Q2 ends tomorrow. Now that half the year has passed, we can look at what the market is telling us and infer some tactical positioning.

From a macro, more strategical, perspective, the global view is unchanged. Central banks will keep interest rates high this year (with the Fed signalling two additional potential hikes before the end of the year), and the only reason for them to cut would be an actual recession. They have hammered these points multiple times. We are in the “higher for longer” scenario I wrote about back in April:

Looking ahead: the macro big picture

Amidst all the weekly updates and competition tracking I realized I haven’t posted any long macro overviews for a while now. And these used to be the most read things on this newsletter. So, to amend this, here is a macro overview of markets during the past 4 months of 2023 and what can this tell us about the upcoming two months (end of Q2) and beyond.

On the other hand, the economy has been quite resilient, even surprisingly so given very high interest rates.

There is an inherent paradox happening. Almost every macro indicator is signalling an imminent recession. Never has a recession been so widely expected. All the leading indicators (like housing permits, credit creation, new orders index, expectations, etc.) as well as things like the 10Y2Y and 10Y3M yield spreads are suggesting a recession. And we’ve had these signals for quite some time, since mid last year, actually.

A year has gone by, interest rates are up to over 5% and will stay high for a full year, and yet, the economy is strong. Almost incredibly resilient to a 500 bps rate increase. Labor markets are still strong, inflation is going down (even though core inflation is still sticky), and the stock market, it seems, is getting ready for a frenzy.

The AI bubble has been driving markets up

The search for another bubble has been quick. The meme stock and crypto mania from 2021 have found the next best thing: AI.

Disclaimer: Calling this an AI bubble doesn’t mean I don’t believe in the potential this technology has. I certainly do. But I also see it as a hype that will massively drive up valuations of tech companies engaged with AI. Valuations that are already quite high.

AI-related investments took off in 2023, ever since we got introduced to ChatGPT. Look at the drivers: NVDA up 189% year-to-date (YTD). META up 129%, AMD up 72%.

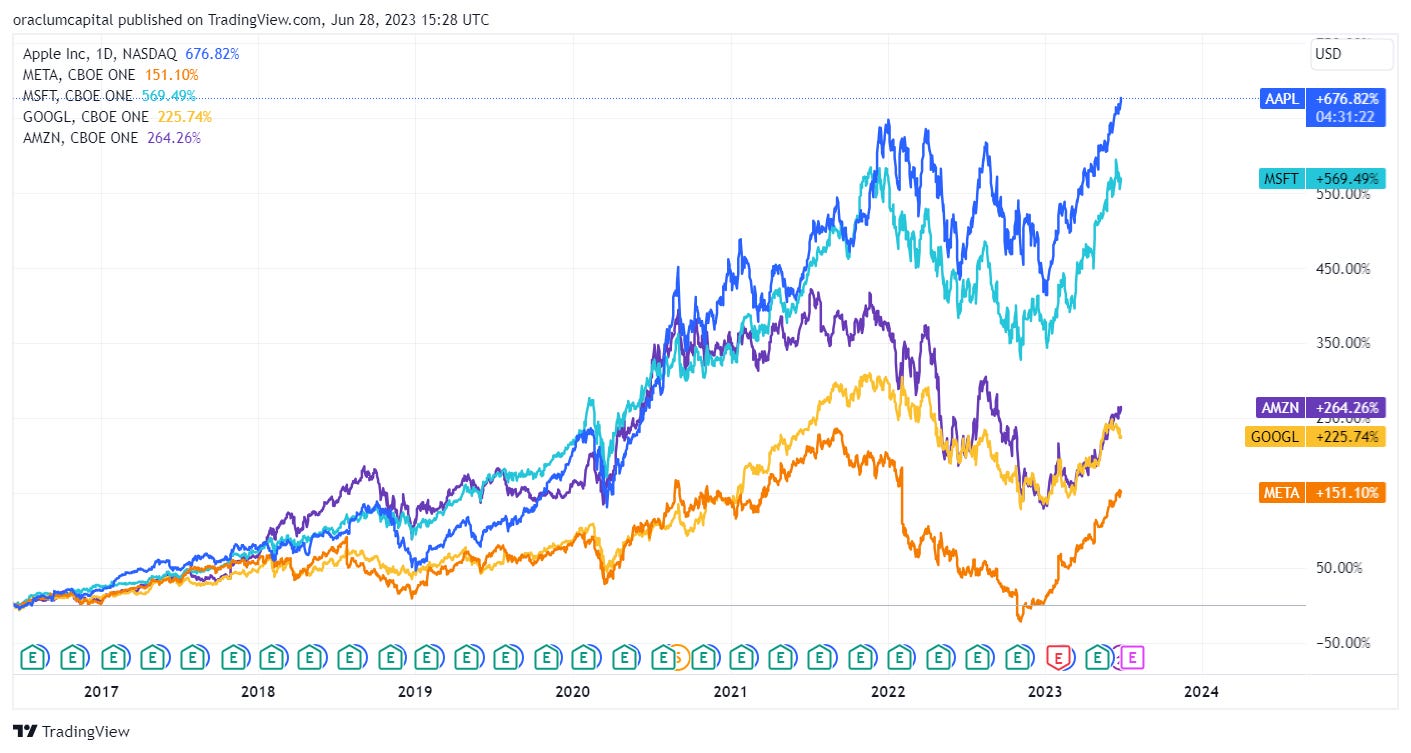

The charts bellow offers another perspective on that impressive rebound in tech stocks since 2023. I wrote about this divergence in equity market performance where the top 5-6 stocks have been driving indices while the rest of the market is pretty depressed, in line with interest rates being at 5% (just look at the Russell 2000, it’s been sideways for over a year).

The divergence is so obvious. Tech (XLK - Apple, Microsoft, Nvidia), Communications (XLC - Google, Meta, Netflix), and Discretionary (XLY - Amazon, Tesla) are all up over 30%, while Finance (XLF), Health (XLV), and Energy (XLE) are all negative. SPX, in that nice middle ground, is up 13% this year.

But isn’t tech supposed to be hurt the worst by such high rates? Indeed it was, in 2022. Markets priced in rate hikes during 2022, and sent the tech sector down over 30%. But now, this year, markets are pricing in rate cuts, sending tech stocks back up rapidly. AAPL and MSFT are at all time highs! As is NVDA, the prime beneficiary of the AI bubble. It’s stock price went down over 60% in 2022, and has gone up 270% since its 2022 low. Incredible.

How long can this continue?

That’s the million dollar question this year, isn’t it?

Are we in a new bull run, driven by a handful of tech stocks, or are we in a powerful bull trap? Well, depends on what you look at. Outside of the three aforementioned tech-led sectors, markets are performing poorly. But the valuations in tech still seem way too high. In fact, they’ve inspired me to make the following comparison (first chart is SPX, second is NDQ).

These charts are more a meme than a real prediction. I don’t expect neither the S&P nor NASDAQ to fall back to pre-2020 levels over the next year. That would be very very unusual if it happened. Doesn’t mean I won’t hedge against it, but it’s still a low probability scenario.

Then again, this is what happened to NASDAQ during the previous tech bubble burst:

It completely reversed its entire 1998-2000 gains (which were over 300% btw). It also had that distinct little bull trap towards the end of 2000, just before the second big leg down.

But in today’s market this isn’t happening. We had a few rallies in 2022, and a few legs down, with the worst coming after Jackson Hole last year (Aug 26th ‘22), sending SPX to <3500 by mid October, the lowest point of this bear market. SPX is up 25% since that low (moving up, sideways). That was the last big leg down. Another big leg down (big meaning over 20% or 30%) seems very unlikely, even with a recession. The banking panic in March earlier this year was the type of catalyst that should have resulted in another pull down, but it never materialized.

Furthermore, if a new bubble in AI just started, it is no time to short it, even if rates are over 5%. Bubbles can be exhausting for short sellers, so you might as well ride it for as long as you can. That being said, it is highly advised to hedge against a potential reversal for as long as the macroeconomic uncertainties are high.

This also doesn’t mean we shouldn’t expect a medium term correction. Especially with a more hawkish Fed, signaling further rate hikes, which can be a good catalyst for another down move.

So is it a bull market? In AI stocks, definitely. In markets overall, perhaps in the long haul, but right now, in the short term, it looks more like a bull trap. Short squeezes have been pushing rallies, and sucking in more call buyers. There is a point at which this stops. As liquidity is being drained out, and the Fed starts signaling greater action over core inflation which is still sticky, we might get another pullback. The probability of this scenario increases every week. It’s a matter of timing really. My expectations of a pullback down to 4,000 are in September (traditionally the worst month for equity performance). If it comes earlier, the hedges will perform nicely.

Actionable insight: how to position?

If you’re holding long positions (especially in tech) that’s fine, but buying protection at this point is imperative. You can either buy put options on your equity holdings (which are now cheaper than they were back in April when we first discussed this), or sell covered calls on the same holdings. Whichever makes you more comfortable.

If, on the other hand, you’re an investor that doesn’t have access to such hedging instruments, diversification is your best bet against a sudden move down. Being long AI-related tech companies was the best bet this year, and it will most likely remain that way. So a smart thing would be a sectoral diversification. Long tech, short energy and small caps for example.

In any case, keep an eye on how the macro uncertainty will unfold. You can always come back here to read about the medium term outlooks, and see if your long tech portfolio needs some adjustments.

A lot is coming up next week. We’re especially excited over our new survey launch. We’ll see you back on Tuesday, have a great weekend!

DISCLAIMER: None of the contents of this website can act as investment advice of any kind. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. This website contains no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to share & subscribe!

Amazing insight. Hvala Vuće!