NOTE: If you wish to get our updates immediately on Wednesday before the market opens, make sure to fill out the prediction survey on Tuesday (and leave your email within the app). We reward our participants with early indications of where the market will end up. Everyone else gets the results a day and a half later.

Our weekly predictions are here, available exclusively to our subscribers (competition participants get it a day and a half earlier), for Friday, November 5th 2021 (4pm EST; at market close). Keep in mind that our accuracy is much better for low volatility assets, so interpret the predictions with caution. For an overview of our accuracy thus far, see here.

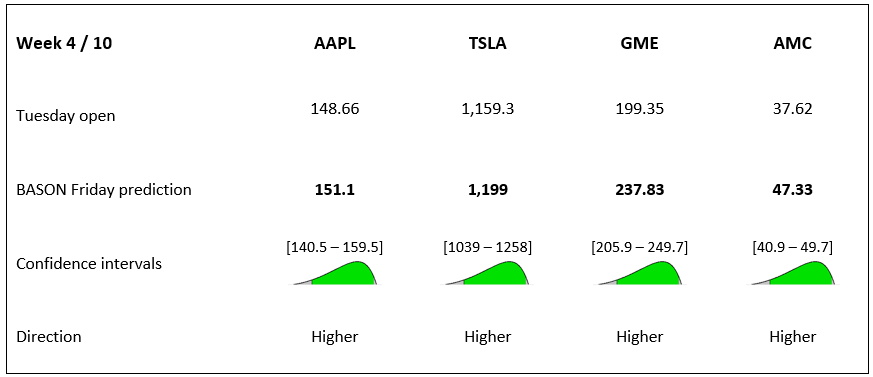

Our estimate for the Friday close for our 5 major indicators this week is the following:

The users, and by extension the BASON, were a bit more careful for this week given the anticipation of yesterday’s Fed announcement over tapering its $120bn stimulus program. The Fed did - finally - announce a taper to begin later this month, but the markets shot up after that, already above our weekly price targets. Higher levels were expected, as you can see for all indicators, but probably not as high as they might end up tomorrow (at least for the Dow and the S&P).

As per these predictions, we once again bought two SPY $455 calls with 05/11 expiry date (using the lower boundary of the C.I. for the strike price), and we used an iron condor for the SPY 05/11, at 460/461 to 469/470 (a slightly narrow margin, where we profit if it ends in this interval). We sold 10 contracts here.

Our call is likely to give us between $400 and $1000 profit, and our iron condor gave us $400 when we sold it, so if it expires outside our C.I.s, we stand to lose in total $600. But even if SPY ends up above 470, we will still hold a profitable position.

On the other hand, the stock predictions are all aiming higher. TSLA just shy under $1,200, GME and AMC exploding again, and AAPL keeping its momentum as well.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind, nor should they be considered as such. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

Keep following us on Twitter to stay informed about the weekly survey each Tuesday.

Excellent Article. I was off a dollar on the strikes for the SPY trade on the outright and the put leg of the Iron Condor. I suggest you add to your criteria for the outright by including a wasting component. Instead of just looking at the lower bound of the C.I., it may be helpful to include a decay analysis in the Time Value of the option. Try to look for options with less than 1% Time Value left for the option. This let's you assume a flat market with upside exposure and only lose the Time Value of the Outright and keep 100% of the Iron Condor and doesn't restrict you to the lower bound C.I.