Quick summary:

The 2024 Q1 competition is up & running. Still a great time to enter - click here.

Last week was sideways price action, and despite the BASON being relatively precise, in these types of weeks we rarely make money.

This week is one of the most anticipated in the past few months. We not only get the most important fiscal and monetary policy decisions, we also get Big Tech earnings: GOOGL and MSFT on Tue, AAPL, AMZN, and META on Thu. Are you feeling bullish or bearish?

In the podcast (9 mins) we discuss the anticipation of these two events, plus some electoral implications that might impact the decision.

The Treasury has announced its Q2 borrowing estimates yesterday. This is the first part of QRA, second part comes out Wed morning, before market open. We analyze what this means in the paid section.

The competition

[NOTE to winners from Q4 and 2023: we have made the prize payments. Do let us know if you haven’t received yours yet, we will look into it].

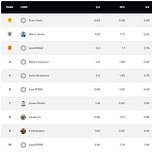

The composition up top keeps changing, which is expected in the first few weeks. This makes the whole thing all the more interesting. Btw, kudos to some of you who still have relative precision of SPX or DJI under 1 (that means their predictions were within a few points of the actual value on Friday for 3 weeks now).

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

After a gap up open on both Mon and Wed, the rest of the week was just pure sideways, as you can see below. In weeks like these, BASON typically doesn’t make money. The prediction was that markets will continue to go up, and on Wednesday we kept pushing higher before a sell-off wiped out all the gains. The recovery was partial over the next two days and we ended the week with a 1% loss.

Coming up this week:

Quarterly refunding announcement, yesterday the borrowing estimate, tomorrow the composition.

FOMC meeting on Wednesday: watch out for any hints of March rate hikes, and what Powell will say on QT.

A whole number of earnings for Big Tech and beyond:

It will be a difficult week for predictions, especially since a lot hinges on Fed and Treasury decisions, while earnings are likely to see a decent reaction as well. With economic growth in Q4 being 3.3%, it’s hard to see earnings disappoint. So do pay attention to the price action afterwards. If it’s muted, it’s not a good sign. If it rallies on good news, the bull run continues. Again, subject to what we hear from the Treasury and the Fed.