Quick summary:

The 2024 Q1 competition is up & running - click here.

After a hotter than expected CPI report on Tuesday, the markets sold off strongly during the day, but then bounced back already on Wed and Thu, reversing the losses. On Friday another hot inflation print (PPI this time) initiated another sell-off.

Our positioning was short, so we lost most during Wed and Thursday. We made back some of the premium on Fri, but not nearly enough to break even.

This week is gearing up for NVDA earnings, after Wed close. Another crucial event, apparently. We discuss it on the podcast, have a look.

The Saturday paid section dived deeply into explaining why Big Tech dominated over macro conditions. This Saturday we’ll follow up on this narrative conditional on NVDA earnings.

The competition

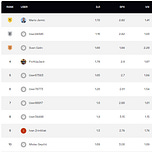

Good performance up top continues. It seems like DJI and VIX predictions are becoming better compared to SPX and QQQ. This is very interesting given that usually, SPX predictions were the bell of the ball. There was a bit more volatility in those two, which could explain slightly lower precision, but overall, after the first 6 weeks, this is very decent performance by our top 10 cohort.

Keep it up everybody! And remember, consistency is key to staying in the top. And good predictions, obviously.

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance & what’s coming up

Another week very similar to post-FOMC actually. The event of the week, CPI on Tuesday initiated a sell-off of over 2% at one point for SPX, only to see it recover in the next two days, closing the gap entirely. These bounce-backs are a powerful indications of a bull market. No bad news lasts, as all dips are bought very soon. The upward trend is never penetrated.

In light of this, anyone holding shorts should close them quickly as they turn a profit. If you see the markets bouncing back quickly, chances are, they’ll close the gap.

After FOMC’s signal of March cuts being off the table, and after two hotter than expected inflation reports, the sell-offs were short-lasted. This is why all eyes are on NVDA this week. Bears are looking for (another) catalyst to the downside, this time with more lasting impact, and bulls are looking for an NVDA-driven rally all the way to $800 for the stock (and another all-time high for SPX and NDX).

How great will those earnings have to be? Well, since Q3 earnings NVDA added $600bn of market cap, making it the third most valuable company in the US, just below Apple and Microsoft. Another stellar earning report will not quite get them to #1, but a worse than expected report will send them back below Google and Amazon.

What do you guys think? Are we getting that sell-off that pulls the market down, or do we keep on truckin’?

In addition to the NVDA earnings show on Wed after close, in this 4-day week (yesterday was off) we get Fed minutes on Wednesday, PMI and home sales on Thu, and some Fed speakers throughout Wed and Thu. This should provide decent volume for the week.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.

Share this post