[This is the second text in the 2025 market overview series. The first one came out last week, presenting the bull 🐂 view. The next one, to be published Dec 20, will deliver our 🦈 view.]

Before we dive into the bearish view for 2025, let’s just do a quick recap of the bull view one more time.

It rests upon two main pillars:

Trump administration will be great for the economy. Tax cuts, deregulation and cutting government administration (hint: DOGE) is expected to benefit SMEs the most, while the appointment of Bessent as the Treasury Secretary is looked upon favorably in both Wall Street and Silicon Valley. Easy money, boost to domestic lending, more M&As, boom in private equity. Reaganomics on steroids!

Fed will continue with the cutting cycle. The major reason for end of last year’s optimism were the final two FOMC meetings where the Fed delivered expectations of 3 rate cuts before the end of 2024, while the market started pricing in 6 cuts and went on a bullish spree. Next year, the cuts will continue, and this should add positive momentum for the markets year-round.

Because of this expect a continuation of high GDP growth and strong labor markets. 2025 will be the year we get the soft landing. In that case it is not unreasonable to see S&P500 to go beyond 7,000.

But it’s not all fun & games. There are many risks lurking…

Bear view: inflation, recession, overvalued markets in need for a correction

The bear view revolves around three basic arguments:

Resurgence of inflation - Trump’s tariffs, along with a set of his other policies and decisions that may trigger geopolitical instability, will almost certainly reignite inflation. This will present the biggest obstacle for the Fed to continue with rate cuts. The Fed will have to pause, which will be bad for both equities and bonds. This will then set the stage for a much bigger market correction, and consequentially - a recession.

Recession incoming - recessions never start during a hiking cycle. They typically begin as the cutting cycle starts, and as the yield curve disinverts. This is that point when the economy finally shows some weakness and the market reaction precedes it. Higher inflation will be the catalyst, and then we get the final step of the macro boom-bust cycle: higher interest rates => bond yields pushing up (triggered by inflation) => equity selloff => earnings compression => a bigger equity selloff => recession. In other words, a hard landing, as the Fed will have to cut fast and deep after the recession starts.

When everyone is bullish, be contrarian: markets are overpriced, P/E ratios again spiking to 2021 levels, and market sentiment is way too bullish. Furthermore, market skew has been immense in favor of Mag7 companies, and they too seem to be overvalued, even in the wake of the positive anticipated impact of the Trump administration. The thing is, because of the skew, even a relatively small correction in Mag7 stocks means a relatively large impact on equities in general. And Mag7 stocks have shown to be rather sensitive to inflation; their reaction to any spikes in inflation is typically negative, driving a broader market sell-off.

These three drivers all go hand in hand. And to be fair to the bears, none of these are being priced in right now. In other words, they do provide a good asymmetric trade. To see just how good this trade might be, let’s dig into each argument.

The inflation threat

The biggest danger for markets, the economy, and the Trump administration is, without doubt, inflation. Any resurgence of inflation would be bad news for all. Keep in mind when I say resurgence, I don’t mean we get inflation back to 8-9%. But even back to above 3% or close to 4% would signal a big problem.

Why? Well because price levels are still elevated. Inflation is clearly coming down since mid 2022 (as expected - shortages followed by gluts), but it keeps being sticky (just look at core inflation, still at 3.3%) and higher than in the entire preceding decade. Also, the last two prints have suggested an uptick (2.6% in Oct and 2.7% in Nov, versus the low of 2.4% in Sep).

Prices of most goods are still high. Lower inflation doesn’t mean prices are going down, it means that prices are growing at a slower rate. I know this might be obvious to you, dear reader, but for many people, surprisingly, it isn’t.

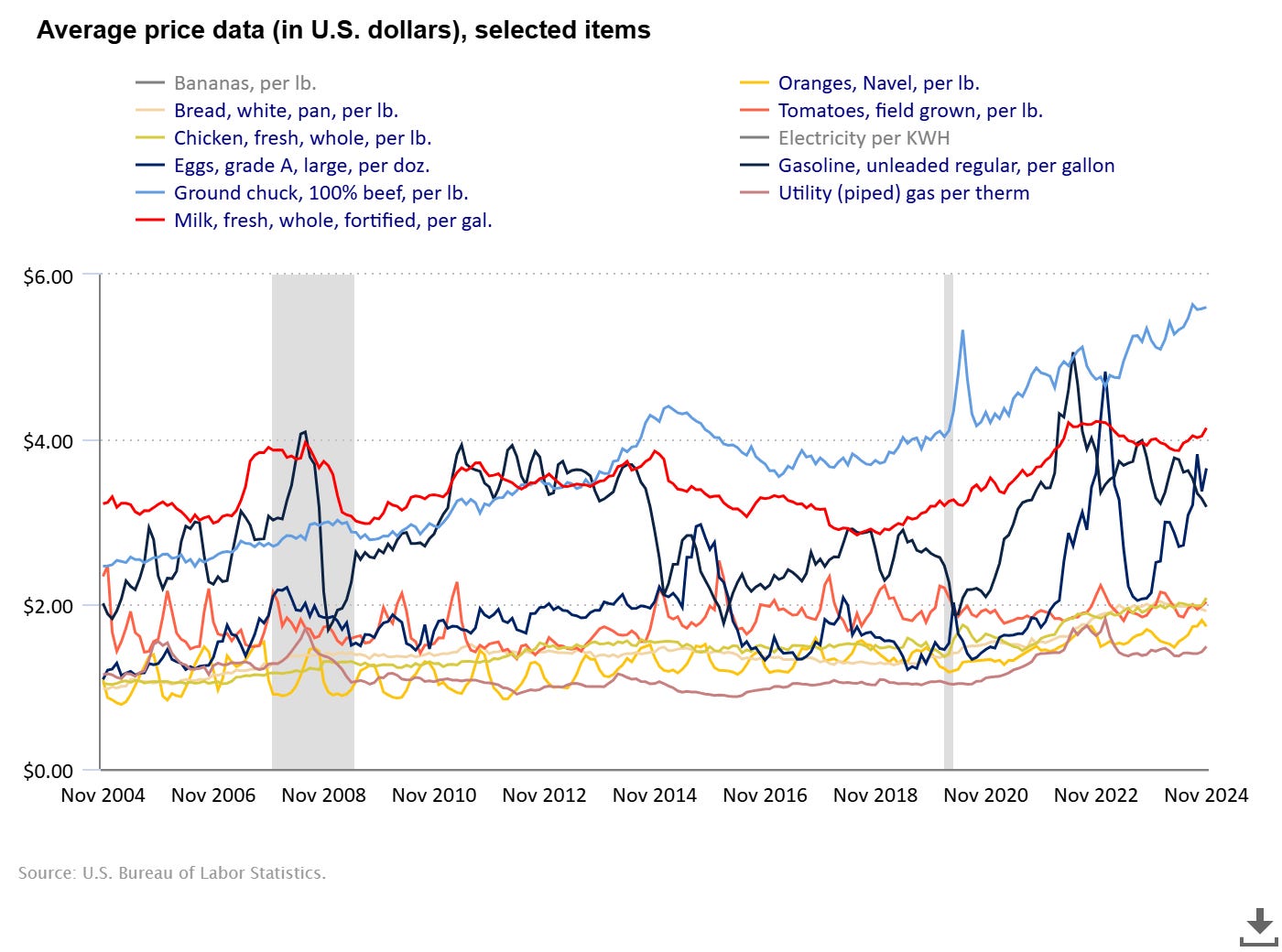

Anyway, prices of everyday goods are still both a real and a psychological problem. Things like ground beef, milk, eggs - basic everyday goods that people notice. And of course, services (see bubble chart below) - the biggest driver of elevated prices and something that is highly unlikely to go back down to where it was a few years ago.

And now, with easier financial conditions, can we really expect inflation not to go up?

Another thing that is contributing to inflation pressures is wage growth. This time last year it was between 4-5%. Today it is 3.6% in the private sector and still a very high 4.7% in the public sector. Wage growth is important to smooth out the inflation shock over time, but sustained wage growth at above inflation levels only adds to inflation pressures. You have a paradox that high nominal wages are necessary to combat inflation in order to keep real wages at least steady, but high nominal wage growth keeps prices high and growing. It’s not your average hyperinflationary spiral, but the logic is similar. Obviously on a smaller scale.

Which is why last year we mentioned that:

bringing inflation down from 3% to 2% will be much harder than it was bringing it down from 9% to 3%.

2024 has shown this to be painfully accurate. People still feel the burden despite the gradual decline in the growth of price levels. It hasn’t had any negative market impact this year, however. But next year it will, the bears say, as momentum will shift on the other side and the market reaction will be brutal.

The one inflation component that has somewhat stabilized and reversed this year were energy prices. However, the bears will point out that these are subject to potential geopolitical shocks in the Middle East and in Ukraine in particular. And with Trump at the helm, any foreign policy mishap could have dire consequences for the energy markets and add to the inflationary momentum.

All this, and we haven’t even mentioned tariffs! The biggest risk for inflation, on top all of the aforementioned. Tariffs are imposed on goods imported from abroad. By design they increase prices of foreign goods like cars, or wines, or olive oil from Europe, washing machines, furniture, and TVs from Asia, but also intermediary goods like steel or copper, or various food items from Mexico for example. The logic is that domestic consumers are discouraged to buy foreign cars, TVs, and wine, and buy american instead. However, if the product is intermediary, the importer typically shifts the price of a more expensive input down to the end consumer. They certainly won’t bear the burden themselves. In addition, higher prices of foreign goods tend to increase prices of complementary US goods. What you get in the end is a net increase in price levels across all goods, foreign and domestic, plus a hidden increase in prices for all end products that use foreign intermediary goods in the production process.

This is why tariffs are the most dangerous policy for Trump domestically. They might be the drop that tips the bucket.