Welcome back folks! A new podcast episode awaits - it’s a good one, don’t miss it - plus the usual summary of last week’s performance, and a heads up for the week.

Quick summary:

New survey, for Q4 competition, is up & running - click here.

Last week saw another strong three-day sell-off from Wed to Fri. We covered it all in our Saturday newsletter. Despite beating earnings, most equities either sold off or ended the week flat. A sign of things to come?

Unlike the week before, this time BASON went short, and we made a 4.5% gain for the week. It was a perfect 6/6 week for our predictions.

This week it all comes down to two things: the quarterly refunding announcement (QRA) from the Treasury (came out yesterday, they will provide the detailed structure of debt issuance on Wednesday), and the FOMC on Wednesday. This time, the main focus won’t be on FOMC. The podcast has the details.

Our paid subscribers get an exclusive insight into how we will position for these two crucial events. The first part is today, the second part on Thursday. Don’t miss that either:

The Q4 competition is live, make sure you jump into the survey. Prizes are as last quarter, $5,000 distributed across the top 20 participants.

NOTE: For all those new to the whole thing, here is a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Podcast episode #6: US Treasury borrowing plans and US markets

What to expect from the Treasury and FOMC this week? Dive in to our 14-min conversation to find out:

Last week’s performance

A week almost identical to the one before. Jumpy on Mon and Tue, and then a sharp sell-off for the rest of the week. SPX lost 150 points. And all this despite both GOOGL and MSFT beating earnings on Tue after close (GOOGL got destroyed, MSFT bounced, but still ended the week flat), META beating on Wed, and AMZN on Thursday. We covered most of this in our weekend newsletter, with the main message being: stocks beat earnings, markets says “so what?!”

It’s all about the flows, away from equities and into other assets. More on that below.

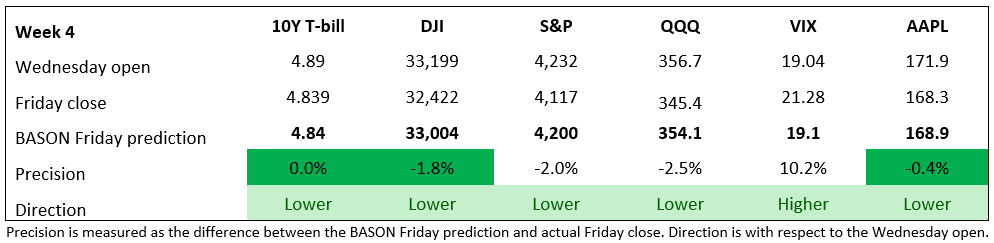

As far as our performance is concerned, it was a perfect, 6/6 week. All 6 went in the right direction, and while accuracy was not the best for S&P and QQQ (they went down even strongly than anticipated), the 10-year ended up exactly at its target. The sharp move in our direction made sure we capitalized on our positions, and made 4.5% for the overall portfolio last week.

Finally, one last reminder to join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions: