Quick summary:

The Q2 competition is up & running - click here.

NVDA once again outperformed earnings, and triggered another 10% rally in the stock over the next few days.

Interestingly, it didn’t pull the rest of the market with it. Quite the contrary, in the same day NVDA pulled an 8% growth, the rest of the market tanked, and quite heavily. NVDA is NOT like an FOMC event after all.

As we said to our paid subscriber posts over the past few weeks, this is in line with expectations over how the markets would behave. Mixed, with strong potential sell-offs, but still grinding up.

PCE index release this Friday is highly anticipated, with markets hopeful for signs of easing price pressures that align closer to the Fed's 2% target.

The competition

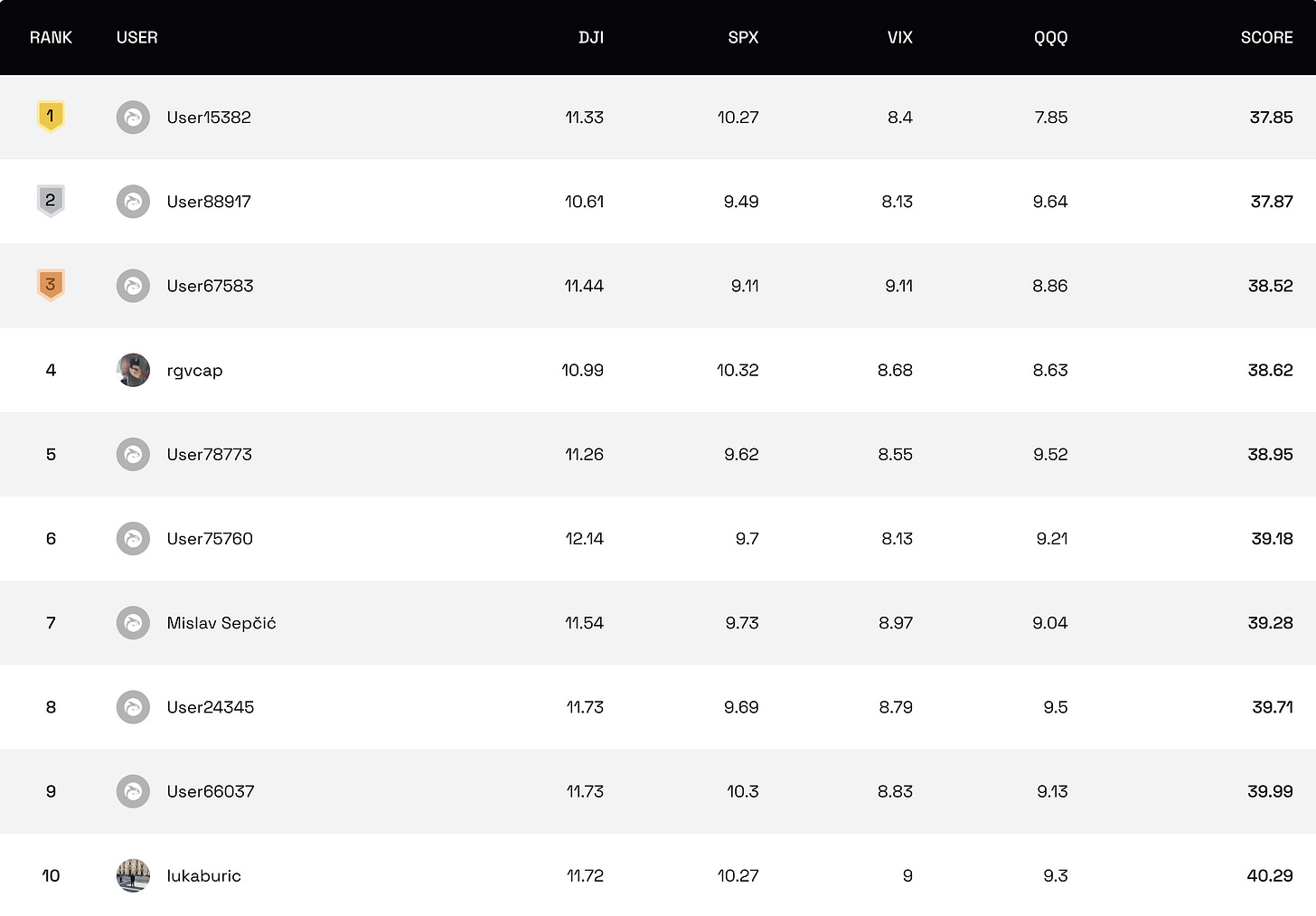

Exceptional work from everyone on this week's leaderboard, with standout performances in the SPY, DJI, and QQQ sectors. Hats off to our top 10 for setting the pace with their impressive insights! 5 more weeks left in the Q2 competition.

Consistency is key to staying in the top. And good predictions, obviously.

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

The spotlight was on Nvidia and major retail players like Lowe's and Target, which all shared their latest earnings reports. Nvidia confirmed its robust performance amid high demand for AI technology, and as they announced a 10:1 stock split, this further triggered demand for the stock. The retail sector offered insights into their adjustments amidst a potentially cooling consumer market. Additionally, the Federal Reserve's May FOMC meeting minutes and speeches from various Fed officials underscored a cautious approach towards future rate decisions, with a strong emphasis on the need for more data to assess inflation trends.

This is what it looked like in markets last week - jumpy! A post-minutes sell-off on Wednesday, followed by a gap-up on Thursday (driven by NVDA earnings), and then a massive sell off during the day, followed by another mini rally on Friday.

As you may know by now, these are not the ideal environments for BASON, so we lost about 1% last week, despite being bullish, anticipating NVDA.

If you followed our advice over the past several weeks, we announced exactly this sort of market behavior; volatile (jumpy swings), and yet grinding up:

Warning: volatility ahead.

Well, as we said on Wednesday, the signal was short-term bullish. But we also said this: “…we didn’t get the clear signal we were hoping for - either up or down. The Treasury slammed the breaks, but the Fed came to the rescue. So for now, the short term trend should be positive, but in the longer term the headwinds are still there.”

And then again over the next two weeks, feel free to read these again:

What are earnings and technicals telling us?

Today I thought it would be good to go from our usual macro overview and obsession with fiscal and monetary policy to a more micro perspective of how firms are doing with their earnings, and how certain technical levels suggest the market might be moving. We close with a brief analysis of that old adage: “sell in May and go away (until end of September/early October")” - does it hold through this (election) year?

Data dependent.

We got the new inflation numbers this week. PPI came in higher (2.2% vs 1.8% in March), but CPI came in lower (3.4% vs 3.5% in March). Core CPI is continuing its downtrend and is now sustainably below 4% (down to 3.6% in April). Core PPI reversed and went up a bit (see figures below). We didn’t get any major change: inflation is still sticky, and housing and transportation are still its main drivers.

Bottom line: the structural forces of the market are unchanged. We got a very good earnings season, and markets are grinding up, but it’s by no means a nice, straight path like we had from November ‘23 to February/March ‘24. The macro forces are still important, and we are still very much data dependent.

This week, as markets reopen after the Memorial Day holiday, attention shifts towards inflation, with the PCE index due on Friday. Markets are hopeful that the PCE data will show a continued easing of price pressures, moving closer to the Fed's annual target of 2%. On the corporate front, Salesforce and Dell are set to release their earnings, likely influencing tech sector sentiments. Retail will also be under scrutiny with reports from Costco and Dollar General, providing further clues on consumer spending health. This week is crucial for Federal Reserve communications, as it marks the final period officials can speak before the blackout period leading up to their next meeting.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.