I got a lot of questions about what happened this week, so even though I said I will revisit what I wrote on Wednesday in two weeks, I cannot resist a quick comment.

Specifically because of what followed after Wednesday.

This week, the action did not come from the Fed nor the Treasury. Instead, it came from Mag4 earnings and the unemployment report on Friday.

First on Tuesday, MSFT was punished for lower than expected growth, but then on Wednesday we got a powerful rally that started overnight (overturning a 1.5% decline into a 1.6% rally at the open), most likely thanks to the BoJ decision to increase rates the second time this year. And then just as it seemed that good META earnings on Wed after FOMC will carry the rally further (which was my conclusion on Wed), we got a big sell-off on both days afterwards. The market did open gap up on Thursday, but then, as SPX was up about 0.7% in the first hour, it dropped like a stone, to -1.5% on the day. The swing from the night before was reversed. At the end of the day AMZN earnings disappointed, AAPL delivered, but was drawn down together with the rest. And then came the job report before Friday open. Job numbers went down, and unemployment ticked up from 4.1% to 4.3%. Now that is a cause of concern.

Altogether, over Thu and Fri, SPX went down 3%, NASDAQ 5%, bond yields (10Y, 2Y) went down more than 100 basis points, and even gold continued its ascent. VIX shot up a whopping 40% in 2 days (went from 16 to 23, and was even over 29 at one point).

What does all this look like? It looks like investors are pricing in a recession.

The VIX reached the March 2023 levels of panic:

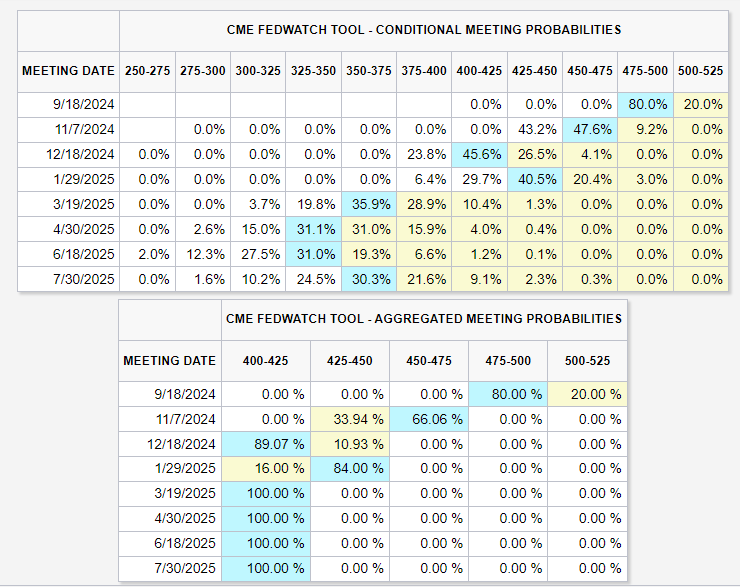

Have a look at rate cut probabilities. 80% chance of 50bps cuts already in the September meeting, and 90% chance we will get 150bps in cuts in December.

Investors are basically saying that the Fed is late. AGAIN.

So yeah, markets are pricing in a recession, and very quickly. This most likely means the sell-off will continue. If you haven’t hedged already, do so before it’s too late.

Throughout this year, I kept saying that Fed cuts this year will come either as a result of a true soft landing or a slowdown/recession. In the case of the former, the rally will continue, but in the case of the latter, we could undergo a major correction. Just as I started to think that maybe the soft landing crew got it right all along, this happens.

In a nutshell, the Wed conclusion was WRONG.

We are in between the final two scenarios mentioned last week, leaning towards this one:

Poor Mag4 earnings, Fed not dovish, Treasury increases coupons - sell off continues, we get a repeat of last summer.

Earnings were poor, the Fed was not dovish, and the Treasury did not pump (it didn’t increase coupons, but it gave no particular signal).

This increases the probability of a longer duration sell-off, similar to last summer.

How long will it last? If it indeed lasts, with a few minor rallies in between (as is usual), here are several dates to keep in mind:

August options expiry (Aug 16th) - a sell-off could extend around it.

Jackson Hole (Aug 24th) - dangerous territory here. If the Fed admits a mistake, it would imply an economic slowdown for sure - if the markets keep selling until then, we could get a brief rally, but if they are sideways, the sell-off might pick up afterwards.

September Fed meeting (Sep 18th) & options expiry (Sep 20th) - same logic as above, let’s see what the markets do before and how much they decide to cut anyway

Ok, now I’ll revisit in two weeks :)

Thanks for reading!

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

Shocking but true. I looked through a bunch of texts, predictions, ideas, everything that was within my reach and of all of them only one has a graph, how in 3 jumps the SPX will stop at 5345 - it almost hit - I personally did not think that it would go down there but he ended up right there. A real lottery.