“Everyone has a plan 'till they get punched in the face”

Mike Tyson

This anthological statement from legendary boxer Mike Tyson is ideally applicable to markets. Take, for example, my post from last Saturday entitled “Still bullish”, following a week of good economic data and even better NVDA earnings which nevertheless got sold off.

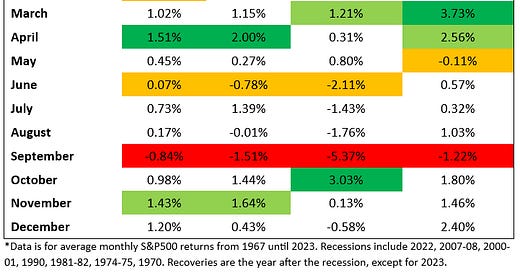

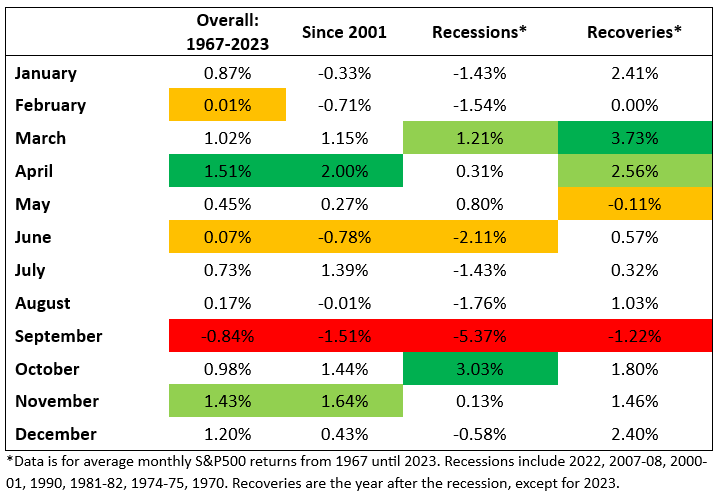

Being bullish coming into a seasonally bad September is perhaps not the ideal set-up, to put it mildly. Just a brief reminder of how markets historically perform in Septembers:

However, if you read the post, the implication is bullish for the year-end, eyeing a 6000 finish for SPX. Bold prediction, but certainly possible given the current batch of economic data, the soft landing narrative, and anticipated Fed rate cuts.

The overall macro view, despite yesterday’s bump in unemployment data, remains unchanged. As long as the economy is robust, as long as economic growth and labor market data are strong (with Fed cuts, this is becoming more likely), and inflation keeps declining (not as a result of a slowdown but as a result of an ease in inflationary pressures), the market will find support and it will rally. Obviously, this is a probabilistic statement. If macro data starts taking a turn to the worse, the recession narrative will prevail over the soft landing narrative very quickly. But we knew all this anyway.

With this in mind, a move down in September - unless it is a “pricing in a recession” type of move - would provide an ideal buy-the-dip opportunity, so that markets can keep on rallying for the rest of the year.

There’s just something about Septembers, everyone coming back to work, the summer optimism is gone, some portfolio rebalancing necessary. Clearly this is just seasonality, it doesn’t have to mean anything. For example, this year, we had a decline in April, and usually April tends to be the best performing month of the year. A typically lackluster June was great this year, and so on. September might not be so bad this year, but it could extend a correction.

One thing that did happen this week is that we got a reversal in the technical indicators. Specifically, the daily signal on SPY and QQQ (and SPX and NDX obviously) signaled an expected bearish move in the next few weeks. These signals are more often right than wrong (but not always, obviously, it’s all about probabilities - never forget this!), so a correction just might happen during the rest of the month.

Let’s have a look at what is going down in September and analyze two of the most probable scenarios.