Quick summary:

New survey (on our new app) is up & running - click here.

Also, our new podcast is live; we discuss the post-Jackson Hole implication and what is in store for investors in September

Last week had some wild counterintuitive swings, so not ideal for performance. But overall, still very strong in August.

Coming up this week: lots of econ data - job openings, employment report, nonfarm payrolls, housing price index, and the Fed’s preferred inflation report (personal consumption expenditures) is on Thursday

The survey is live on our new app, jump right in:

NOTE: For all those new to the whole thing, here is a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Podcast episode #4: "wake me up when September ends"

At the beginning of last week we suggested closing the shorts we had open since July (and added to during August) and taking profits. It was a great trade overall and did its magic in protecting the portfolio whilst making some money (which is the very point of a hedge).

After Jackson Hole, and especially after the bearish reversal following Thursday’s post-NVDA drop (more on this below), we feel the time was good to reengage the hedges over the upcoming 4 month period. Start small and build it up as the market keeps heading in our direction. Some nice SPX put spreads will do. There will no doubt be more rallies over the short term (for example the one that began on Friday and is still bidding), and if SPX breaks the 4540 level soon, then we’ll reconsider the validity of the hedges (and accept a small loss if necessary or keep adding if the conditions favor it - stick around to see where it goes). That’s the longer term view, preparing for September. The podcast discussed this in greater detail.

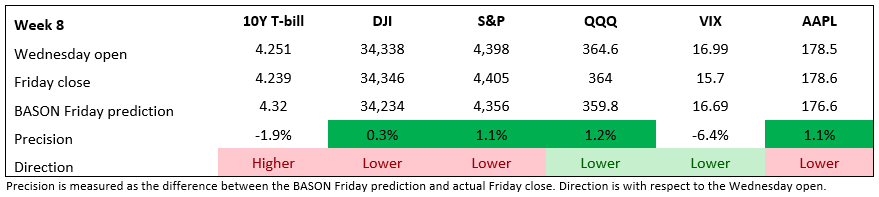

The shorter term (weekly) view is always conditioned by BASON anyway. Have a look and tell us how it feels:

Last week’s performance

Strange but exciting week. Almost perfectly contrarian. Monday and Wednesday featured decent rallies, and then Wed ended up by NVDA killing its earings expectations. Really stellar performance in Q2. The stock price went up over 10% in after hour trading, and expectations were that Thursday will open with another brutal rally.

It didn’t. It open sluggish and almost immediately reversed ending the day with a negative 2% swing. One explanation was that this was due to too many OTM NVDA call options (1dte) being bought the day before, and then an IV (implied volatility, or vega) crush happened and pulled down everything; NVDA as well as the rest of the tech stocks. An IV crush happens when the underlying stock doesn’t move as much as expected. In other words, had NVDA rallied over 10% and stayed there after open, the IV crush would have most likely been avoided. But with so many people buying OTM calls, it was - with the benefit of hindsight - inevitable for an IV crush to rain on the party. Well, at least for the option buyers and holders of long positions.

On Friday, as we eagerly anticipated Jackson Hole, it too produced a very volatile trading day. First a strong sell-off followed by a gradual intraday reversal with markets ending up not far off their first half an hour on Monday. Not the expected reaction to what Powell had to say.

We predicted markets ending up lower actually, but braced for the Thu rally that never happened. In the end, Friday’s price action invalidated our directional predictions, but made good on their precision.

This week is full of economic data. The labor market has job openings, employment report, and nonfarm payrolls coming out. There is also the release of the housing price index, consumer sentiment (came out today) and the Fed’s preferred inflation report (personal consumption expenditures) is on Thursday.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.

Share this post