Recession or soft landing?

Follow the data this week.

Quick summary:

The Q3 competition is up & running - click here to join the action.

Last week’s panic lasted only a few days (until Thursday’s jobless claims basically). With markets going down on Monday (SPX 3%, NASDAQ 5%, VIX up 100%), ORCA’s portfolio remained flat, in bonds and cash. Then by the end of the week, we pulled a 1% gain with our weekly BASON strategy. “Markets down, BASON up” is our favorite set-up.

This week will center on key economic indicators with the release of the PPI and CPI (today and Wednesday), and then again jobless claims on Thursday, providing critical data on whether we are pricing in rate cuts for a recession or for a soft landing?

Corporate earnings this week will highlight the retail sector, with anticipated updates from Walmart and Home Depot, which will shed light on consumer spending trends and sector resilience amid ongoing economic challenges.

On Saturday, I will revisit the arguments made last weekend. Basically, after this week we should get some more clarity on whether there are more legs to that initial sell-off or not. Also, I’ll give an overview of what we can expect after the Fed’s Jackson Hole meeting next Friday (equally important to an FOMC event).

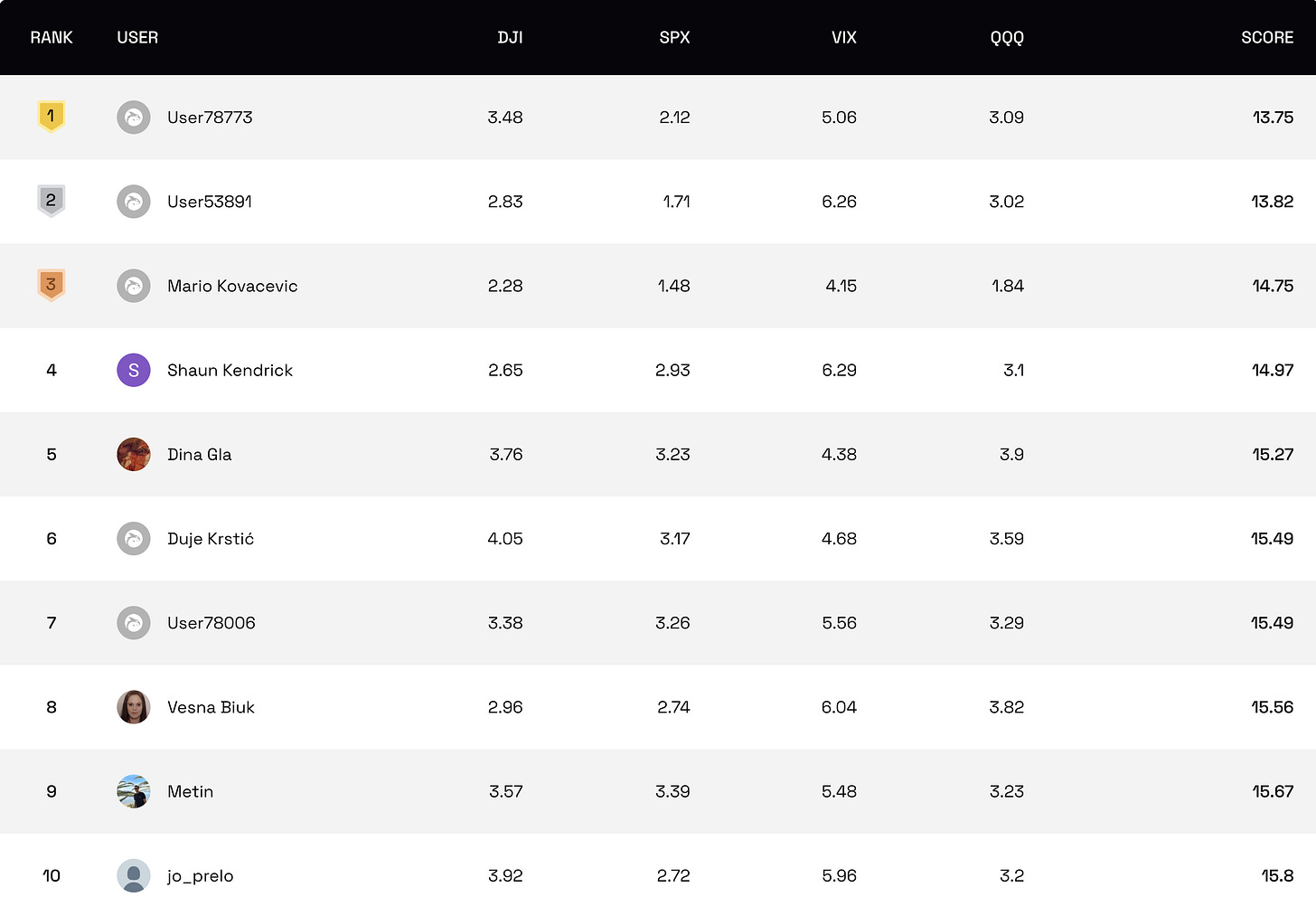

The competition

With half of Q3 behind us, the contest remains open and competitive. Now is the time to review your approach and refine your tactics, ensuring you’re well-positioned as we approach the quarter’s end.

Keep your strategies sharp and your eyes on the top!

NOTE: For all those new to the whole thing, read more about it here or watch a video of Scott and myself guiding you through the survey, showing you all its features, and briefly explaining how the competition works.

Last week’s performance

Just by looking at last week’s chart starting Monday (see below), one would reach a very simple ‘trending up’ conclusion. And that’s indeed what happened; markets trended up most of the week (higher highs, lower lows), even after that strong sell-off on Wednesday (when we made most of our returns for the week).

One could hardly tell that we had that huge panic on Monday, when following the Nikkei going down 12% overnight, SPX finished the day at -3% and NASDAQ -5%. And of course, the doomsters calling for the end of capitalism, etc., etc. Give it a few more weeks, maybe we repeat the narrative again.

But then you look at the VIX, and it paints a clear picture of what panic looks like:

A quick explanation of what was that all about:

Why the panic on Monday?

Many have pointed at the USD-YEN carry trade as the culprit.

What is the “YEN carry trade” and what does it have to do with the US equity market?

Japan has had less than zero interest rates for almost a decade and has just last week increased them to 0.25% (up from 0%). Now, a lot of investors loved to borrow in Yen due to low interest rates, exchange them for USD in order to buy US assets (bonds with 5% interest, but also equities during the tech rally).

The “carry” is what you get from making 5% in US bonds, while paying off close to 0% interest in Yen. Borrow cheap in Japan, get higher returns in the US, and pocket the price difference basically risk free.

But since BoJ increased rates last week for the second time this year (raising expectations for future increases), it created a huge outflow of money from Japan, as borrowing is anticipated to be more expensive. Investors now need to close their loans, so they need to buy back the Yen with their USD, selling their top performing assets (like the AI Big Tech trades) in the process. YEN appreciates 10% against the USD and the carry trade unwinds.

Then there was also the weaker US jobs data on Friday, where job growth slowed down, and unemployment went up from 4.1 to 4.3%. This signals the US economy is slowing down and entering a recession, so investors are now pricing in 5 (!) Fed rate cuts before the end of the year, thinking the Fed is late again, and should have cut already. The soft landing narrative has been replaced by the recession narrative.

But even all of that can hardly explain the extent of the panic, where the VIX, the market’s favorite panic/volatility indicator, goes up over 100% in one day, reaching 2020 pandemic and 2008 crisis levels. Over a Yen carry trade and slightly worse payrolls.

Overreaction? Oh yeah.

Short vol was the play here (as VIX went down from 60 back to 20). This was btw why the markets bounced back, short vol trades.

So this week, we’re getting some more data to see whether the recession pricing was warranted.

Specifically, today we get PPI inflation data (came in lower than expected, 2.2% vs 2.3%) and tomorrow CPI data (both before open). Now here’s the tricky part. Thus far, a decline in inflation typically sent markets up, as everyone was pricing in a soft landing. But now, if we get slower inflation it could amplify the narrative of a stagnating economy, increasing the odds of a recession. So the markets sell-off. Watch the reaction to these data prints.

Last Thursday, the weekly jobless claims number alleviated many concerns from the jobs report on the Friday before. A report that was nothing special sent markets back up as if it was the key labor market indicator (it isn’t). Let’s see what they say this week and then we can adjust the macro view accordingly.

…join the $20,000 competition!

Join our survey competition to get an opportunity to participate in our quarterly ($5000) and annual (3% of our profits) prize distributions:

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.