Quick summary:

The Q2 competition is up & running - click here.

Last week, good earnings (mostly by MSFT and GOOGL) pushed markets back up, despite a scare in economic data coming a day prior. So it was a jumpy market, but it still ended up higher.

This week all eyes are on tomorrow, May 1st, when we get major fiscal and monetary policy decisions involving the Treasury’s QRA decision and the FOMC meeting, which are expected to influence both bond and equity markets significantly over the next 3 months. We wrote about our expectations of these events on Saturday - make sure to read it coming into Wednesday.

The first part of the QRA decision got out yesterday before market close. We cover this in the paid section, updating our probabilities for Wednesday.

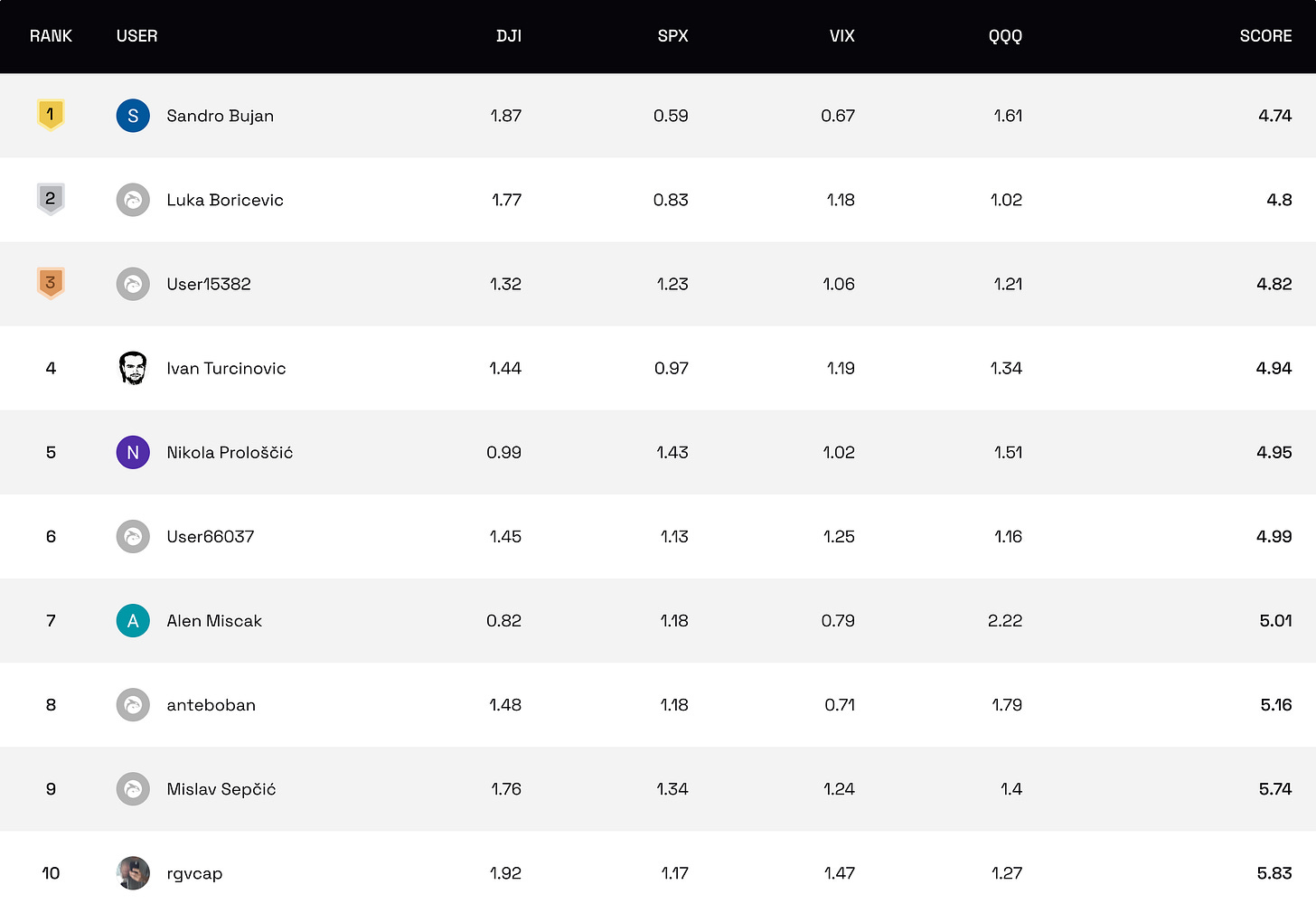

The competition

The scores are in, and they're looking great, especially in SPX and QQQ. Well done to our top performers this week for making it onto the leaderboard!

Consistency is key to staying in the top. And good predictions, obviously.

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Podcast ep #10: FOMC meeting, May 2024

Last week’s performance

Last week, the market was a mixed bag with Mag7 stocks mostly exceeding expectations, led by Tesla, Microsoft, and Google. In contrast, economic indicators were less favorable; U.S. GDP growth for Q1 was only 1.6%, well below expectations, and PCE inflation rose slightly to 2.7%. But after this news, the Thursday dip got bought (again), so we ended with a decent bounce-back following the breaking of the major technical level from last week.

This week, apart from the obvious on Wednesday (more on that below), we get two more Mag7 earnings, from Amazon today after close, and Apple on Thursday after close. Also today we get AMD earnings - the semiconductors are becoming more and more important for markets. It’s not NVDA, but it’s still quite important.

Many other earnings get reported: PayPal, Coca Cola, Mastercard, McDonalds, Starbucks, Pfizer, CVS, Qualcomm, Novo Nordisk (the Ozempic drug maker), Coinbase, etc. Additionally, the unemployment report on Friday will provide another crucial data point, potentially impacting market sentiment if job growth continues to exceed expectations, suggesting ongoing resilience in the labor market.

QRA: part 1

The first part of the QRA was announced yesterday, and it’s a very interesting signal.