is coming out as the best performer, up 12%, outperforming even gold and SPX (+7.5%). Bonds were again among the worst performers, remaining marginally negative as yields failed to decline following all the uncertainty regarding geopolitics, tariffs, and the US budget.

But animal spirits were back up, that’s for sure. Just look at NVDA and BTC. Stunning. As if we never even had the tariff episode.

Macro data

Least we forget, this week we got a new set of macro data - the PCE inflation and a GDP revision.

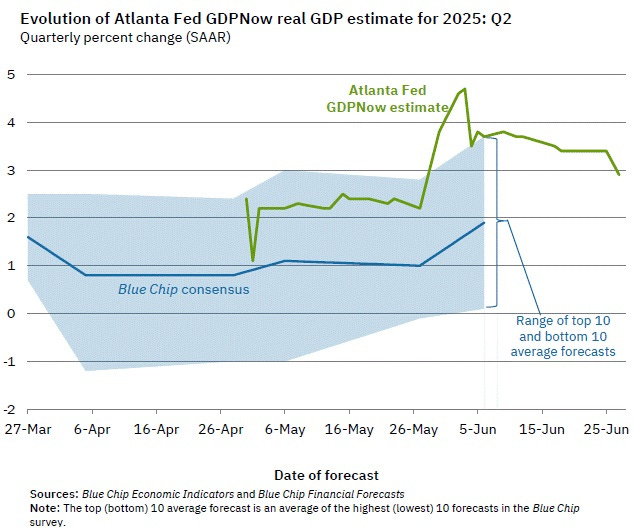

The GDP revision was a decline of 0.5% for Q1, which was slightly worst than the previous estimate (of -0.2%), but nowhere near the feared -1% or worse from earlier in the year. So that was pretty much as expected. At the same time GDPNow data is pretty robust and is estimating Q2 GDP at 2.9%. Still no sign of a growth slowdown.

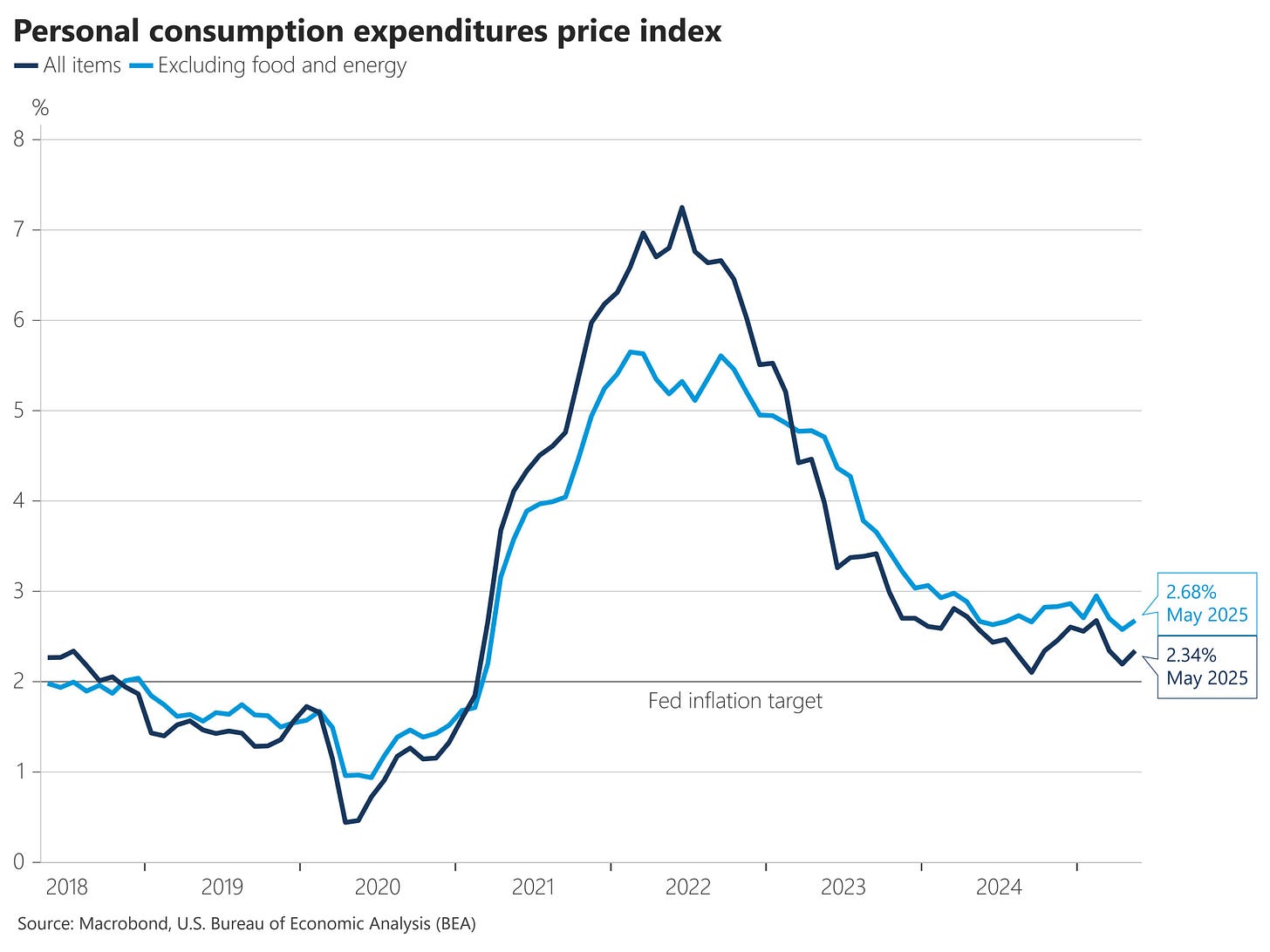

As for PCE inflation, the Fed’s main inflation gauge, it went up a bit last month, 2.7%, up from April’s 2.6%, which is nothing dramatic, but it did signal that tariffs somewhat impacted durable goods inflation.

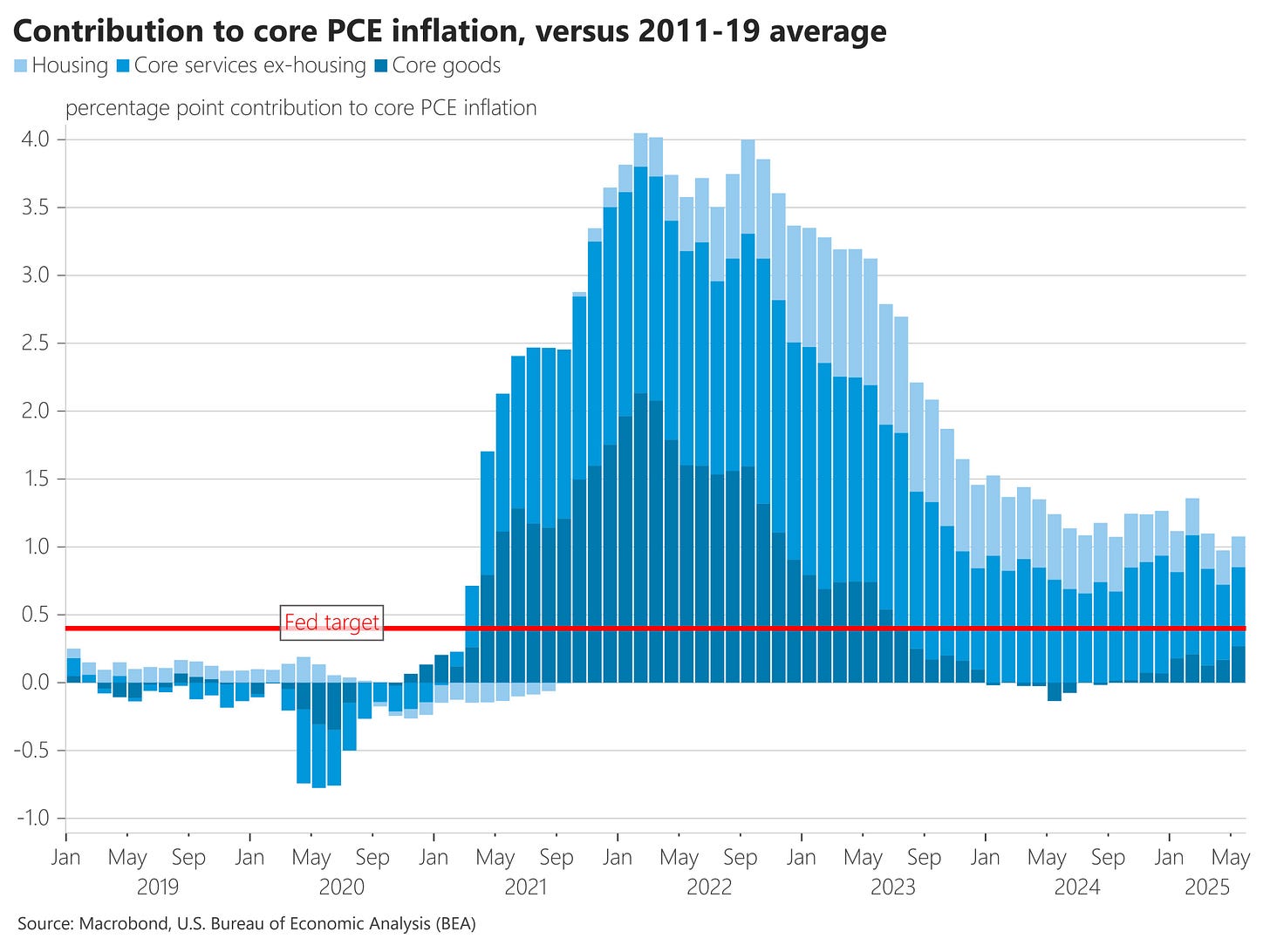

You can see this on the other chart below. Thus far in 2024 core goods were pulling inflation down. But over the past few months they have started to make a positive contribution to inflation. Hence the reason for concern from the Fed last week (reemphasized again this week during Powell’s Congressional testimony: the Fed would have already cut had it not been for tariffs).

It is therefore somewhat appropriate to finish the quarter with yet another reminder that tariffs remain to be the main issue for investors. Just as we crossed over to all-time-highs, one tweet about tariffs sent us back down.

It’s important to fully understand this impact. The following charts show why the Fed is so concerned over the tariff impact on inflation: