Just a reminder: these types of market positioning/macro analyses will no longer remain free as of September. The paid subscription will start soon, I’m excited to let you know what this will include.

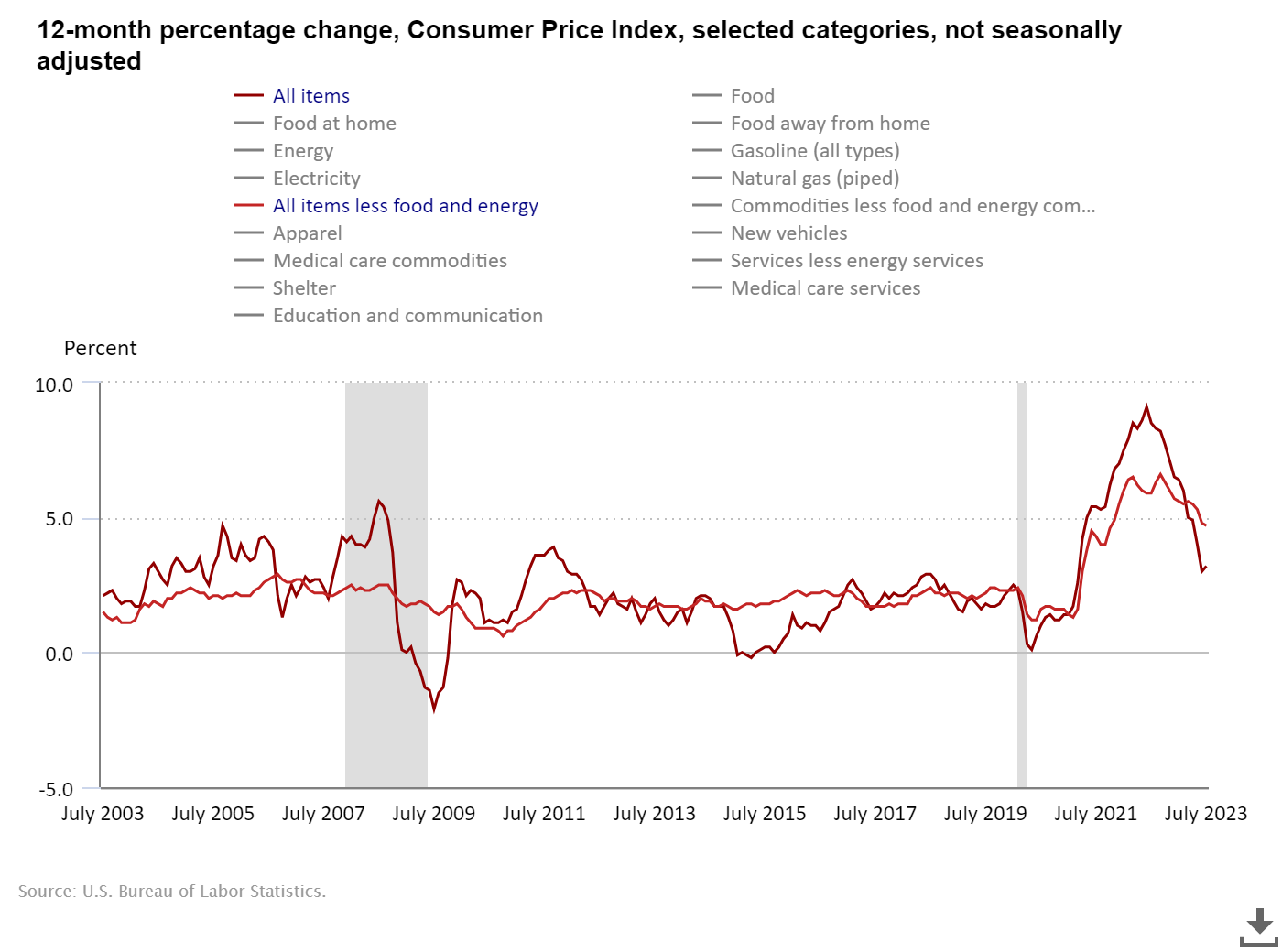

Today the latest CPI report came out, and headline inflation was slightly better than expected, up 0.2% in July 2023. Year-on-year inflation is now at 3.2% (3.3% was expected), while core inflation is at 4.6% (4.7% expected). This was the first time there was an uptick in headline inflation since July last year. The core inflation (without food and energy) hasn’t had that uptick, but in itself is still high enough for the Fed to keep higher for longer. This level of 4.6% is still quite high and not going down fast enough for the Fed to even consider changing their position (i.e. lowering rates).

Over the past few weeks, the market was looking for a catalyst for a sustained down move. We suggested that Fitch’s rating downgrade last week, even though it did trigger a sell-off, was not the catalyst we’ve been waiting for. But the CPI most certainly could have been, had it came in hotter than expected.

The immediate reaction to the news was a decent rally; 1.3% for SPX, 1.6% for NDQ breaking the weekly highs. But then, about half an hour later, the reversal came and before the end of the day pushed SPX down to its weekly lows, ending the day barely positive.

The weekly highs weren’t enough to break the bearish pattern that has been in play for the past three weeks. It didn’t even break the August bearish pattern of the past 10 days. (Note: we don’t trade on patterns, just like to look at them from time to time. We trade on our own proprietary signals). Ever since the year-to-date high on July 27th (about 10 days earlier we suggested an increase in hedge positions which were getting really cheap), the markets have been making lower lows and lower highs - a typical sign of a technical bear trend.

Had the CPI come in hotter than expected, the sell-off would have been immediate and brutal. Instead, all we got was a reversal when the markets started to price in that the Fed is even less likely to lower rates, given that core CPI is still well above 2%. No easing in sight this year:

Before updating the probabilities over an orderly sell-off over the coming weeks, we still need to wait for PPI tomorrow morning. If it comes in better than expected, watch if it breaks at least the August highs (another 1.5% rally would do that). If it fails and reverses again, like today, an orderly sell-off becomes a more and more realistic scenario. If it comes in worse than expected, the probability of a strong sell-off goes up significantly.

After that, the next “catalyst event” we’re looking at is Jackson Hole on August 26th. This is when the Fed will come out and confirm higher for longer is here to stay, and no easing to be expected this year. The narrative of a “full employment recession” is already being thrown out there. For markets it just means that interest rates will remain high. Which would be bad for equities.

If nothing happens there either, or if the Fed - by some miracle - suggests an easing due to a “soft landing”, then the August sell-off we just witnessed for the past two weeks will be a mere correction, and the “new bull market” narrative will reign supreme.

However, in our view, there is still ample potential for a strong leg-down selloff. Just because we had a decent inflation result doesn’t mean we’re out of the woods quite yet. The sharp reversal today exemplifies this better than anything.

We’ll keep a close eye on this, and inform you, dear reader, of everything we find.

DISCLAIMER: None of the contents of this website can act as investment advice of any kind. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. This website contains no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

very happy to start paying for all of your content in Sept. thank you!