Week 9 results: profits collected

As of this week, we will be showing you our skin in the game: profits (or losses) from trading arising from following our predictions.

The survey is up & running again for this week, take 2-3 minutes and give it a go here:

The results for week 9 were once again within the expected 1% margin, although the S&P and the Dow did manage to bounce back above their Tuesday open’s. We predicted they would stay marginally lower, but the end result still falls well within the expected 1% confidence intervals. And, as always, lower than the weekly volatility for each indicator.

A particularly interesting result is the first time prediction for the VIX index. It had a highly volatile week, jumping up 49% from Monday’s low to Thursday’s high, yet our BASON prediction managed to capture it with only a 3.6% error, and got the right directional move. The same goes for oil, the 10-year T-bill yield, and even for Bitcoin.

Testing the profitability of the BASON predictions

However, the main point of this week’s results section is to showcase a viable profit strategy based on the BASON predictions. In our featured text from two weeks ago we introduced the possibility of using an options trading strategy to benefit from BASON predictions, or more precisely, to benefit from the prediction always falling within at least 2% confidence intervals.

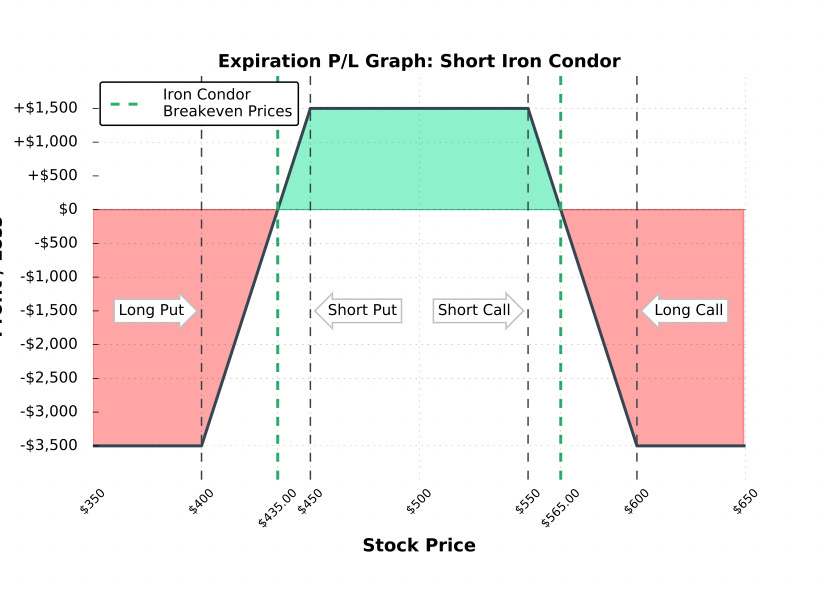

We proposed to follow an iron condor options strategy (see here for a very easy and simple explanation). An iron condor is a directionally neutral strategy, meaning that you make money if the underlying stock price (or index price), stays within a certain range (shown on the graph below). Basically, in this strategy you profit from time decay of your option positions.

The key is to figure out the right range, and what we’ve proposed is to use the confidence intervals of our S&P predictions as the upper and lower boundaries of the range (the short puts and calls), betting that the index will finish close to where the BASON predicts it will finish (either slightly above or slightly below). Since we do predictions for the end of trading day Friday, the options have to expire on the Friday of the same week.

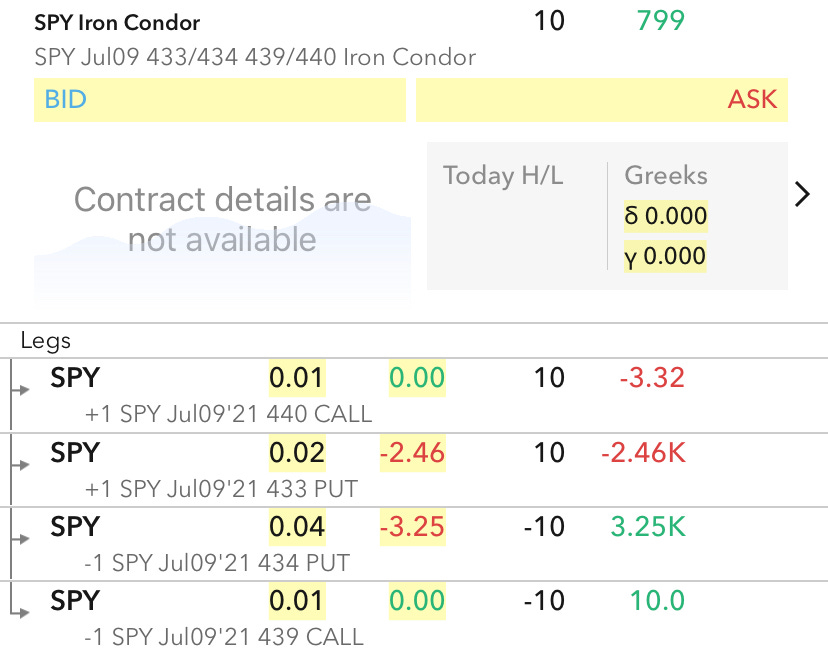

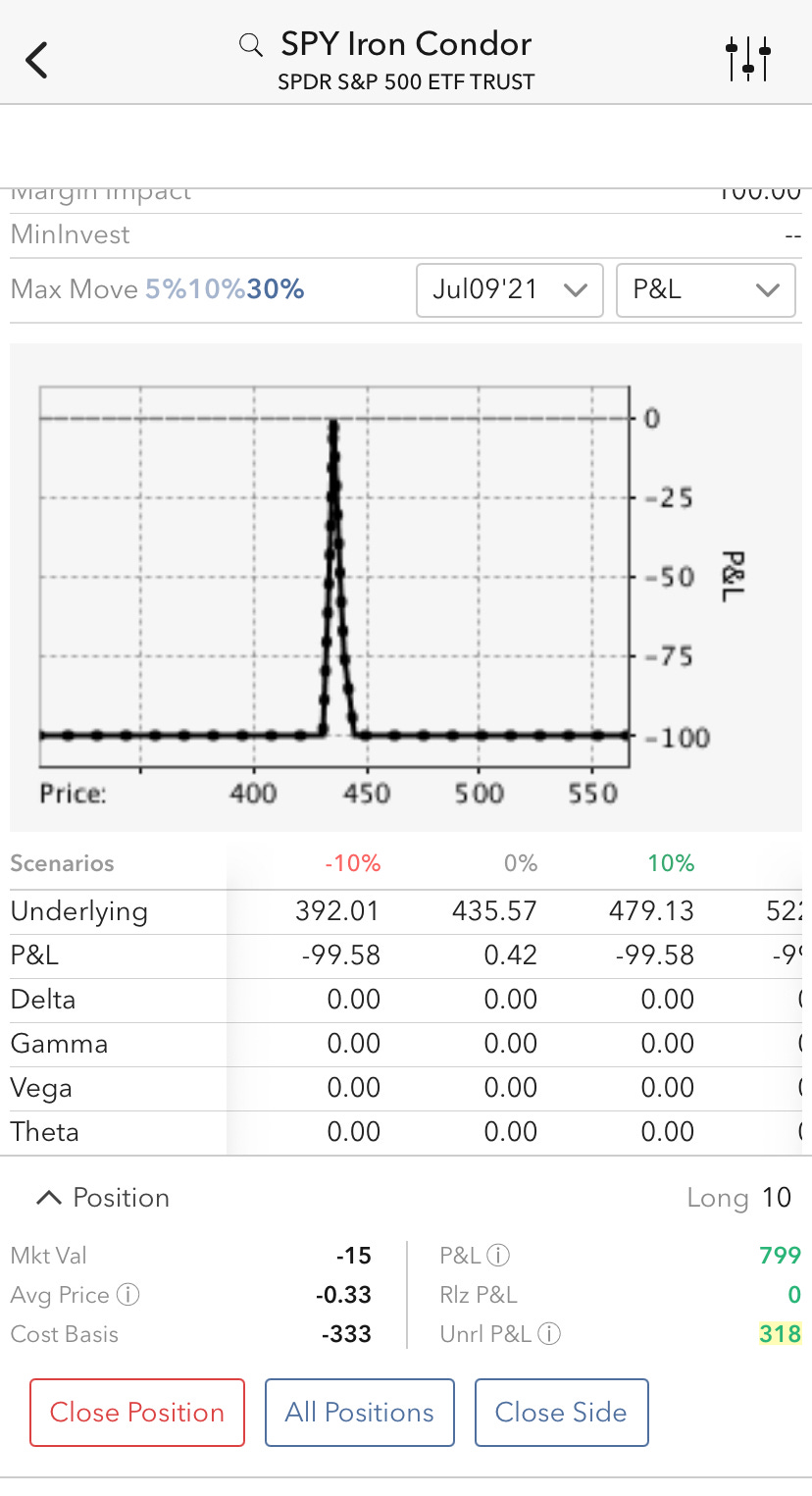

The screenshots below show the strategy we used. We bought 440 SPY calls (the ETF tracking S&P500) (long call), sold 439 SPY calls (short call), bought 433 SPY puts (long puts) and sold SPY 434 puts (short puts), all with the July 09th expiration date (last Friday). As you can see below, our profitability only happens in a very narrow range, in between these prices. We bought/sold only 10 contracts of each, so our profit and loss margins were small. In total we stood to win a maximum of $360 (the money we collect when selling the iron condor), and could have lost a maximum of $600 if the S&P fell 3% below or above our prediction. It was a limited gain/limited loss strategy, however a strategy that ultimately paid off. We held until expiration and picked up the entire $360 profit (minus the brokerage fee).

This might not seem like much, but remember the strategy is still in its testing phase. Once testing is complete we will easily increase the total exposure, and buy/sell several hundred instead of only 10 contracts. However, until that happens, the disclaimer below still holds.

Remember, all our survey users get the prediction two to three days before it happens. Plus there is a chance to win $100 each month. So don’t forget to participate and, if you wish, test the opportunity while it’s still being offered for free:

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.