We got some major economic data this week and markets digested them in their usual fashion: jumpy, but higher. As of yesterday, the S&P500 has officially erased all its losses since “Liberation Day”, April 2nd. It was back at 5,700 on Friday, and if this level breaks through and holds next week, that will only add fuel to the bullish momentum. As we said last week, we were indeed on the verge of a breakout. Sort-term, of course.

However, it was far from easy getting there. First on Wednesday, we got a significant sell-off following the news of Q1 GDP being -0.3% (keep in mind, the April chaos was NOT in Q1), and PCE inflation coming in hotter than expected. It was a stagflationary threat and panic selling was immediate.

However, something very important happened on Wednesday: a bounce off the key levels we talked about last week:

The yellow line was the downtrend from February highs, which was successfully broken last week, and the green line was the local resistance that, clearly, turned into support. The bounce was almost perfect, and the markets made steady gains over the next two days.

I’m not taking any credit for a prediction here, that wasn’t the goal anyway; my point was only related to the bullish momentum - it will continue if markets hold the support lines. They did, so we kept rallying. Same for next week, actually.

Clearly, good earnings from MSFT and META (less sensitive on tariffs) on Wed after close helped sustain the up move, and bad earnings from AAPL and AMZN (much more sensitive to tariffs) on Thu after close didn’t push the market back down. What happened was positive news from China overnight, and a decent unemployment report yesterday, and that kept momentum bullish.

Now that major earnings have passed (NVDA still left to go, end of May), and markets did not react in 2022 fashion (which was our biggest fear), the bulls are in charge once again, at least in the short-term.

But it’s never that simple, is it?

Because next week, on Wednesday, we get another FOMC meeting. So today let’s dive into the scenarios.

FOMC: what to expect?

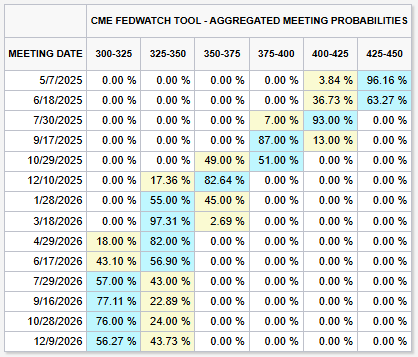

Well, first to state the obvious. Higher PCE inflation print and no change in unemployment data means that it is highly unlikely that the Fed will cut rates in their May meeting. Nor in the June meeting for that matter, and this is now being reflected in expectations:

The first cut is priced in for July, and then September, with the long-term rate still anchored at 3%. As far as the Fed is concerned, the inflation battle is not over, tariffs are a key threat in that area, and despite growth weakening, as long as the labor market is strong (and it still is), they will not cut rates as much as the Trump administration wants them to.

So what could they do next week?