Quick summary:

New survey is up & running - click here.

Last week saw another good performance and a 90%+ return

5/7 correct direction with errors of 1%

This pushed us to a new all time high, +267% overall, +75% in 2022

Awaiting for the FOMC this week

Welcome back, dear subscribers. The Q3 competition is now open for week 12 (two more weeks left in Q3, before the winner is announced). The leaderboard is updated and available within the app. You know the game: get in, have your say on our 5 indicators and 2 stocks, take opportunity from our early info on price targets, and keep pushing for that $2000 prize!

Note: If you haven’t already, don’t forget to leave your email after you finish the prediction, so that we can send you early results on Wednesday - see the end of the post.

For all those new to the whole thing, watch this quick video guiding you through the survey, showing you all its features, and briefly explaining how the competition works:

Watch more on our YouTube channel. Thanks for participating, and keep having fun!

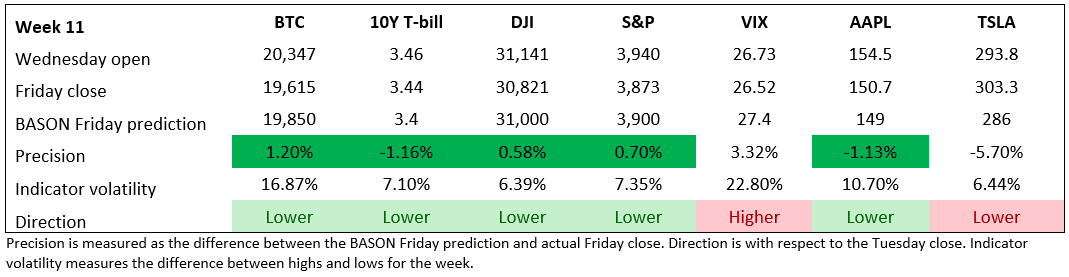

Last week’s accuracy & precision

It was another week of stellar performance. Errors for the S&P and the DJI were at 0.7% and 0.58%, respectively, while errors for BTC, the 10Y yield and AAPL all came at around 1%. All five were predicted to go in the right direction (lower), with the only real surprise being TSLA - ending up slightly higher from it’s Wed open.

The VIX finished Friday at almost the same level as its Wed open, even though it was running at 28 earlier that day (and well within our directional prediction). The problem was the options expiry-driven mini-rally that happened in the final trading hour on Friday (investors cashing in on their puts, market makers taking the opposite side and markets rallying slightly) - this brought SPX back within our confidence intervals but also sent the VIX down.

The reason I like last week’s performance in particular was that it came after a huge drop on Tuesday (when most of our predictions were made). Typically, this would encourage our users to seek some kind of a reversal over the next few days. Not this time. Peak bearishness is still among us.

This week it’s all about the FOMC meeting and the rate hike of (most likely) 75bps. This rate hike was probably already priced in after Jackson Hole, but the big story now will be forward guidance and the new Fed dot plot graph, giving an updated signal of where the Fed sees rates going in 2023.

Another rally, or a retest of the June lows? You tell us :)

Performance: 90% weekly return

As mentioned last week, we opened the following positions:

As per our predictions, this week we're trading 385/386 to 400/401 SPY 16/09 iron condor (10 contracts) for $420 immediate gain. Stop loss is at 50% (around $280 max).

We are buying a put for downside protection, 1 SPY 400 put 16/09 for $8.1.

For DIA we are trading the following iron condor: 304/305 to 316/317 DIA 16/09 (10 contracts) for $330 immediate gain. We are also buying 1 DIA 16/09 316 put for $4.95. Stop loss is at 50% for both.

Both puts reached their take-profit levels (100% is the trigger) on Friday - SPY was sold at a profit of $814, the DIA for a profit of $490.

The condors were a bit more problematic, but both allowed us to take the premium. DIA was pretty much in the clear the whole time, for a profit of $302 (almost the full premium). SPY was borderline, so when it shot back in the late hours, it managed to secure a $244 premium (would have been even more had we waited until the last 15 minutes).

Altogether we ended the week with a $1850 profit. A 90% return on the week.

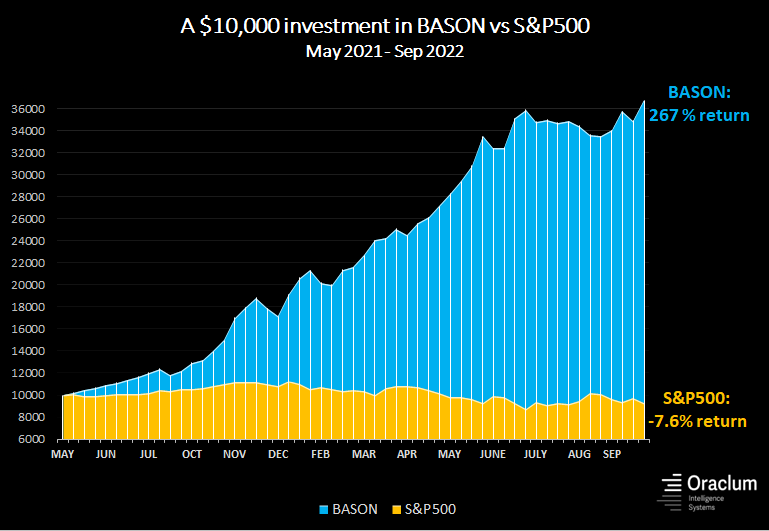

Our overall return is now at an all time high at +267% since we started this competition, and +75% in 2022. After a rough few weeks during the rallies in July and August, we are finally back to our best. I do expect more turbulence in the weeks ahead, but still confident of capturing the right trend at the right time.

The S&P is -18% in 2022, and -7.6% since we started the competition. Still no other benchmark (commodities, etc.) comes even close to BASON’s performance this year.

…join the competition!

Participate in our survey competition regularly to get our predictions on Wednesday and take opportunity from our early info on price targets.

NOTE: Remember, by participating in the competition and leaving your email in the user profile, you get our predictions before everyone else (on Wednesday after the markets open). Leaving your email is the only way for us to contact you. If you want it, ofc.

DISCLAIMER: This prediction survey is still in its testing phase. Neither the survey nor its results act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum bears no responsibility for your investment choices based on these predictions.

And, as always, don’t forget to subscribe to the newsletter!