Back to 'soft landing' or not really?

Paid subscriber analysis

After the most anticipated week of Q4, in which both the Fed and the Treasury made their moves, this one was much calmer, and much more sideways. After last week’s rally, this is expected. Markets often take time to consolidate. Already on Wednesday we gave our recommendation on how we intend to position - closing shorts and going long both stocks and bonds - benefiting immediately.

From our recommendations:

This makes the whole thing a bit strange. The up move came in too aggressively, raising the question of whether or not the rally might be a false dawn? Or - the alternative scenario - are we once again back to square one, pricing in a “soft landing”, and getting ready for another big push up?

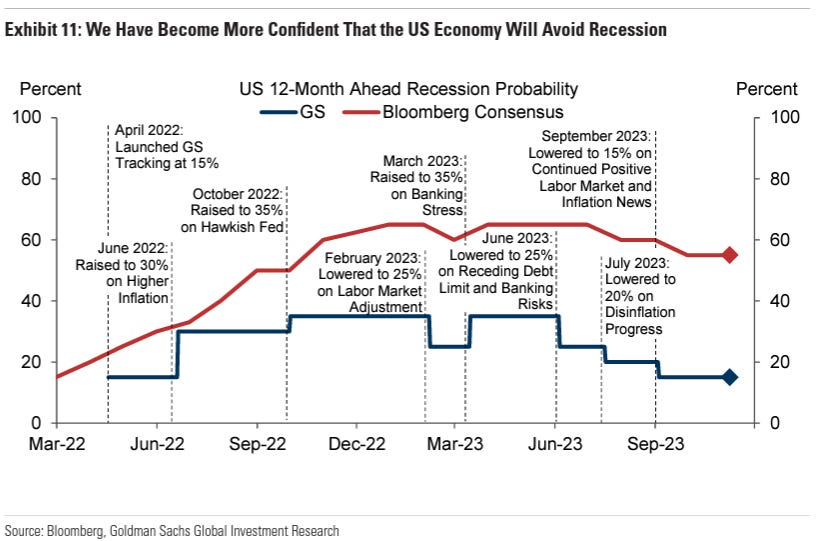

Goldman Sachs seems to think so. In their 2024 macro outlook report titled “The Hard Part is Over”, published three days ago, their economics team says the economy is continuing to outperform, they are expecting strong disinflation coming into next year, they have downgraded recession probability to only 15% for next year, they see major upside in both equities and bonds, and they expect most central banks to finish hiking and start cutting rates by H2 2024.

It’s a good report, I recommend it.

However, it’s not just about recession probabilities. I agree that a recession probability is lower, especially coming into an election year, but this won’t determine market moves over the next year. Long term yields will be the crucial catalyst, as they typically are.

We might be back to square one, macro wise (recall our macro playbook), as the swift reversal in long term yields means the Fed no longer has the same “help” from the bond market in the tightening cycle. And that’s not really a good thing.

Why?