ORCA: using science to predict markets

About Oraclum Capital and the ORCA BASON Fund

Dear readers,

we have launched a new website where you are able to directly reach out to our team if you are an interested investor (with accredited status - see the SEC definition):

After filling out the form, you’ll get an email from us inviting you to a 30-minute call with me. We’re happy to keep you informed about our monthly, quarterly, and annual returns.

Note: the expression of interest is non-binding, it does not represent financial advice, nor can it be interpreted as direct investor solicitation. We are allowed to “generally solicit and advertise” the existence of the fund under Rule 506(c) of Regulation D of the Securities Act of 1933 in the United States, but we are only allowed to respond to accredited investors. If you are not an accredited investor, please refrain from contacting us over this matter.

The Fund

Our alpha is derived from using wisdom of crowds and a network analysis of social media bubbles to predict where markets will end up.

We trade options strategies on equity indices based on weekly signals that we derive from our prediction competition. We buy 2 day-to-expiry (DTE) options with maximum risk exposure of only 2% each week.

With a 68% accuracy rate in predicting SPX direction (over the past three years). We gain 4-5% per week when we get it right, lose up to 2% when we get it wrong.

The methodology we use is a scientific innovation developed in our previous company, Oraclum Intelligence Systems. We've used it to successfully predict both Brexit and Trump in 2016, and Biden in 2020, all within 1% accuracy, among many other things.

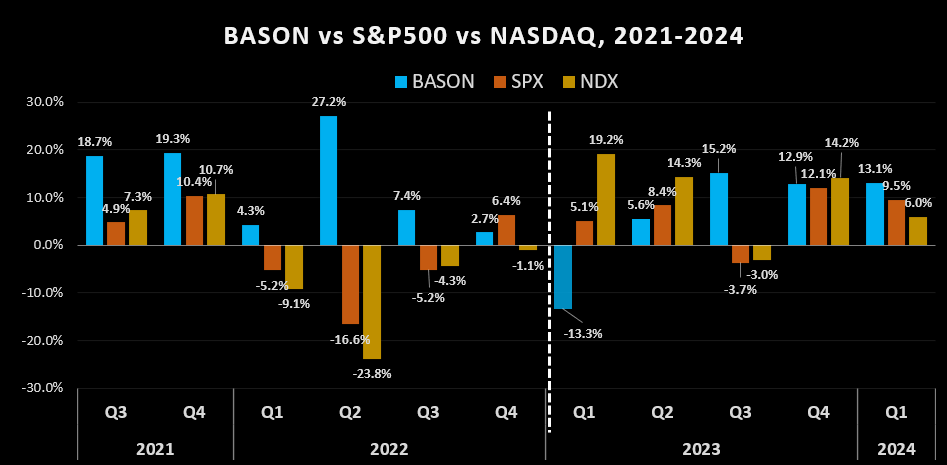

In 2021 and 2022, we live traded the method, securing 54% and 73% in annual returns. Moving into 2023, we enhanced our approach with additional strategies, achieving 19% YTD and a 37% increase since our March lows:

Notice how we tend to perform really well when markets go down (Q1, Q2, Q3 2022, and Q3 2023), but we can also deliver when markets rise (like the current quarter - update coming up by end of week). Q1 last year was our only negative quarter thus far. But the lessons we have learned there were truly invaluable. And necessary.

The BASON methodology

The way this works is through a weekly competition for traders, where we use our unique Bayesian Adjusted Social Network (BASON®) Survey to produce weekly signals of direction in financial markets. The (BASON®) Survey is based on two pillars:

(1) Wisdom of crowds: what you think will happen (e.g. S&P target for end of week), and what others think will happen => Bayesian self-correction

(2) Network analysis: homogenous vs heterogenous groups – looking for best observers, eliminate echo chamber bias (e.g. bearish or bullish)

Weekly survey competition: wisdom of crowds

We make predictions on selected asset prices by asking a pool of traders and investors what they think about what might happen, and how others around them think about what might happen. We then eliminate individual biases through our proprietary network analysis which is the cornerstone of the BASON®.

The BASON® has been successfully applied in predicting elections (Brexit and Trump in 2016, and Biden in 2020, all with errors <1%), marketing campaigns, post-event predictions (COVID impact), etc.

We are perfectly aware that no single individual can predict markets. However, the logic applied to predicting markets is similar to that of predicting elections – no single person in any of our surveys ever gets it exactly right, but collectively, once corrected for their biases, the crowd delivered stunning accuracy.

Why BASON® is the best thing on the market?

Progressive risk exposure

We limit losses to 2% per week, and make 4-5% per week when we get it right. We get it right about two thirds of the time. Roughly, the way this works is the following: we lose money (1-2%) about 17-19 weeks per year, we make roughly the same (around 1-2%) in 27-28 weeks, whereas in about 6-7 weeks each year we make the really big weekly returns (5-6% or more). These account for the majority of our annual returns.

This all depends on our risk exposure, obviously. We apply a progressive risk exposure strategy: when we make more, we increase risk exposure, when we start losing in consecutive weeks, we lower risk exposure.

Weekly compounding effect

Each Friday we take profits and reinvest them the following week.

Investment approach

We have designed the strategy to benefit from positive asymmetry, meaning that we are implementing a strategy that has at least a 3:1 potential risk-return profile for any given week. Rather than selling volatility, we are buying volatility each week, looking to profit handsomely in a handful of weeks each year where the market makes its largest swing in our direction, but we also benefit during less volatile times as long as the S&P500 ends up in the same direction as our prediction. In losing weeks, we limit the losses relative to our maximum allowed risk exposure each week. We use a set of progressive risk exposure rules, adjusted depending our overall performance achieved during the year.

Our portfolio is 10% allocation to BASON options (generating the bulk of our return), and the rest is used as a collateral hedge, parked in short-duration T-Bills held to maturity.

See the full fee structure here.

Note: the expression of interest is non-binding, it does not represent financial advice, nor can it be interpreted as direct investor solicitation. We are allowed to “generally solicit and advertise” the existence of the fund under Rule 506(c) of Regulation D of the Securities Act of 1933 in the United States, but we are only allowed to respond to accredited investors. If you are not an accredited investor, please refrain from contacting us over this matter.