A deeper look into BASON's performance

Building our portfolio with 3 strategies

In this long post we describe the performance of our BASON portfolio over the past year if the portfolio had been constructed using 3 different strategies, each of which we describe below. We have combined our standard options strategy - the one we present to you each week - with two others: one based on BASON’s predictions, and the other a global macro strategy I’ve sometimes discussed in the newsletter.

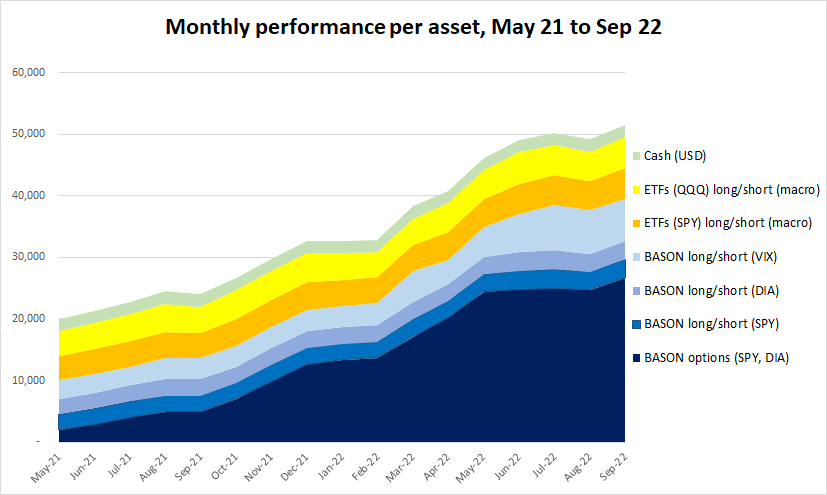

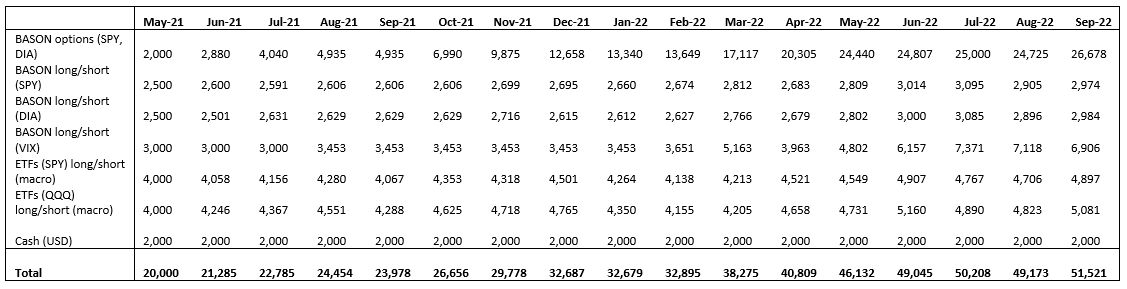

We wanted to see how we’d do if we combined all three into one super portfolio that looks like this:

The compound annual growth rate (CAGR) of such a portfolio would have been 155% from May ‘21 to Sep ‘22 with a Sharpe ratio of 10.65 (which is really, really good - this means our volatility was very low compared to our high returns).

Can you think of anything better?

Not really, right? :)

So what are these strategies? And how are they linked to BASON? Let’s dig in!

Strategy #1

It’s been almost a year and a half of doing BASON predictions and live trading them using our options strategy. We started in May 2021, and with a few breaks last year, ran the full three quarters in 2022. The results of our options strategy - which we share with you every week - have been well documented throughout all this time. You know by now that we delivered a 267% return just on that strategy alone, where we only spend $2000-$3000 each week and keep the rest in cash (so basically the return just on the options is around 1400%).

This strategy is awesome as it works during both bull and bear markets (107% return in 2021 during the bull run, 75% return in 2022 during the bear run). It’s not even that volatile (only 4.2% standard deviation), precisely because we have limited exposure, so our drawdowns for the portfolio are never greater than 5% (see figure).

Ok, but is there more to it? Keeping options limited at 10% of the portfolio is fine, so can we use something else for the rest of it?

Certainly!

Strategy #2

We gathered our data and did some backtesting. We wanted to test direction specifically and the strategy was a simple long-short buying (or selling) equity ETFs based on our index predictions. The formula was straightforward:

If BASON_Friday (the prediction) > Wednesday_open then long

If BASON_Friday (the prediction) < Wednesday_open then short

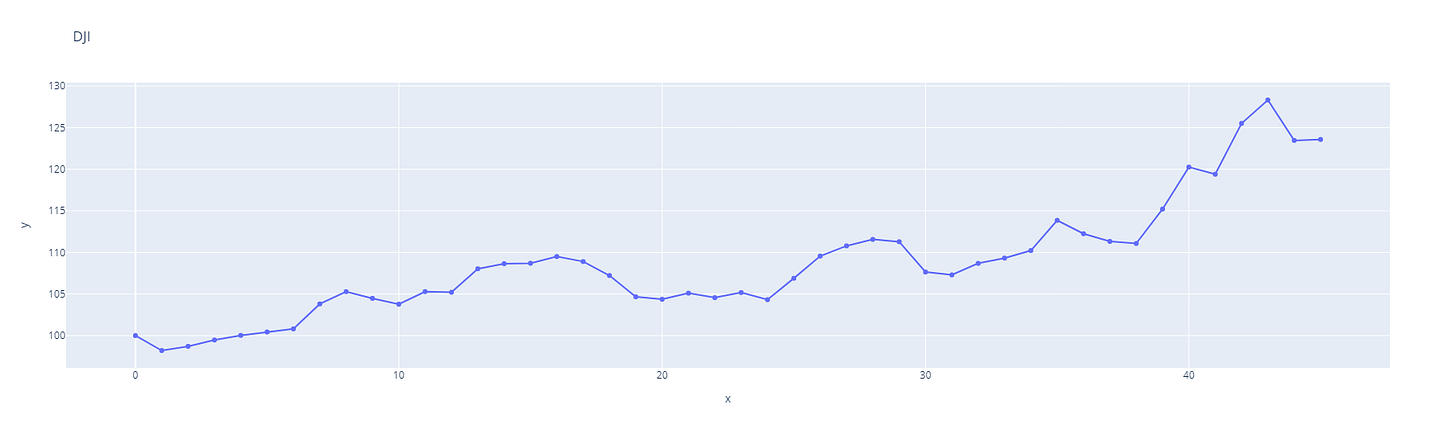

This strategy, backtested over the same time period, delivered great success for the SPX (+23.5%), DJI (+23.6%), and the VIX (+149%):

(Note: all three strategies were tested with respect to ETFs of each index we used - so SPY, DIA, and UVXY).

Sharpe ratios were 11.3 for SPX, 13.06 for DJI, and 13.1 for the VIX. Beta was negative for each (-0.2 for SPX and DJI, -0.34 for VIX), simply because we gained the most during declines this year. But overall, our strategies are essentially beta neutral (independent of market direction) since we make money when our predictions are accurate, and lose when they aren’t.

Remember, this strategy was just backtesting, not live trading like we did with the first one. Still, the returns were really good and encouraging.

Strategy #3

Finally, add to this the macro strategy I’ve been applying to my personal trades (and have often written about in the newsletter - e.g. the bull vs bear conundrum back in April, when I closed half of the shorts in June, etc.).

This strategy is also very simple. It was long both ETFs from May 3rd 2021 to March 18th 2022, after which it sold both and took up equally sized short positions (with hedges in the form of 3-month ATM calls on each). It lost money in January and February, but it gained significantly from April onward.

Overall, the SPY long/short macro delivered a 22.4% return, and the QQQ long/short macro delivered a 27% return from May 2021 to September 2022.

Pulling them together

Combining all three, the performance is stunning (as you’ve seen in our first three charts above):

How volatile were the returns month-by-month? See for yourself below.

Notice again the high upside and very very low downside in the few months that we failed to outperform some of the benchmarks.

BASON

How does the BASON work? What’s the logic behind it? Have a look at our video explaining the whole approach in greater detail:

There’s more on our YouTube channel.

What’s next?

Given all this, we decided to make one change to our newsletters from now on. From the start of Q4, we’re gonna inform you not just of how our BASON options strategy is doing, but we’ll give you an overview of the entire portfolio each week. The BASON options, the BASON long-short, and our main macro plays and how they’re all holding up.

Maximum transparency as always, and full skin in the game.

Thanks for reading and if you haven’t already, don’t forget to subscribe and share to your friends:

Great work!

Great news!