Nothing breaks, yet.

Paid subscriber analysis

Trading was intense this week. And very reminiscent of most of 2025 - a Trump tweet moves markets in one direction (typically down), then he backs down, so markets move in another almost instantly (typically up). Ah, the good ol’ days!

In our TA overview on Tuesday we noted that:

“if SPY bounces back to 686-ish, and fails to clear the prior resistance, meaning fails to jump back up above it, this would signify a bearish confirmation to the downside and we can expect the sellers to reengage at that level.”

We actually did see a reversal already on Tuesday during the day, but then all it took was one Trump announcement at Davos - that he will not impose tariffs to EU countries over Greenland - and markets shot back up, breaking back into that zone that we had signified as an important area. And trading sideways for two days.

The resistance zone below did not break and we didn’t get that bearish continuation we were looking for. Momentum turned positive on the 4hr time-frame but not yet on the daily or the weekly. There is still danger therefore. We are unable to go back to all-time highs, and this all feels very earily similar to Feb last year.

So today we talk about the risks in Q1, extending our argument from last time.

Oh, and in case you missed it, I had an article on X talking about “the end of globalization”, offering a rebuttal to that argument.

In video form you can find it here.

Q1 Drawdown Risk Amid Powerful Tailwinds

It’s almost ironic: the macro backdrop couldn’t be more supportive. Inflation is falling, the Fed is shifting from tightening to easing (there’s even talk of an imminent pivot), and global central banks are adding stimulus. On the fiscal side, government spending is still in high gear – the US recently rolled out a hefty $200 billion in mortgage bond purchases to juice the housing market, and countries like China and Japan are unleashing their own stimulus measures. Combine that with an unprecedented corporate tech spending boom (every CEO is throwing money at AI), and you get surging economic growth and even mid-teens earnings expansion for the S&P 500. It’s no wonder stocks have been on a tear.

Yet all this good news has a flip side: the market hasn’t really reflected this thus far. Dare I say it - it was priced in??

Equity valuations have soared – the equity risk premium plunged to 20-year lows and the S&P 500’s dividend yield is barely 1.2%, reflecting near-euphoric confidence. In other words, the market has been partying like it’s invincible. And that’s exactly when it pays to be careful. We’ve seen this movie before: when everybody knows the story (in this case, “fiscal + monetary + AI = boom”), the market tends to find a way to surprise us. Right now, the surprise could well be a first-quarter pullback that catches overextended bulls off guard. As we mentioned last time.

Historically, early-year stumbles aren’t uncommon in the midterm election cycle. In fact, the first quarter of a midterm year has a habit of testing investors’ nerves – even in otherwise strong years. I do believe, as stated before, that 2026 will follow this pattern: a temporary air-pocket for stocks (a chance to buy the dip), despite all those tailwinds at our back.

Midterm Election Years: History of Q1 Turbulence

One big reason I’m cautious into Q1 is simple history. Midterm election years tend to start on shaky footing. The market’s track record in these years is full of early drawdowns – a reminder that even in bullish regimes, politics and positioning can spur short-term volatility.

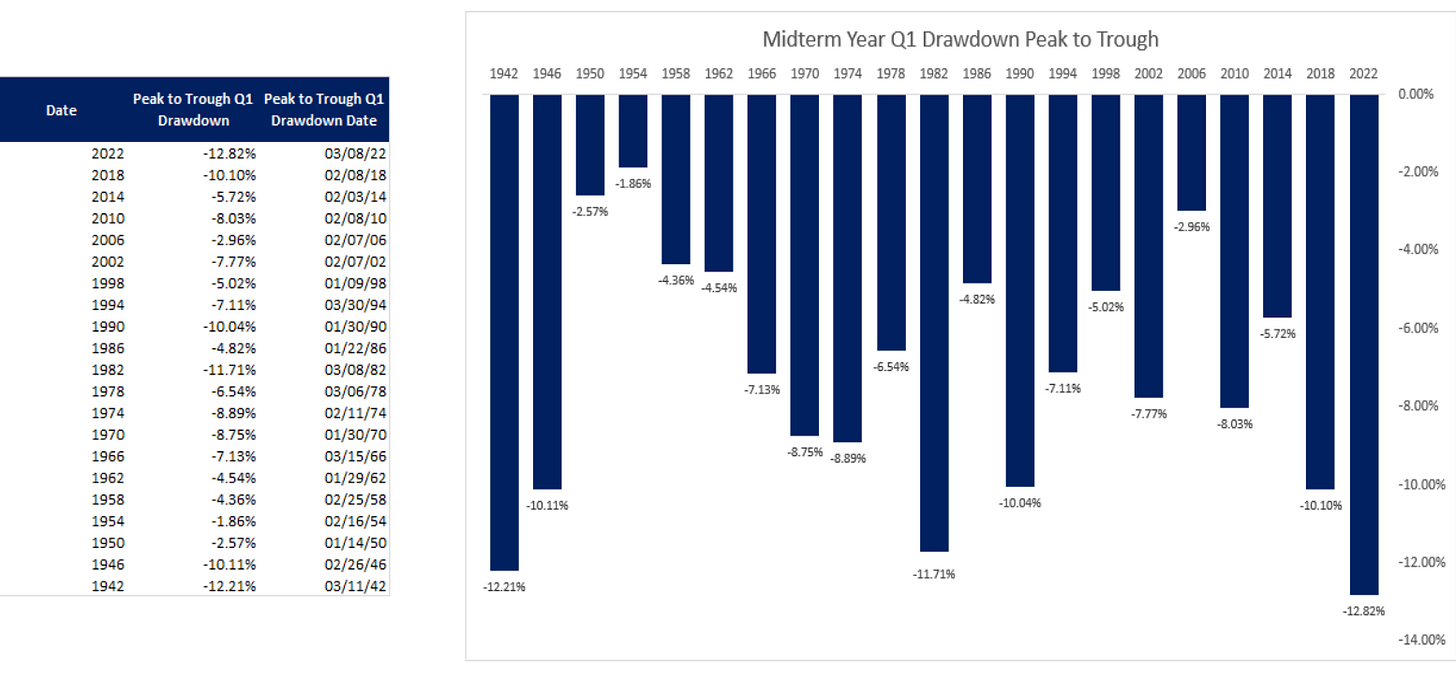

Since 1942, more than half of midterm years have seen the S&P 500 tumble 7% or more at some point in the first quarter. That’s 12 out of 21 midterm years suffering a ≥7% Q1 correction. Whether it’s uncertainty around policy shifts, election posturing, or just the market’s own seasonal quirks, something often knocks the market down early in those years.

Importantly, these Q1 pullbacks didn’t preclude a strong finish for the year – often the year’s high comes much later (historically, the fourth quarter ended up being the top in about half of those midterm years). In several cases, the first-quarter stumble was a healthy reset that set the stage for a sustained rally. I suspect 2026 could fit that mold: an early shakeout to work off froth, then an extension of the bullish trend as the fundamental tailwinds reassert themselves. But to get there, we likely have to stomach a bout of midterm-year volatility first.

Everyone’s All-In: Leverage & Euphoria at Extremes

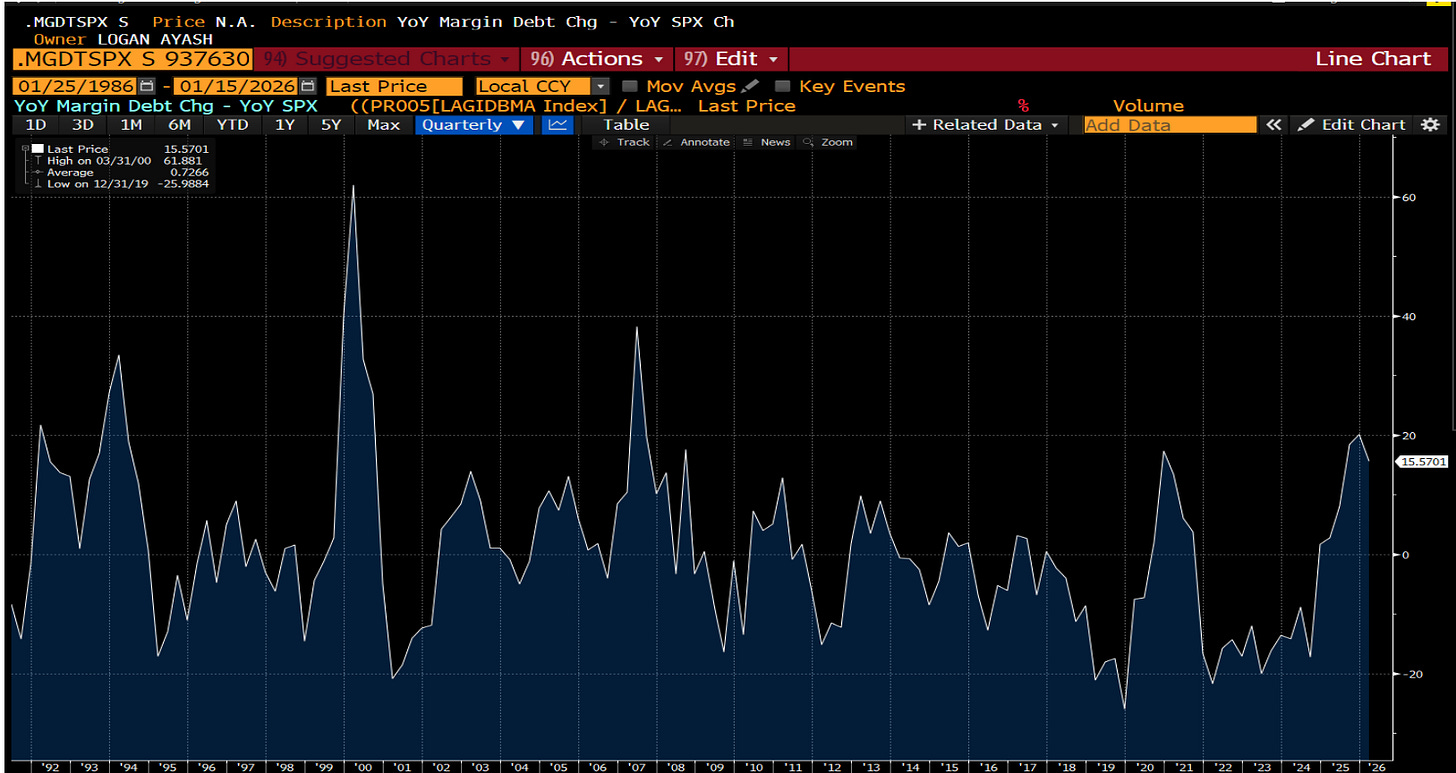

If there’s one thing that keeps me up at night, it’s the extreme optimism and leverage we see in the market right now. Virtually every indicator of positioning and sentiment is flashing contrarian red. Take margin debt, for example – investors are borrowing against their portfolios at a blistering pace.

The year-on-year growth in margin balances (relative to the S&P’s own rise) is near the highest level in 25 years. That means leverage is increasing much faster than the market itself, a classic late-cycle signal. When people start betting with borrowed money en masse, it tells us greed has overtaken fear. It also means any downturn could be magnified: a decline in prices forces those highly leveraged players to sell (or face margin calls), which can turn a modest dip into a swift correction.

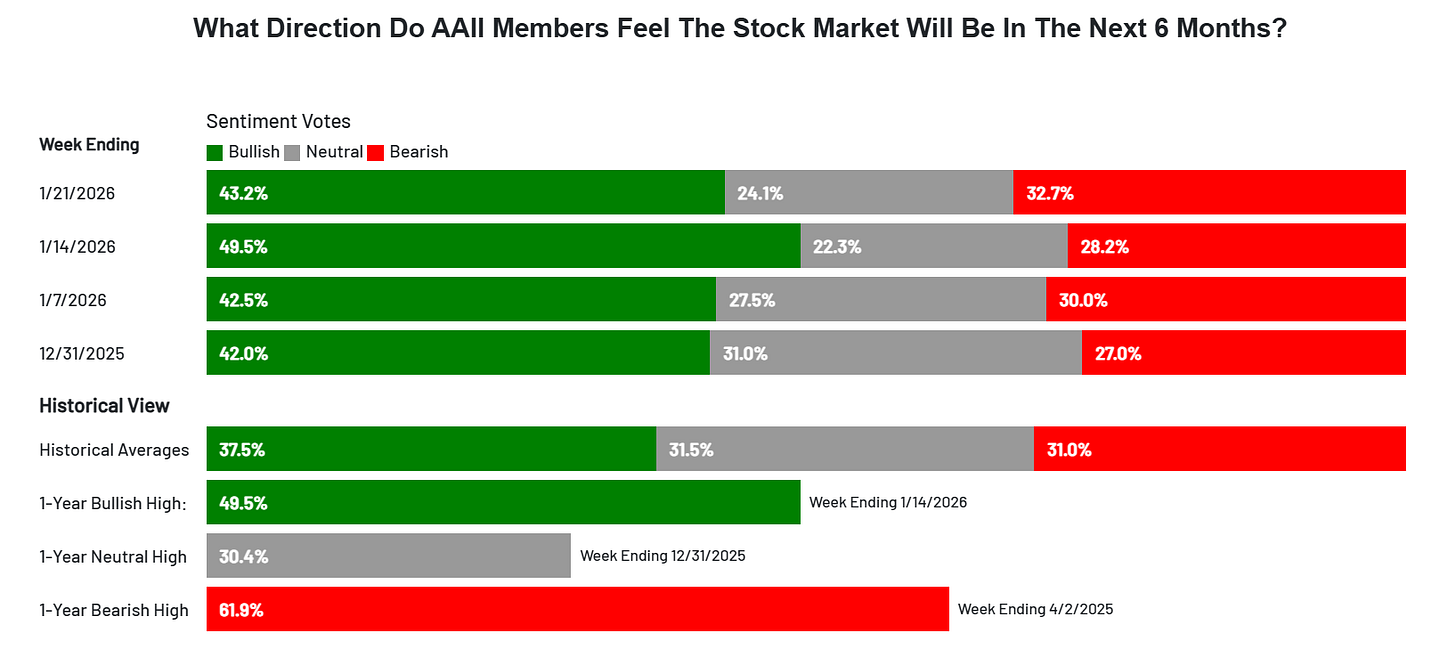

It’s not just the margin stats. Sentiment surveys are showing bulls in full voice. The famed AAII bull/bear ratio recently hit a new high for the year – a sharp swing from the cautious mood we saw at last year’s lows. Similarly, the Bank of America Bull & Bear Indicator is all the way in “extreme bullish” territory, essentially flashing a contrarian sell signal. Seems like everyone is upbeat on stocks.

Even institutional players, who were sitting on piles of cash not long ago, have rushed back into risk. Cash levels at big funds are at historic lows now – the sidelines are pretty much empty. And systematic trend-followers (CTAs) have piled into long positions as well; they’re quite long equities. Crucially, if momentum turns downward, these CTAs could quickly flip to selling, adding fuel to any fire. In short, the crowd is all-in. That kind of one-sided positioning makes the market fragile – if something sparks a pullback, the absence of buyers (and presence of forced sellers) can accelerate the drop. This behavioral context is a key reason we’re on alert for a Q1 air-pocket, despite the rosy fundamental picture.

AI Boom = Earnings Boom (But Watch for the “Scare”)

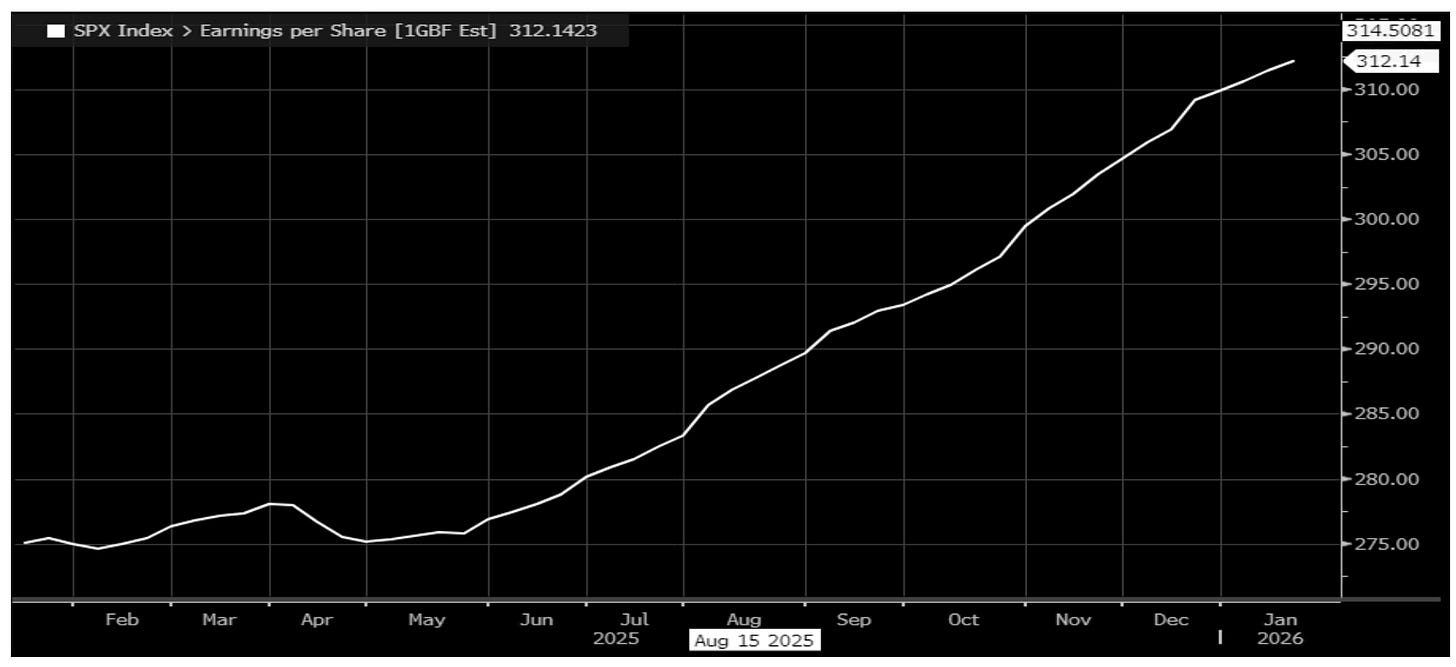

Let’s talk fundamentals for a moment – because they really are excellent right now. Corporate earnings are surging, and we can thank the AI revolution for a big chunk of that. Over the past year, companies have poured capital into AI infrastructure and capabilities at an unprecedented rate, and it’s juicing both productivity and profits. Analysts have been scrambling to upgrade their forecasts.

Forward 12-month earnings estimates for the S&P 500 have jumped to about $312 per share and are still rising. To put that in perspective, that’s a hefty increase in expected earnings – we’re looking at double-digit growth – and it closely tracks the explosion in AI-related capital expenditures. In other words, the AI buildout is directly translating into bottom-line gains for many S&P companies, especially the mega-cap tech names and chipmakers at the center of this new tech cycle.

This earnings momentum is a huge tailwind for stocks. Strong earnings create a fundamental cushion and eventually justify higher prices. It’s one big reason I’m not bearish on the year – the engine of profits is revving hot. However, (and there’s always a “however”), this dynamic comes with a concentration risk. A vast chunk of the market’s earnings growth is coming from one theme – AI. That means if anything even whispers about slowing in that arena, the market could react violently. We’ve reached the stage of the AI trade where expectations are sky-high and everyone assumes perpetual growth. Any hint that the data-center buildout frenzy might cool off – whether due to high costs, capacity constraints, or simply a maturation of demand – could spark a sudden sentiment reversal. I dubbed this the potential “data center growth rate scare.” It hasn’t happened yet, but if, say, a major AI company issues cautious capex guidance or a key supplier notes a slowdown, it could shock investors who are pricing in endless growth. Hence the necessity for protection.

So while I’m thrilled to see earnings climbing (and remain long-term bullish on the AI theme), I’m also aware that the market’s become a bit one-trick in the short run. A scare in the AI story – even a temporary pause in the growth rate – could be the sort of catalyst that triggers the Q1 pullback we’re bracing for. In essence, fantastic fundamentals can breed overconfidence, and overconfidence sets the stage for surprises.

Macro Regime: Liquidity on the Rise

Beyond earnings, the broader macro regime has shifted in favor of risk assets – and it’s important to understand just how strong these tailwinds are (and why they have investors so bullish). First, inflation has decisively rolled over. After the wild price surges of 2022–2024, we’re now seeing clear disinflation: housing costs are easing (rents and owners’ equivalent rent are coming down), oil is languishing at multi-year lows, and wage growth has cooled. The once-hot labor market has turned soft – job growth has flattened out, and the only hiring left is in less cyclical areas like healthcare and education. This “goldilocks” mix of falling inflation and a softer (but not collapsing) labor market is exactly what the Fed wants to see.

And speaking of the Fed: a policy pivot is on the menu. With price pressures waning and growth still okay, the Federal Reserve is poised to stop tightening – and likely start easing. We have a new Fed Chair appointment coming up, and odds are it’ll be a dovish influence. The market is already sniffing out potential rate cuts or other accommodative moves in the coming months. In anticipation, yields have been trending down and financial conditions loosening. The current administration is also hell-bent on getting interest rates lower (not exactly a fan of high borrowing costs in an election year). They’ve been pulling various levers to that end – including the somewhat stealthy mortgage-backed securities purchase program I mentioned earlier, effectively pumping liquidity into credit markets.

Globally, the story is similar. China’s central bank is injecting cash to revive growth, Japan’s government is deploying fiscal stimulus all around, the fiscal-monetary spigot is gushing. Even the US consumer is getting a fresh infusion: lower tax withholdings kicked in on Jan 1, and this year’s tax refund checks are projected to be significantly larger, which means more money in people’s pockets near-term. Oh, and the Treasury just finished drawing down its cash balance (the TGA) by hundreds of billions, which is another form of liquidity injection into the economy. Add it up, and we’ve got a veritable liquidity tsunami underway.

It’s hard to overstate how supportive this is for markets. Ample liquidity and falling rates are like oxygen for equities (and other risk assets). This is why the consensus is so bullish: the macro stars have aligned in a way we haven’t seen in years, arguably since the post-2009 QE era.

But – and you knew a “but” was coming – all of this is very well known and expected. Markets are forward-looking. By the time everyone is on the same side of the boat (”stimulus will boost everything forever!”), the near-term risk is that something tips the boat. I believe that “something” could simply be positioning and sentiment hitting an extreme, as we discussed, possibly catalyzed by an unexpected headline or a data hiccup. It could be an inflation report that’s too hot or too cold, a curveball from the political arena (let’s not forget 2026 is a midterm election year with plenty of policy uncertainty), or an AI scare as noted.

The key point is: the macro backdrop is great, but it’s also fully appreciated by the market. That leaves us vulnerable to short-term shocks. Over a medium-term horizon, I’m actually optimistic that these tailwinds will prevail – once a correction flushes out the excesses, the combination of falling inflation and rising stimulus should propel a resumed rally. It’s the timing and path to get there that’s tricky.