The 10-week prediction competition is officially over. We have a winner of the competition (actually two winners, see below), a number of interesting findings, and yet another profitable week behind us.

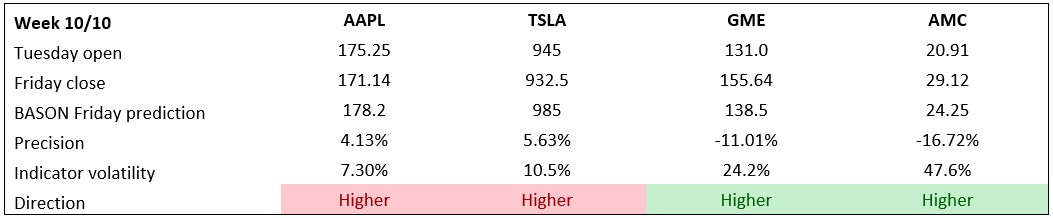

Results of last week’s predictions

First, the results for last week. Despite another turbulent and highly volatile week, the results were actually not bad. When we made our predictions on Wednesday (before the FOMC meeting) and published them on Thursday, it was looking like the market will overshoot most of our predictions. It didn’t. In fact, most ended up lower than our targets (most prominently, DJI and S&P, as well as the AAPL and TSLA stocks, all four going in a different direction). However, despite the wrong direction, the predictions were again accurate within a very narrow margin (1% and 1.5% for the S&P and the Dow), and ever better for oil prices and the 10-year yield. The only overshooting happened with the two meme stocks, GME and AMC.

Profits for the week:

How much did we earn last week based on these predictions?

On Thursday we told you, as always, what we did:

We bought the standard 2 SPY 17/12 calls at 457 strike (cost us around $1200), and given the rally, we are certain to earn over $1000 profit, perhaps even $2000 for this week, just from those calls alone.

We also bought the iron condor for the SPY 17/12 at 462/463 to 472/473. Mind you, we bought this yesterday morning when the SPY was at 461, so we made an immediate $650 profit. …

… We bought 2 AAPL 17/12 calls at 172 strike for $1000, and as the stock continues its growth above our target, we’re looking at doubling that investment, and getting at least $800 profit on it. Looking to be a great week indeed!

It wasn’t that profitable, but it was still quite good.

We kept the $650 from the iron condor, as it remained within the interval, and we made $510 on the SPY calls, selling them automatically (used a stop-limit order) on Friday as the markets started going down in order to capture at least 50% of the profits. Same thing with AAPL calls, sold them on the way down automatically already on Thursday to capture at least part of the profit, or $360.

Altogether we made $1520 in a week that ended lower than expected, during a large sell-off on Friday. This is wonderful news as it reduces the correlation of the BASON to the market (meaning that it matters less whether the market is going up or down, as long as we’re able to estimate where it will end up).

Overall performance

Overall, for the 10 weeks this puts us at a very comfortable 10-week gain of $7720, or a 77% return on investment!

The figure below shows our week-by-week profits and losses. Weeks 7 and 8 were the only losing weeks, and week 1 was a miss for the iron condor, where the call hedge saved us. We therefore made money in 8 out of 10 weeks, for the 77% return. An incredible testament to the power of the BASON. We had our skin in the game each week, and it certainly paid off.

Read more details about the specific strategies here.

On Wednesday, we’ll do a longer analysis of the overall 22-week performance, both for the portfolio and across each individual indicator.

Competition winners!

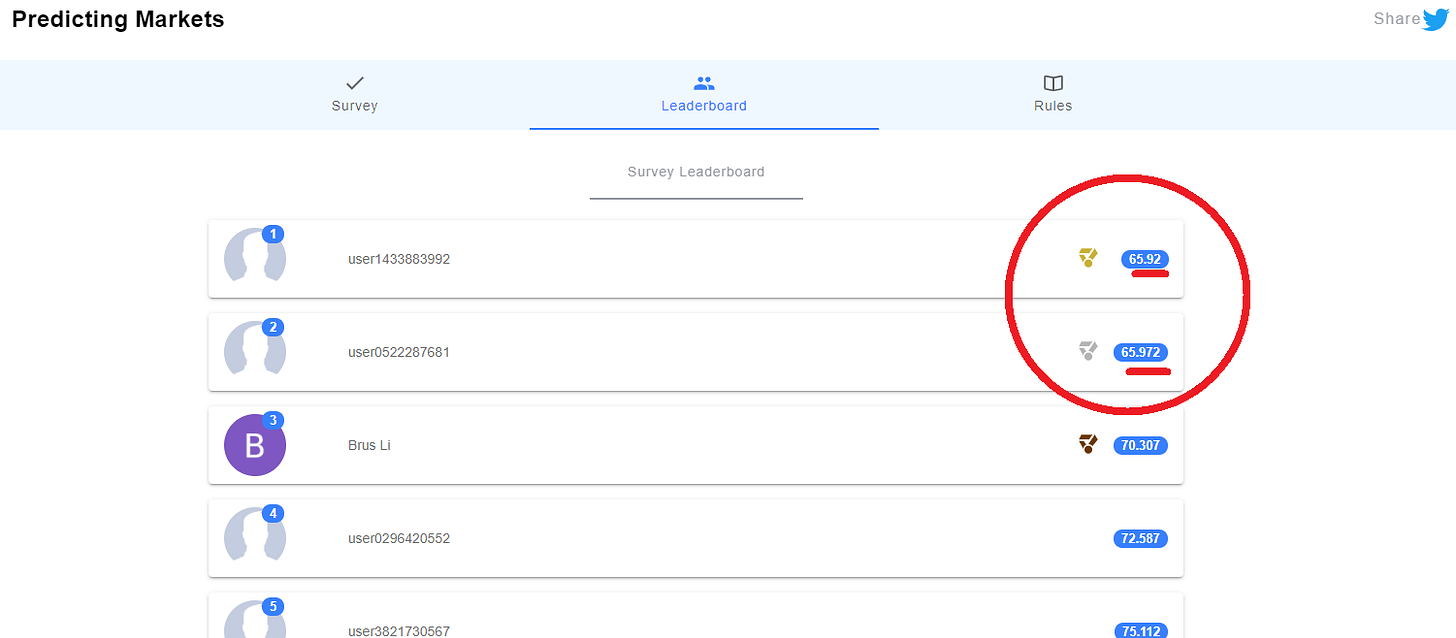

Finally, and most importantly, we have two winners of the competition!

It was a very intense and tight race till the bitter end. The winner was decided by a 0.052 point margin! He won the competition with the virtue of the second decimal point!

Our competition rules clearly state that the winner will be decided by "rounding up to two decimal points", which means that by the virtue of the last decimal point, the first user is the winner of the $1000. Congratulations to Mr Jaksa Vukojevic from Croatia!

However, given that the second user, Mr Sven Celin from Austria, ran a very very tight race, we have decided to award Sven with $500, which would be the prize split into two if two people had the exact same score. We won't split Jaksa's prize money, as he won fairly based our rules, but we did decide to award Sven as well.

Our winners had this to say:

Thank you both once again for playing, and a huge congratulations on the win!

Also, a big thank you to everyone else who participated. I hope we made it interesting to follow markets and compete with each other over who’s better at predicting them.

Keep following us on Twitter to stay informed about the relaunch of the survey in January.

And, as always, don’t forget to subscribe to the newsletter!