Predictions for Friday, March 18th 2022

NOTE: If you wish to get our updates immediately on Wednesday as the market opens, make sure to fill out the prediction survey on Tuesday (and, if you haven’t already, leave your email WITHIN THE APP - click on the link to see how). We reward our participants with early indications of where the market will end up. Everyone else gets the results a day and a half later.

Thanks for following us, feel free to share to your friends:

Our weekly predictions are here, available exclusively to our subscribers (competition participants get it a day and a half earlier if they leave their email), for Friday, March 18th 2022 (4pm EST; at market close). Keep in mind that our accuracy is much better for low volatility assets, so interpret the predictions with caution. For an overview of our accuracy thus far, see here.

Our estimate for the Friday close for our 5 major indicators and 2 stocks this week is the following:

Our predictions for this week come after yesterday’s rally (S&P +2.2%, NASDAQ +3.7%) following the Fed’s first raising of interest rates since 2018; a 25bps increase. Quite the opposite from what one would expect, although, a 25bps increase was pretty much expected, which could be why the rally ensued.

But, as always, we stick to the BASON and its prediction of the markets ending up lower than their Tuesday’s (and Wed) close.

To that end we sold 414/415 to 429/430 SPY 18/03 iron condor (10 contracts) for $790 immediate gain (huge IV yesterday enabled such a big spread and big profit). Falling outside the condor, the loss is limited to only $200, so we’re riding the condor till expiration.

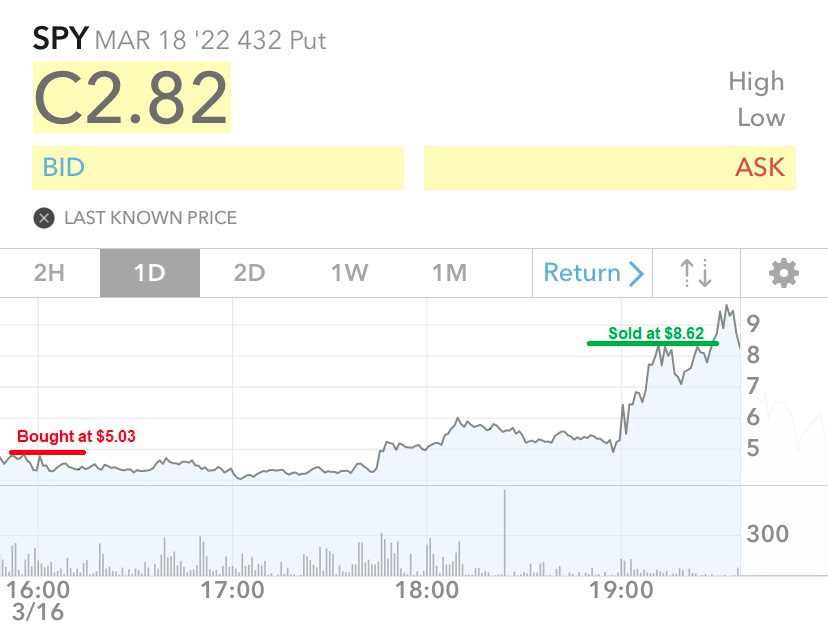

We also bought 2 432 SPY 18/03 puts for $5.03 each ($1,006 total). Interestingly, these puts already triggered a take-profit yesterday! They sold at $8.62 (70% profit) during that downward rally when Powell started speaking (see below). The price ended at $2.82 at close, so it’s a great thing the take-profit was set.

NOTE: I set a high take-profit (70%) and low stop-loss (50%) on the first day of the prediction in case of high daily volatility in the opposite direction - happened a few times before which killed an otherwise profitable options play - and then adjust them to 30% for stop-loss and 50% take-profit the next day.

Also, we sold the 144/145 to 157.5/160 AAPL 18/03 iron condor (10 contracts) for $1100 immediate gain. Again, high IV enabled such a good reward.

If the markets fail to reach our targets and remain high, we will lose $200 on the SPY iron condor, about $300 on the AAPL iron condor. But since our SPY put already gave us $700, we will still have a profitable week, at $200. If SPY and AAPL end up within their iron condors, this will be our most profitable week yet (around $2500).

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Keep following us on Twitter to stay informed about the weekly survey each Tuesday.