Regular readers of this newsletter, which have been with us for over a year, will remember the emphasis I place on bond markets and their great track record in predicting economic and equity performance. New readers might read these two former pieces: on how the yield curve works, and why it is a good recession prediction indicator.

The 10Y-2Y and the 10Y-3M yield curves have both been inverted for almost a year now (with the 10Y-2Y inversion starting already back in April last year), and the inversion has been deep, the largest in 40 years actually.

Just a quick reminder why an inversion is a good signal: when the return on a 10-year bond (something you have to hold for 10 years) is smaller than a return on a 2-year and especially 3-month bond (something you hold for 3 months), this is not normal. Usually, it’s the other way around; longer duration - greater risk premium (the longer you hold something, the higher you wish to be compensated for it).

When yield curves invert it takes, on average, 9 to 12 months for a recession to arrive. Sometimes it can take longer - in 2008 the inversion started two years prior to the “Lehman moment”. And recessions will typically happen when the inversion stops.

Why? Because that’s when investors will start buying more shorter (3M, 2Y) than longer duration bonds, which will push the yields of shorter duration bonds down quicker than those of longer duration bonds, thus eliminating the inversion.

But why would investors buy more short duration bonds? Because they are pricing in a recession with the Fed lowering interest rates quickly. When that happens, short duration bond yields go down (they are tightly correlated to the federal funds rate), and their price goes up. Good trade right there if you can catch it.

So in a nutshell, the bond market becomes a self-fulfilling prophecy of a recession.

Is this a trade you should take now? If we’re expecting a recession soon, should we start buying bonds already?

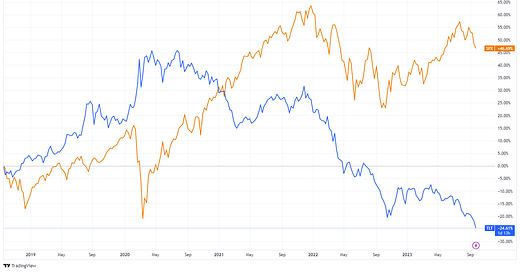

Before we answer that, have a look at this:

This is a comparison of SPX returns with TLT returns (an ETF following prices of long duration US T-bonds, the most traded bond ETF, good proxy of their overall value) over the past 5 years. There is a 70% gap between the two, which, in my opinion, is unsustainable.