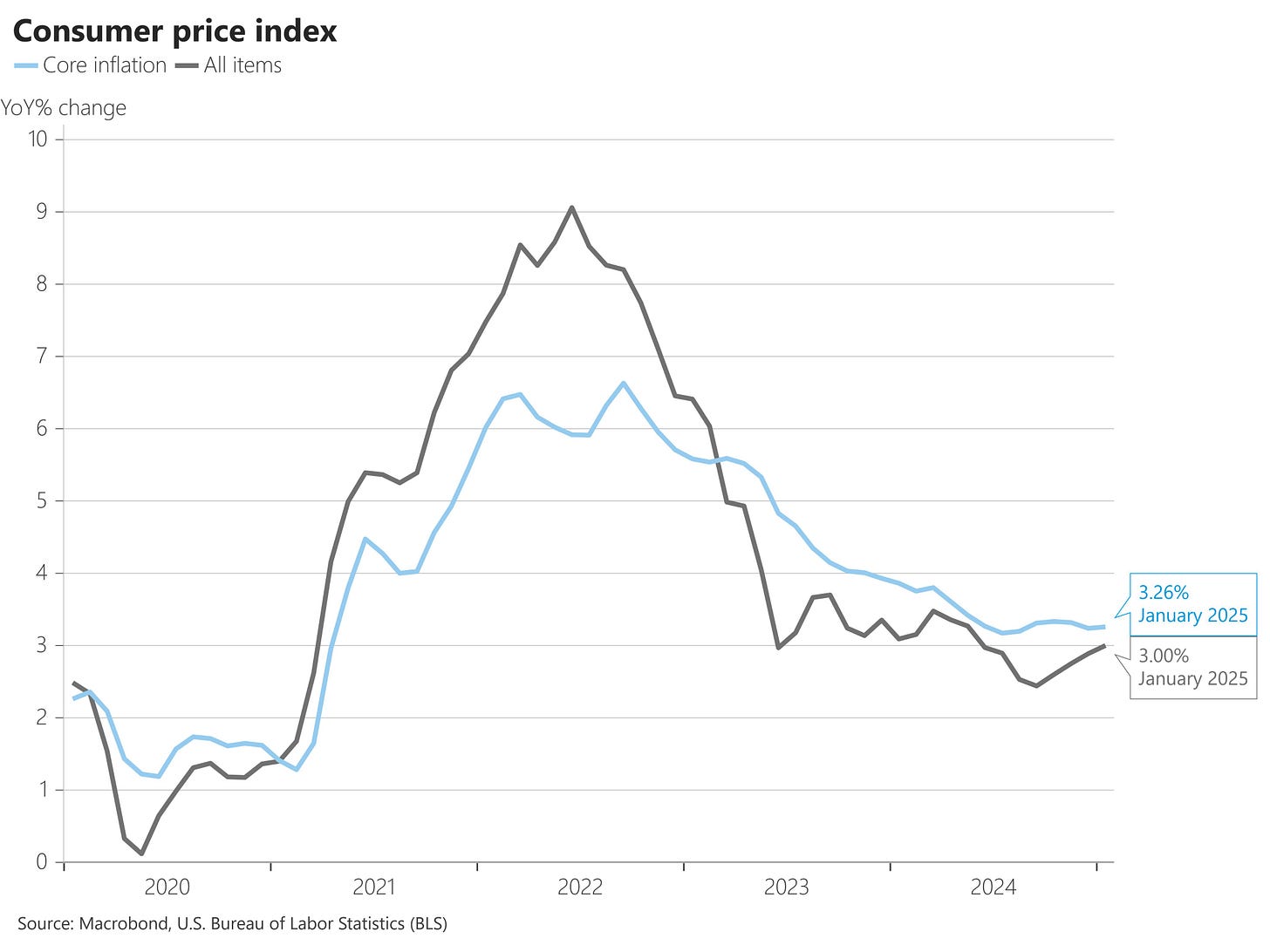

The inflation reports that came out this week were both bad (read: hotter than expected).

First CPI came out with a clear sign that the trend is back on the rise. January CPI was up by 0.5%, pushing the 12-month rate to 3%, while core went up 0.4% in January, and 3.3% annualized (both higher than expected). Then the next day, PPI did the same thing, 3.5% vs 3.3% expected for headline, and 3.6% vs 3.3% expected for core.

To see the trend changing, note that the CPI six-month annualized rate is at 3.7%, while the three-month annualized is at 3.8%.

The biggest increases came from shelter (up 4.4%), utilities (up 4.9%), and food away from home (3.4%). Food consumed at home is also rising. Eggs are at the forefront once again (with prices back at 2021 levels), beef is even higher than in 2021, while milk prices are close to those levels. Everyday goods that certainly hurt the consumer.

We talked about this at lengths back in December, as it was clear to us that inflation was to be the biggest potential headwind for the Trump administration. Inflation back then just started to tick up, wage growth was strong (still is), financial conditions were easy (still are), and the Fed had just re-pivoted to keeping rates higher (for longer).

Furthermore, it seems like some businesses have already started to price in the impact of tariffs (another major headwind), by increasing exactly the goods that will mostly be affected. But this week, despite Trump announcing retaliatory tariffs on intermediary goods (you know, the ones that always get shifted to the end consumer), the markets didn’t react with panic as they did the previous two weeks. Instead we got a vol-driven relief rally (event has passed, hedges got closed, a rally ensued). Unusual, but it happens.

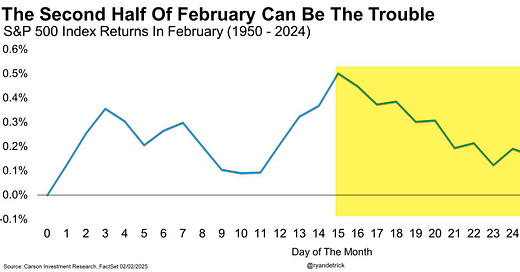

We are in the same loop for the past two months: inflation going up, labor markets strong, growth strong. Which might explain why we can’t see a break-out move in the markets. We were at a slight downtrend until mid-Jan, as the soft landing narrative got repriced, and then pushed up to new all time highs after inauguration week (and slightly better than expected Dec inflation data), to finish just above 6,120 - a level that seems to act as an upper resistance for the past month. Three times we pushed against it, but couldn’t pierce through.

So today, let’s talk about the probability of getting a blow-off top, versus the probability of all this ending badly, and with a correction in between the February and March options expiry dates.