Q4 summary: full results & performance

Plus the 2022 performance summary

Our Q4 competition is over, our winners have been announced on Monday, and we are preparing a new version of the competition in 2023 (more on that next week).

Today, instead of our predictions during this super exciting week for markets (CPI yesterday, FOMC today, options expiry on Friday - I was on Kalshi’s Twitter spaces yesterday, so have a listen to our discussion on what is expected this week from markets - we got the first call right: CPI comes in lower, knee-jerk reaction higher), we will show you our performance in Q4, and throughout 2022, compared with the benchmarks.

Then, next week, we’ll do one final overview of our full prediction performance since the start of this survey competition (May 2021 until Dec 2022), and announce to you what’s in store for 2023. It’s going to be an exciting year!

Q4 performance: precision

Let’s jump right in. If you were following us regularly you might have noticed that the Q4 performance was slightly underwhelming compared to our overall performance thus far. This is not just impression, our performance has been relatively stagnant in Q4: we finished the quarter with only +4% gains (compared to our +160% gain thus far, and our +71% return in 2022, this seems like nothing). But the important point in Q4 was in consolidating the annual win. No point in taking on too much risk by year-end when you made such a great return during the year.

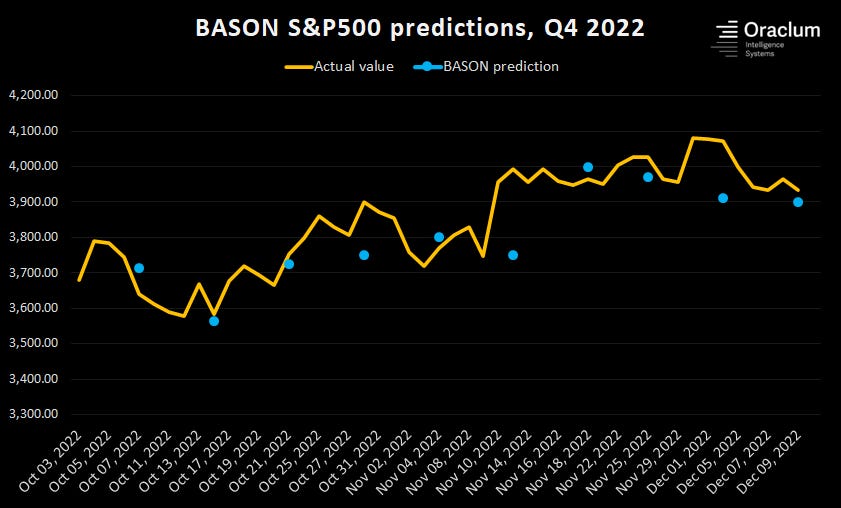

The quarter itself was very volatile. Notice the weekly performance of S&P over the past 10 weeks:

The weeks went like this:

Lower - Lower - Higher - Higher - Lower - Higher (post CPI +5% move) - Lower - Higher - Higher - Lower

Overall, SPX finished higher since October, but was scrambling to find proper direction. Very difficult to capture a genuine trend here. Typical bear market behavior. Notice our three big misses of the change in trend (the inflexion points): week 4 - Oct 28th (last day went against us), week 6 - Nov 11th (miss on the CPI report), and week 9 - Dec 2nd (miss over Powell’s speech).

And yet, despite all of this, our SPX precision was actually quite good. 7 out of 10 weeks it ended within our 2% targets (6 out of 10 within 1%). This means that we earned good premiums on our condor strategies this quarter. It was the directional call/put performance which has been underwhelming, driving down the returns of the overall portfolio. Let’s see how that worked.

Q4 performance: portfolio

Even though we had 7/10 really precise hits, we missed direction five times and that hurt us. Only in two weeks did our calls (or puts) deliver a decent return for the entire portfolio. The rest of the time, due to volatility they got sold even when we got it right (like in Week 2 and Week 8), and they contributed to lower than expected returns in Week 1 and Week 10.

Keep in mind how our portfolio is structured: 10% for options (condors for accuracy and calls/puts for direction), 40% for BASON-based long-shorts, 44% for macro (40% for short positions, 2% for call hedges for each position), and 6% in cash.

However, as emphasized, Q4 was about preservation of our returns. Notice that the drawdown for the portfolio was never greater than 5%, as we like to emphasize. And even with 50:50 precision (as it was the case for the portfolio impact, despite being 7/10 in accuracy), we make money overall, precisely because of our positive skew strategy - make more when we’re right than what we lose when we’re wrong.

The table below shows the summary of Q4 BASON portfolio performance across each asset class of the portfolio (click to enlarge).

Looking at the overall performance it becomes immediately clear where we lost money and where we gained. As emphasized earlier, our excellent accuracy (within 2% for 7 out of 10 weeks) made sure we gained a lot on the condors, but our lack of directional precision made sure we lost on the calls/puts. In fact, the condor performance ensured we still made a decent 32% return even in a quarter like the last one. So if this was just the options strategy - the one we initially tracked ever since the start of the survey back in May 2021 - the performance would have remained stunning.

But we wanted to see how the strategy works within a more balanced portfolio, including the long-shorts and the macro positioning. In this quarter, unlike the previous three quarters, these positions were the losers. In fact, if it weren’t for the call hedges on the macro positions, the bad performance of the long-shorts and the macro shorts would have dragged the whole portfolio down. However, with the macro hedges in the form of 3-month OTM options, the macro part of the portfolio performed well (+3.7%).

Keep in mind that the performance of the macro positions and the long-short positions throughout 2022 were also really good (+14% on average for macro, +53% on average for long-shorts) so one bad quarter is no reason to drop them. But we will keep optimizing the portfolio, that’s for sure!

2022 performance

Just to remind you: in 2022, the BASON portfolio return has been +71.4%.

Compared to the main benchmarks, the MSCI World Index, the Bloomberg Commodities Index and the Barclays Hedge Fund Index, the performance was even more impressive. Sure, we didn’t outperform these in every month, but when we did, we outperformed by a significant margin (notice the huge differentials made from March to June, and also in September). The power of BASON continues.