22 weeks of predicting markets: 107% return!

Achieved with incredible consistency in accuracy

Intro: the setup

2021 has been a great year for Oraclum’s predictions. Even better than 2016 when we predicted both Brexit and Trump (1% margin of error), or 2020 when we predicted Biden (also 1% margin of error) in addition to numerous COVID-related economic consequences.

Why has it been better?

Because in 2021, over a period of 22 weeks, we have made stunningly accurate predictions of the S&P500, Dow Jones, Bitcoin, the 10-year T-Bill yield, and oil prices (in addition to 4 stocks: Apple, Tesla, Gamestop, and AMC for the past 10 weeks) using our unique BASON methodology. We were asking people where they think the markets will end up at the end of each week, and what their friends think about the same question, while applying network analysis to control for their groupthink bias.

(read more on the BASON methodology here, here, here, or watch the video.)

We’ve been running the whole thing as a survey competition on Twitter where we asked traders and other stock market enthusiasts to give their predictions on the weekly movements of the aforementioned indicators. The survey (available here via our app) was open for only 24 hours each week (from Tuesday 8am EST to Wednesday 8am EST), and users were asked to predict the value of each indicators for the end of trading day Friday (4pm EST) of the same week.

We sent out the predictions each Wednesday morning to our survey users, and published them online for everyone to see on Thursday afternoon. This way users could track our precision for themselves each week.

More importantly, we had our own skin in the game - we invested actual money each week on our S&P predictions (adding AAPL in the last two weeks), using two simple strategies: an SPY iron condor where our prediction confidence intervals are the upper and lower boundaries of the condor range, and SPY call (or put) options to act as a hedge if SPY breaks the upper (lower) boundary. The downward hedge was a simple stop-limit order that either reduces losses or preserves profits (like it did last week).

How did we do?

Investment returns

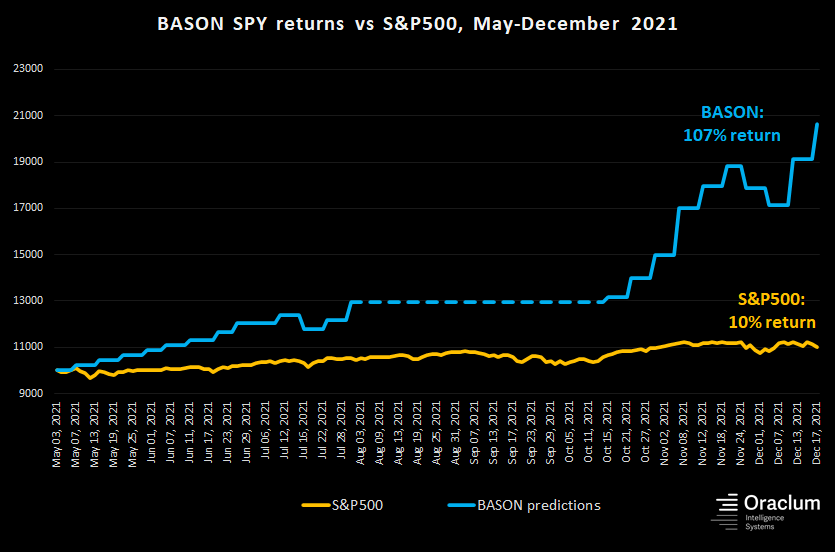

After 22 weeks of applying the BASON to predicting markets on a weekly basis, it has delivered a stunning 107% return! In the same period, a passive investment in the S&P500 would have delivered only a 10% return.

We started with a $10,000 initial portfolio, where we agreed to have a maximum 20% exposure each week (i.e. up to $2000 weekly on buying option contracts).

What does that mean?

Each week we would spend around $1000 (depending on the running price) on 2 SPY calls, and we would be exposed to around $600 loss if the iron condor broke out of its range. Each week we therefore got an immediate $400 or so in profits from selling 10 iron condor contracts, and were waiting for the payoff from the call strategy. Our maximum loss each week would be around $1600. With our stop-limit orders this was even lower (to about half that - like in weeks 7 and 8 for example).

We were therefore hedged from both an upwards-facing shock and a downwards-facing shock. Our upward hedge made sure we made money in the face of higher volatility, and our downward hedge made sure we limited our losses.

In the last two weeks we’ve added AAPL calls which further boosted our profitability. AAPL predictions were correct every single week, and we would have made an even higher profit had we been monetizing them from the start. Interestingly, AAPL’s prediction went against us in the last week, but given that it shot up two days before, our stop limit made sure we took profits when it started going down on Friday.

Why not expose ourselves even more?

If we had invested the full $10,000 each week the returns would have been even greater, but so would the risk. This is why we opted for a limited risk exposure strategy, with a goal of always preserving the initial $10,000, even when the portfolio grew to over $15,000. It currently stands at $20,658.

Therefore, even with such a hedged strategy and limited risk exposure each week, we managed to deliver a 107% return.

For the sake of a cherry-picked comparison, in the same period (May-December 2021), TSLA delivered a 40% return, while Bitcoin delivered a 24% return (to be fair, TSLA was also close to a 100% return in October).

Is this called “beating the market” then?

No, not yet.

Anyone can outperform the market during a short window. What matters is how this will hold up over a longer time horizon. This is why it is important for us to carry on the competition for the entire next year as well, keep gathering the data and adding to the consistency in our predictions. And most importantly, keep having that skin in the game.

Correlation with the market

The next important question is how correlated these returns are to the market (in this case the S&P500). A high correlation (above 0.8) would not be good since it would imply that most of these results are due to good luck - markets went up most of the time, we predicted they would go up, so we’re riding that wave. A high negative correlation also wouldn’t be good because, again, markets went up most of the time :)

But it so happens that our correlation stands at a very decent 0.57, shown on the graph below.

Yes, in most cases the markets went up and we predicted they would go up. Three times they went down and we predicted they would go up, so both the BASON and the markets lost money that week (lower left quadrant).

However, on six occasions, the markets went down and we correctly predicted they would go down, or we had our predictions close to the final value of the S&P, so we made money (exactly what happened last week when we preserved our profits on the way down).

This is ideal - markets losing money, but the BASON calling it correctly and still being able to profit. That is exactly the scenario we’re most excited about.

Prediction accuracy

Ok, time to examine the accuracy of every single indicator. We start with the S&P500 and the Dow.

Not much to add to these charts. Overall very very close to the actual values, sometimes almost exactly correct (we had a few weeks where the precision was within a 0.1% margin of error - scary!).

Next we have Bitcoin, oil prices, and the 10Y yield. Overall looking quite good, but not as accurate as the Dow and the S&P predictions, particularly during periods of higher volatility.

Finally, the last 10 weeks we tried on stock predictions for the first time, and the results are quite good. Again, volatility here was much higher, particularly for TSLA and the meme stocks. But AAPL is the one that delivered really good results, only dropping out of a 2% margin of error on two occasions - both of which would have made money following our strategy.

What’s next?

The survey will be off during the holidays, so Merry Christmas and a Happy New Year!

We will restart in mid-January, as we are improving the app for an even better user experience. See you again throughout next year. May it be a profitable one for us all :)

Thank you for following us, and if you’re new to the newsletter, don’t forget to subscribe!