As announced, we’ve integrated the podcasts into the newsletter so that you can access them more easily. We’re also still running them on our YT channel.

In this 14-min episode (recorded earlier this week, before the Fitch rating downgrade) we discussed last week’s FOMC meeting and its short-term and long-term implications on markets (higher for longer is here to stay). Our view is still unchanged. Prepared for leg down move in the medium term, waiting for a catalyst.

Was the Fitch ratings downgrade the catalyst? Could be, it’s still hard to tell. This week saw a strong initial negative reaction on Wed, a reversal on Thursday suggesting the market might have shrugged it off, followed by another powerful post-earnings move up on Friday, only to see it brutally reverse by the end of day. That price action from yesterday alone is quite bearish, as markets have rejected pretty decent earnings of Big Tech thus far (even AAPL’s results were a beat, but investors were selling due to disappoint product sales).

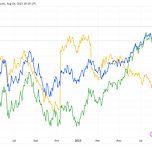

On the face of it, the ratings downgrade doesn’t change the mandate of institutional investors in holding US Treasuries. It’s still high investment grade. But the signal to sell bonds was strong this week. 10-year yields jumped to 4.2%, getting close to that October 2022 peak. The bond market therefore keeps screaming recession, and is close to it’s worse 2022 levels, but SPX is 900 points (25%) higher, and NASDAQ is 4800 points (43%) higher since those lows for both bonds and equities. Something doesn’t add up.

This week, however, the bond-stock correlation from last year returned, as the sell-off of both assets was quite strong. Back to 2022? Too early to tell.

So was Fitch the catalyst for another leg down? We still feel, as discussed in the podcast, that the catalyst is more likely to happen during Jackson Hole by the end of August, or sooner if inflation starts to pick up again. We’re watching commodities for any signal in that direction.

Hope you enjoy it!

Share this post