The whole message from Jackson Hole can be summed up by what was said in the first 30 seconds:

“At last year’s Jackson Hole symposium, I delivered a brief, direct message. My remarks this year will be a bit longer, but the message is the same: It is the Fed’s job to bring inflation down to our 2 percent goal, and we will do so. We have tightened policy significantly over the past year. Although inflation has moved down from its peak—a welcome development—it remains too high. We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

As I’ve mentioned earlier this week, after last year’s Jackson Hole, markets went down 15% over the next month and a half. And Powell’s second sentence was: “the message is the same as last year”. Well, if that wasn’t a signal to short I don’t know what is.

However, in my opinion, it wasn’t the reaction to JH on Friday that was the bearish catalyst, but the brutal reversal the day before.

On Tuesday we suggested to close the shorts, take profits. This worked well, especially with the Wed rip. I was expecting the rip to continue after NVDA killed earnings. And it did, after hours, when SPX was up 0.7% and NDQ over 1%. NVDA earnings were driving the entire tech sector up. But then, almost immediately on Thu open, all hell broke loose. NVDA actually finished negative for the day, SPX made almost a 2% swing move down (from +0.5% to -1.35%). And all that happened before Jackson Hole today.

That price action makes me more bearish than what Powell said (which was really nothing new to be honest). Naturally, you wait until after the speech to position, and these are the kind of shorts you can hold on to during September. The thing to watch from now on is the econ data: new inflation prints, labor market, and how the economy is doing. The worse off inflation becomes, the more bearish we become. And if the economy is showing little signs of a recession, this too is more favorable for shorts in the short run (as it confirms the higher for longer scenario).

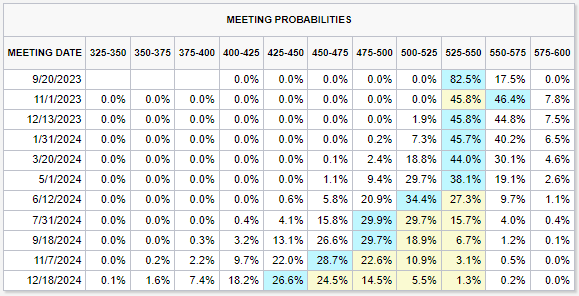

The rate probabilities are not favoring the bulls either. The rate cut expectation has moved to July, and another hike is now expected in November.

In the bond markets, the 2Y Treasury yield is over 5%, the 10Y is over 4.2%. Still a very strong warning for equities. The verdict is to keep reengaging the shorts and getting ready for September. Not too aggressive, though. Not yet.

Obviously, this is a longer duration trade, so we have to make sure we can withhold potential reversals. But overall, that bull trap we talked about back in July sure is coming to fruition.

DISCLAIMER: Neither the survey nor any of the contents of this website can act as investment advice of any kind. The results of the survey need not correspond to actual market preferences or trends, so they should be interpreted with caution. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website and through the survey competition should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. The survey and this website contain no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to subscribe to the newsletter.