Cutting cycle: good📈 or bad📉?

Paid subscriber analysis

Two weeks ago, I wrote this to our paid subscribers (calling it scenario #1, and assigning it a higher probability of occurring):

Markets rally into Vixperation, and into the Fed meeting. If they are at 5,650 or 5,700, then a supportive Fed (and especially supportive dot-plots) will compress volatility, and markets will squeeze up, setting up a rally for the rest of the year.

Last week, I reiterated the same point:

SPX is going for that 5,650. The implication stays the same. We are rallying into FOMC, where a supportive Fed very likely causes another squeeze.

Therefore, the odds are shifting in favor of the squeeze post-FOMC, but please do be on alert as anything can happen during FOMC weeks. Particularly as we get an updated dot-plot chart.

Now that the FOMC had passed, and after it announced the beginning of a hiking cycle starting with a 50bps cut, we are well under way to realize the aforementioned scenarios: a rally (jumpy, but still trending up) for the rest of the year.

The dot-plots were not entirely supportive, hence the mixed reaction the first day, but Thursday’s powerful rally fully embraced the squeeze and we finished at a new all time high for SPX (over 5,720). In technical terms, we broke through a triple top, which means breaking through a strong resistance area (5600-5670, see below), which, if the bullish cycle reinforces should act as the next support. Take this with a grain of salt obviously, these things are always correct ex post anyway.

Cutting cycles in the past

Today, I wanna talk about the cutting cycle. What does it historically imply and should we be worried?

You might have come across some analyses online pointing out that a cutting cycle is typically a bad thing as it anticipates (or is a result of) a recession. Like, for example, the charts below drawing a parallel between the current cutting cycle and the 2007 one:

I would take these with a huge dose of skepticism. For one, today is not 2007. Bob Elliott makes a good point here (I’m c/p since Substack doesn’t allow embedded tweets anymore):

“This is not the 2008 cycle. Those drawing conclusions from '08 about the need to cut fast today to avoid the risk of a precipitous drop in growth ahead are missing the big picture. '08 was the bursting of the greatest debt bubble in 100 years. This cycle is totally different:”

Adding to his point, just recall this text comparing the current ‘bubble’ with others in the past. Today, we are more likely at the beginning of a prolonged AI bubble (and a major secular bull market) rather than at its peak. No reason to see it burst (and deliver a 15-20% sell-off) any time soon.

The key issue is still soft landing vs recession, as I’ve been saying throughout 2024. If we do indeed achieve a soft landing (like in 1995-1998), then we avoid a recession and markets keep making new all time highs.

Only if the economy seriously slows down or we encounter some major (geo)political shock do we see a major sell-off. But this needs to be something big. An election result, or a war, or an event like the unwinding of the Yen carry trade are likely to only be temporary setbacks that act as buy-the-dip opportunities. Just like they did the majority of this year.

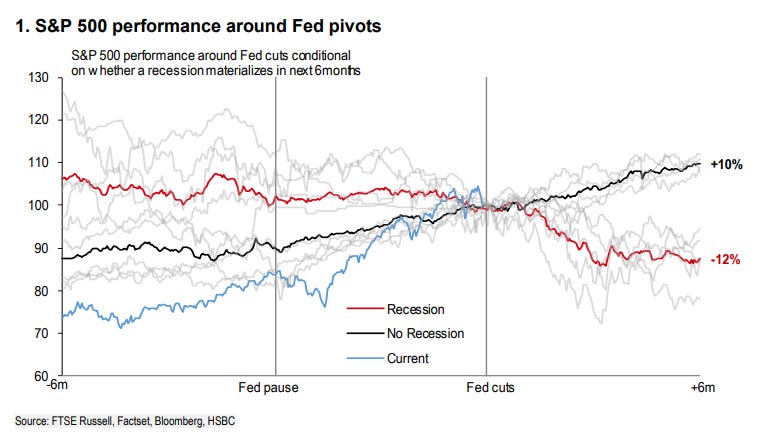

To that end, the following figure is interesting; a comparison of how the market performs after the cutting cycle begins. If there is a recession, 6 months from now markets are on average down 12%. If not, they are up on average 10%.

However, keep in mind these are small sample sizes, as is evident from the following chart, courtesy of Goldman Sachs. There were only 3 cases of an economy entering a recession within 12 months of the first cut, out of 8 cases in total (where the median market return is positive).

A similar research by JPMorgan has found that when markets are trading close to all time highs (around 1% from ATH), the Fed has cut rates 12 times, and the SPX never finished negative a year later in all 12 occasions, delivering an average return of 15%.

But anyone can massage numbers to their liking. Bears will point out recessionary episodes after rate cuts, bulls will look elsewhere. Both will confirm their own narrative.

So what’s the best state of play?