The first big earnings week has passed, but it was still all about tariffs and markets reacting to signals from the Trump administration. On Monday we got a 3% sell-off as there was no change in trade talks during the long weekend, amplified by speculation over whether Trump was going to fire/replace Fed Chairman Jerome Powell (we hinted on something along those lines last week). But Trump himself alleviated those concerns on Tuesday after close; first by saying he never had any intention of firing Powell, just that he thinks the Fed should lower rates sooner rather than letter (and thus push down the 10Y and 30Y yields so as to ease pressure off the administration). But the key signal was Trump saying he will not keep the high tariffs on China, that he will “not play hardball”, and that he is looking to “make a deal with them soon”.

This set the stage for markets to push up during Wed, Thu, and Fri (luckily for us, as ORCA was long this week). The swing this week was from -3% to +4%. Happy times.

The end result was a few interesting technical breakouts. First on Thursday, the short-term level of 5,450 was breached and sustained - a level which has failed three times before over the past three weeks (see green line). And then, the downtrend from February highs was broken this week as well (hourly candles). Sustaining that level would be a big deal for short-term price action. But most importantly, something called the Zweig Breadth Thrust Indicator was triggered, and when this happens, we get a new bull market. More on this below, in the paid section.

NOTE #1: All these technicals don’t have to mean anything. They’re interesting, but in most cases only useful ex-post.

NOTE #2: Trump’s “This is a great time to buy” tweet seems to have been the bottom of this market. So far.

NOTE #3: April price action was quite something! Talk about kangaroo markets. I’m getting a seizure just by looking at the chart.

The Great Dumping of US bonds and dollars

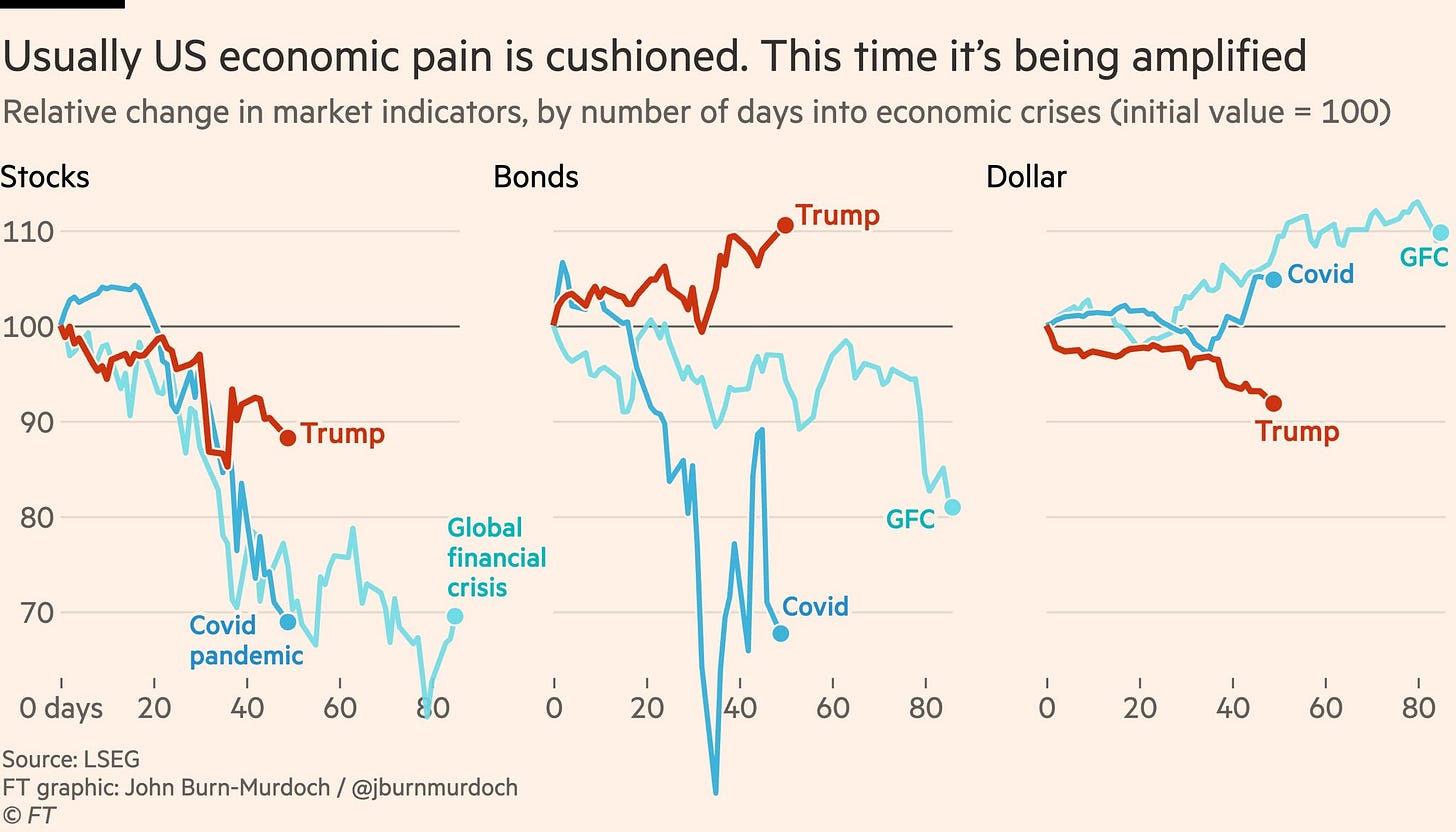

The April sell-offs were significant for another reason. Typically when we get an equity pullback, investors pile into bonds or cash. In bear markets you would then see an inverse correlation between equities and bonds, and a rise of the USD (as there is greater demand for keeping USD cash). These two act as cushions for the pain in equities. Your equity losses are lower overall if your bond portfolio is up and if the USD appreciates (see chart below from the FT: bond yields down, mean bond prices up, thus helping investors cushion the blow). That’s why the 60:40 portfolio was the name of the game during the past 30 years.

However, ever since the 2021/22 inflation episode the bond-stock correlation broke, and both bonds and stocks went down together. Why? Because bonds are veeery sensitive to inflation, and we didn’t have any inflation since the 1980s. And so the correlation broke. Today, same thing, for a similar reason. The bond market reacts to heightened inflationary expectations due to tariffs, but more importantly - foreign investors are dumping their US assets and their US dollars. So instead of shifting from US equities to bonds and/or cash, they seem to be pulling out of all US assets.

That is definitely not a good sign for the administration, and is a direct consequence of what I mentioned what happens when a capital account surplus is reversed:

…in the long run, if the US no longer wishes to be a debtor nation with huge current account deficits, and instead wants to turn this into a surplus, the we can no longer justify such huge capitalization on the US stock markets, nor can we expect such high demand for US debt.

That, in my opinion, is structurally a much much worse situation than having twin deficits and large public debts.

This is international econ 101. US asset classes will not sustain their high levels, nor will bond yields go down if capital flows are reversed due to a massive shift in trade policy. Hopefully the administration is realizing this by now and the impetus will shift towards reducing trade barriers (i.e. make trade deals) rather than raising them. That’s what the markets seem to be hoping for.

Earnings, part 1

As far as earnings, TSLA was a disaster; revenue and EPS both below expectations, net income fell 71%, revenues down 9%, and yet, TSLA stock was up almost 20% since the earnings report. Shocking. Makes you forget everything you knew about valuations. But that was the China tariff rollback impact. Same with AAPL (up 6% since Wed), as these two companies are most sensitive to the China trade.

Then on Thursday, GOOGL beat earnings, as it showed little impact of tariffs on its bottom line - as expected (similar to NFLX the week before). We discussed all this last week.

However, we were not particularly optimistic last week, saying that the administration was running out of time on making major trade deals. This was the conclusion:

Thus far, probabilities are increasing in favor of a bearish scenario. Unless, of course, we get a major deal announced. The clock is ticking…

On Monday, this is what went down: a nervous sell-off. During the week we still didn’t get any major trade deals passed, but all it took was for Trump to calm things down on Tuesday, and then again Treasury Secretary Bessent on Wednesday, triggering this very interesting chart widely shared on X last week:

Whenever Lutnick or Navarro talk about tariffs, that’s bad news for markets. Beware!

Next week is the big one for earnings. We get MSFT and META on Wed, and AMZN and AAPL on Thu.

Expectations are same as last week, but there is something else that is happening simultaneously. Vol compression, breadth, and good earnings. Can it be?