Quick summary:

The ninth week of the Q2 competition is up & running - click here to join the action.

Markets absorbed three major potential catalysts last week—Moody’s downgrade, weak bond auction, and Trump’s 50% EU tariff threat. None of which produced a major sell-off, just temporary ones.

This week it’s all about Nvidia earnings on Wednesday. They could drive the next major move, especially with recent market strength hinging on tech momentum.

Other macro events this week include Friday’s PCE inflation report, Q1 GDP revisions, Fed speakers, and FOMC minutes—all under the shadow of ongoing tariff risks. Oh yeah, Trump gave the EU an extension, so futures shot up. Happy trading everyone!

The competition

NVDA earnings are about to take the spotlight, and with markets on edge, every move matters—same goes for the leaderboard. Things are tight at the top, so if you're planning a push, this might be the perfect window.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Markets had three solid reasons to drop last week—a US credit rating downgrade from Moody’s (announced after hours Friday), a weak 20Y bond auction midweek, and Trump threatening a 50% tariff on the EU. Each catalyst sparked roughly a 1% dip, but none of them stuck. Monday recovered by the close, Thursday clawed back losses from Wednesday, and Friday ended with a strong push higher—even after Trump confirmed the tariff threat was real and not just posturing. But then he reversed this decision on Sunday, so futures trading was up yesterday (US markets were closed due to Memorial Day).

SPX and NASDAQ still closed the week lower, as did bonds, while BTC climbed back to $110,000 and gold pushed above $3,300. Despite the negative headlines and weaker seasonal flows, markets continued to bounce off every dip. It’s another sign that we might be in the early stages of a grind-higher phase—sideways up—so long as no major shocks hit in the next two weeks.

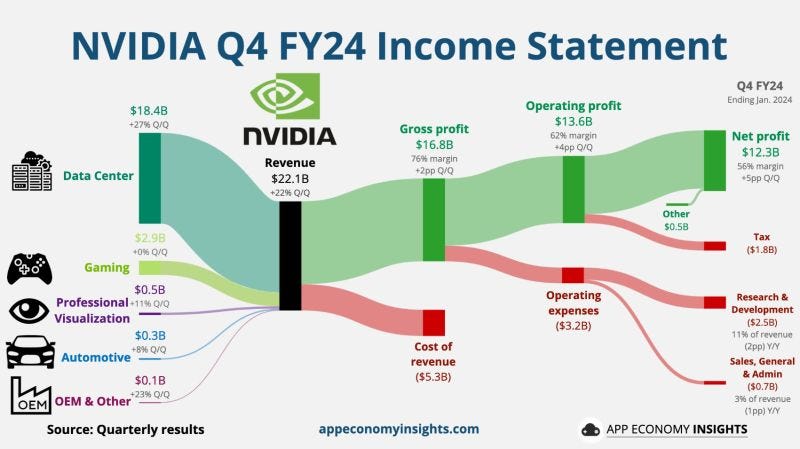

NVDA earnings drop Wednesday, and that could either seal the momentum or shake things up again. Analysts are expecting an EPS of $0.81 (19.7% Y-o-Y increase), and revenues of $43bn (65% Y-o-Y increase). NVDA was clearly affected by the whole situation with Chinese tariffs, however reports of a recent surge in orders from China, worth $16bn for H20 AI GPUs, alleviated some of these concerns and pushed the stock price back to over $130 (it was below $100 post Liberation Day). The expected post-earnings move is +/- 8%.

If they beat earnings, this clearly adds fuel to the bullish momentum. If not, if they disappoint and sell off, then we will see if this is yet another buy-the-dip moment, or we get an, albeit unlikely, prolonged down move. A deeper sell after NVDA earnings most likely will not happen unless there is some other catalyst. Judging purely by last week’s price action. But as we mentioned two weeks ago, this week is also a period of lower support, so if it is to happen, now is the time. We covered this in more detail on Saturday - have a look.

Beyond NVDA, the macro calendar takes center stage. Friday’s PCE inflation report will show how price pressures evolved in April, alongside updates to Q1 GDP, trade balance, and consumer sentiment. Several Fed officials are speaking this week, and the minutes from the May FOMC meeting land Wednesday—adding more fuel to the ongoing rate path debate. With markets still digesting tariff risks and positioning light, this week could determine whether the grind-up continues or if volatility creeps back in.

…join the $32,000x competition!

Join our survey competition to get an opportunity to participate in our quarterly ($8000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.

nVidia will probably push up.... but I'm afraid that PCE and GDP will do their thing and bring everything back from where it started on Tuesday-Wednesday.... this year is probably one of the craziest in history - certainly if we look at Trump's statements and his "rambling" and changing his mind almost after every statement - I wonder if he even thinks anything before he speaks.... LOL