We ended last week’s analysis with the following conclusion:

To sum up, I do expect a mean reversion next week, but if earnings of GOOGL (and TSLA) disappoint, or get punished anyway, then brace yourself for an April-like sell off. The sell-off might not last that long, until FOMC basically…

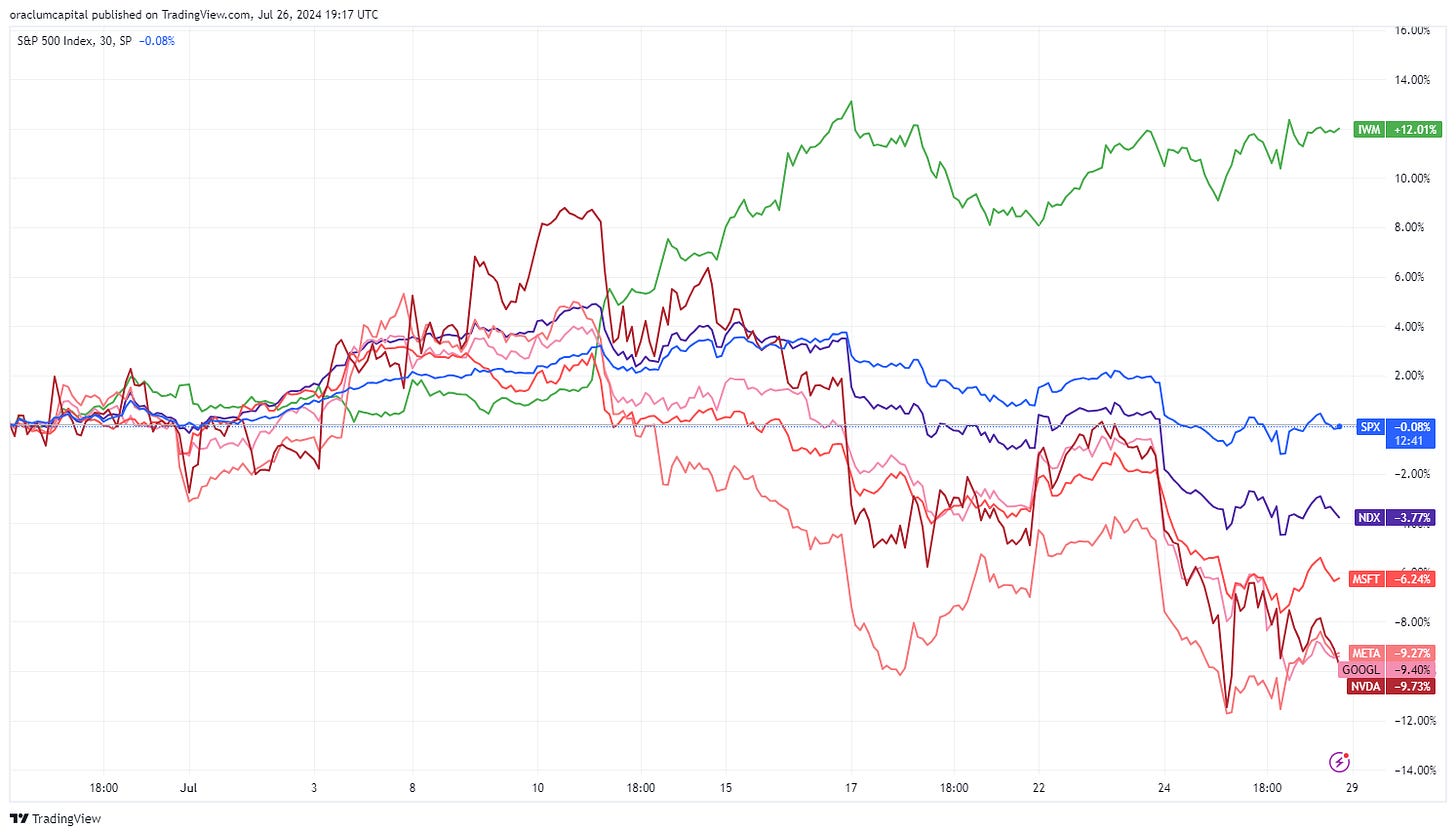

The mean reversion was fully under way on Monday (+1% in SPX, 1.5% in NDQ), continuing onto Tuesday as well, but as anticipated, both GOOGL and TSLA disappointed after Tue close. GOOGL went down 5% the day after, and TSLA a whopping 12%. SPX had its first -2% day in over a year! NASDAQ went down 3.5% as the entire tech sector (Mag7) got punished. It was a bloodbath well in line with what we presented as the window of weakness last week.

On Thursday the bloodbath continued, but was interrupted by a very strong intraday squeeze, only to plummet down before the end of the day once again. The price action went from -0.6% to 1% back to -0.5% on the day. Jumpy!

Friday however rallied, despite a worse than expected PCE inflation, to make the week even more jumpy, especially what the sell-off into the close. A nice little “W” pattern (or whatever) to end the week there:

Rotation into small caps

The talk of the town this week was sector rotation. From tech (Mag7) into small caps (Russell 2000, IWM). The average correction in Mag7 was around 6-7% this week, and the Russell grew 2.5%. On a monthly basis, IWM is up 12%, with SPX stagnating and NDX and the tech stocks down.

Why the rotational trade into small caps? The main reason is the anticipation of cuts just around the corner (triggered in particular by the last inflation print, as the narrative shifted - we talked about this as well). As the Fed starts to cut, small cap companies are likely to benefit more, as their access to capital gets cheaper. So investors will allocate some of their portfolio to small caps, and in order to do this, they sell their most profitable positions - from the AI trade, selling Mag7 stocks, especially after lesser than expected earnings (at least this week).

The second reason for the shift to small caps could be the market pricing in a potential Trump presidency. Trump is expected to cut regulations and taxes, and force even stronger interest rate cuts, which is perceived to be good for small caps. On the other hand, his foreign policy stance on China-Taiwan could trigger big problems for the “AI trade”, dependent on semiconductors produced in Taiwan. This is merely speculation, but it doesn’t take a lot to feed a narrative. We’ll cover this in more detail in the coming months.

But all in all, what we got was a correction, as a consequence of the rotational trade. Will this momentum continue coming into August? That all depends on the fun-packed next week.

4 Mag7 earnings + FOMC + QRA = bonanza!

First, we get 4 Mag7 earnings; MSFT (Tue), META (Wed), APPL (Thu), and AMZN (Thu, dividend announcement expected), and in the middle of all of this, the FOMC meeting on Wednesday, and the new quarterly refunding announcement (QRA) by the Treasury on Monday and Wednesday.

Exactly this time last year (July 31st), the QRA provided the fodder for a massive 3-month long sell-off. Remind yourselves again why these events are important and how they move markets:

So, what can we expect this time?