Value vs growth: which will be outperforming the S&P this year?

Thus far in 2023, Big Tech is the driver. Will it last?

Last year, for the first time in almost a decade, value stocks outperformed growth stocks. Actually, it was more about defensive stocks (energy, health care, consumer staples) outperforming the cyclical ones (in particular the high growth ones like tech), which is what you might expect in a bear market driven by interest rate hikes.

Will it continue this year, or is the trend already back to what we’ve gotten used to over the past years - pile into Big Tech and just leave it there?

So far in 2023, the answer is the latter; we are back to seeing investors pile into Big Tech.

The 2023 divergence

One thing I mentioned in my previous long post was this:

…if you take out the 6 big tech stocks, SPX is actually in a down trend. The flight to tech has been happening ever since January and has continued in March as investors sold bank stocks and doubled down on big tech.

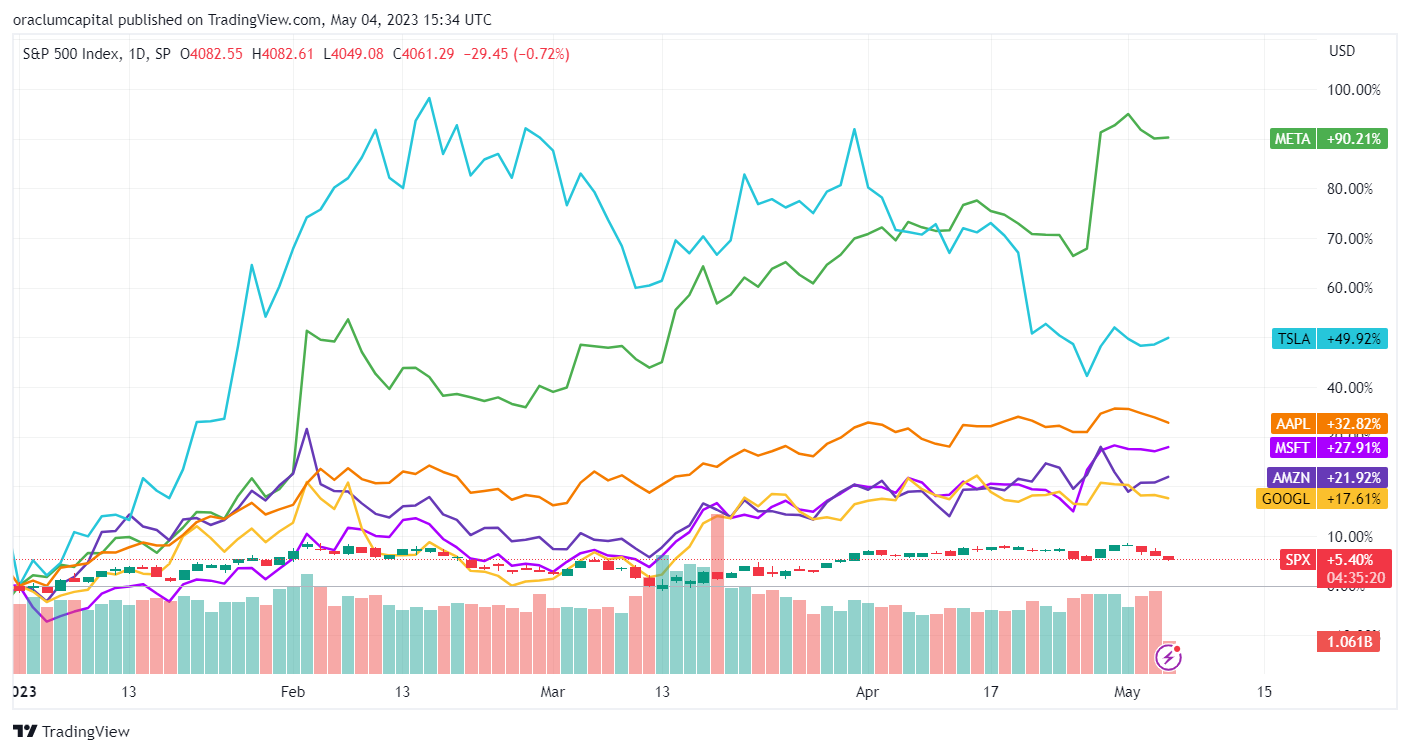

Looking at the chart below, this trend is more than obvious. The two SPDR tech ETFs: the largest component, XLK (Technology), comprising 25.3% of SPX (most notable stocks include Apple, Microsoft, Nvidia, Salesforce, Cisco, Adobe, Oracle, etc.), and XLC (Communication services), comprising 8% of SPX (most notable stocks include Meta, Google, Netflix, Disney, T-Mobile, Verizon, Comcast, etc.), have outperformed SPX by a wide margin. 20% return of XLK and 19% return in XLC, year-to-date, compared to +5% for SPX ytd.

The divergence started sometime in mid-January, when tech stocks started gaining particular momentum. After what has been a terrible year for tech in 2022, investors started going back into tech, especially Big Tech, in 2023, possibly as an anticipation of the Fed cutting interest rates in a soft landing scenario (in my opinion, the low probability scenario - read more here).

In February, markets started pricing in a more hawkish Fed after all, which initiated a slight correction. The second week of March started with Powell’s testimony in Congress hinting they might raise rates to 50 bps instead of 25 bps at their next meeting. And then a few days later, SVB filed for bankruptcy and the sell-off of bank stocks started. Almost exactly at the same time, all those investors selling bank stocks started shifting their portfolios back into tech (and bonds). The divergence since March 13th is clear. Further rate hikes have again been priced out, and the tech rally continued.

The financials component of SPX, labelled XLF (containing all major bank stocks, JPM, BofA, Wells Fargo, Goldman, plus stocks of Berkshire, Visa, Mastercard, etc.), comprising 13% of SPX, was very much in line with S&P performance until the March event. SVB failure pulled down all bank stocks, and the XLF is currently at a negative 8% return ytd, a gap of 13 points against SPX, and an even bigger 27-28 points gap against tech. Btw, the regional SPDR ETF, called KRE, did even worse. It is down 38% year to date.

Going back to tech, most of the returns came, unsurprisingly, from its largest components, the 4 Big Tech stocks: Apple, Microsoft, Google, and Meta. And of course, Tesla and Amazon. Meta has been the standout performer, up 90% this year alone. TSLA is second, up 48% (it was leading most of the year but then faced disappointing Q1 earnings rolling back some of its returns). Their performance was particularly impressive given that they beat even the likes of Apple (+32%), Microsoft (+27%), Amazon (+21%), and Google (+17%), all of which outperformed the SPX by a wide margin. So yeah, piling into Big Tech since January was the best possible strategy in 2023.

Btw, Amazon and Tesla are both in the XLY (Consumer Discretionary) component comprising 9.94% of SPX. The return between XLY and its tech counterparts, XLK and XLC, has been almost perfectly aligned until March, after which consumer discretionary lost some steam and is up 12% ytd (see below).

Other sectors

But overall, 43% of SPX has seen some pretty robust growth year-to-date. Arguably, the flight to tech was the single most important driver of SPX returns, as all other sectors severely underperformed. Let’s have a look at them.

These sectors are most synonymous with value stocks, more defensive. Companies like P&G, Coca Cola, Pepsi, Costco, Walmart, Target, Colgate, Philip Morris (all of which members of the Consumer Staples ETF, labeled XLP, with 7.4% of SPX), health care companies like UnitedHealth, Johnson&Johnson, Pfizer, Merck, AbbVie (all under the label Heath care, XLV, comprising 14.7% of SPX), and of course energy companies, mostly oil producers (Exxon, Chevron, etc.), under XLE being 4.7% of SPX.

Financials also fall into the value category (we saw what happened there) as do utilities (XLU, 3% of SPX) and industrials (like UPS, Boeing, Union Pacific, Caterpillar, Lockheed Martin, etc. XLI, 8% of SPX). Although, keep in mind that consumer discretionary, XLY, in addition to AMZN and TSLA, also contains some value stocks like Nike, Home Depot, Starbucks, McDonalds, Lowe’s, etc.

All these sectors underperformed. Staples (XLP) are, as of recently, up for the year (2%), but still lower than the index itself, while health (XLV) and energy (XLE) are negative along with financials (XLF).

Looking back at 2022 and since the pandemic

Interestingly, this turn of events in 2023 has almost completely overshadowed what was going on during 2022, and especially since the pandemic.

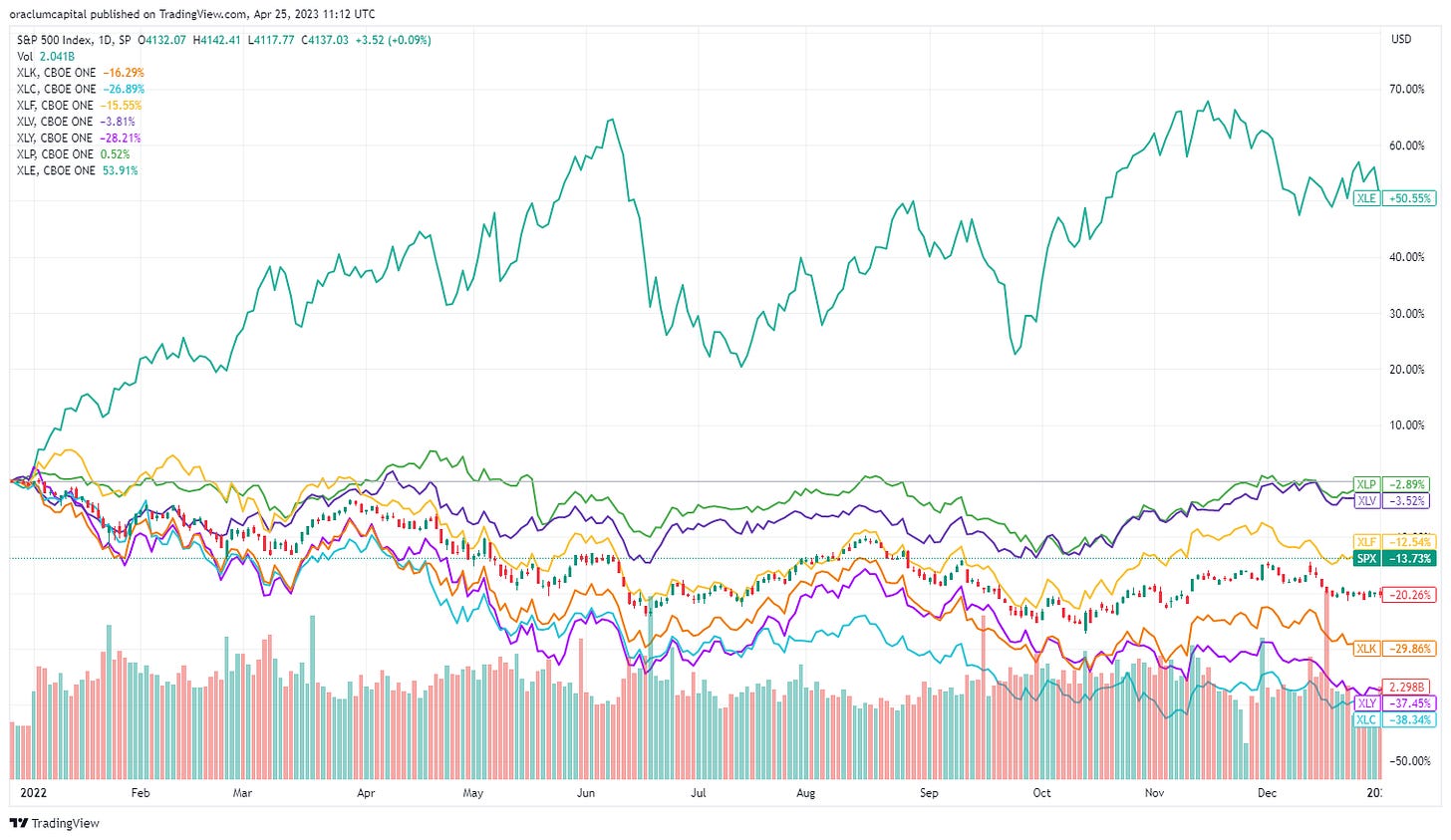

Take a look at 2022 performance of SPX sub-components:

Do you see a pattern?

Energy was heavily outperforming all other components (and all asset classes, actually). An ex-post obvious outcome of high inflation driven by commodities and high energy prices.

DIGRESSION: There is a great paper by Bertrand and Mullainathan called “Are CEOs rewarded for good luck?”, concluding that in energy companies facing an exogenous positive price shock, Boards will pay themselves significant bonuses even though their companies’ performances came as a result of good luck, not skills.

Every components except energy finished negative, where health care (XLV), consumer staples (XLP), and even financials (XLF) - the value stocks - outperformed SPX. Outperformed is a strong word here; they fell less is more accurate.

Tech, on the other hand, had a terrible year. Technology (XLK) was down almost 30%, Discretionary (XLY) and Communications (XLC) down 37%. The Big Six were the major driver down, the same way they were the driver up thus far this year.

But if we roll back a longer time frame, looking at since before the pandemic, the story is again completely different.

Notice how it was energy (XLE) and financials (XLF) that were hurt the most in the aftermath of the COVID shock. Tech was rampant in the subsequent period as everything shifted online. It was a clear argument in favor of growth as opposed to value.

2022 changed this dominant trend, pushed tech/growth down, and value up. Also note that communications, XLC, was the worst performing indicator cumulatively in those three years.

Longer time frame: 2001 to 2023

Let’s look at an even longer time frame, the past 23 years. The table below highlights which sub-component delivered the biggest annual return for each year, from 2001 until 2023. (I took these years given that many of the biggest tech companies today didn’t exist prior to 2000. This makes it more comparable to today’s scenery).

Tech (and growth stocks in general) tends to outperform - often by a wide margin - during strong bull runs, and especially during recoveries (2020, 2009, 2003). Energy was outperforming during the oil price shocks of mid-2000s and during the inflation run of the past two years.

But notice something else. Whenever the S&P had a bad year, either a decline or low growth (e.g. 2022, 2018, 2015, 2011, 2008-07, 2005, 2001-2), it was the value stocks which outperformed (or at least fell less). Consumer staples were the best shot in 2011, 2008, and 2002, and second or third best in 2001, 2005, 2007, 2015, and 2022. Health also did well in some of those years (2022, 2018, 2014, 2011), whereas consumer discretionary and finance have mixed results with respect to these mini-cycles.

Now we are at a crucial turning point of the year. Tech has been the driver thus far, value is falling behind, and the key question is whether this will (can) continue?

What next?

In other words, are we back in the post-COVID regime, the aggressive/recovery bull market, or is this just a temporary repositioning towards growth (tech) that is bound to shift back to value and other defensive stocks?

Which sector are the macro fundamentals favoring at this point? Inflation declining primarily due to falling energy prices and the rise of inventories, combined with a strain on domestic demand, are taking its toll first and foremost on the energy sector. Consumer discretionary is also likely to feel the burden. So these would be the sectors to avoid/short, for now.

But growth stocks are highly sensitive to higher interest rates, right? Absolutely, which is why they got hurt so much during 2022. The run back into tech since Jan 2023 has mostly been associated with expectations of a soft landing, according to which inflation goes down and the Fed starts lowering interest rates this year.

As I mentioned in the previous post, I think this view is wrong. Soft landing is still a low probability scenario, as the Fed raised again this week (to 5.25%), will probably pause for now, and adapt expectations with new inflation and jobs numbers. Higher for longer is still more likely than a soft landing. When/If this changes, I will change my thesis and adapt the portfolio, naturally.

Earnings in focus

A lot of it still comes down to earnings, which were quite good for Big Tech the past two weeks: MSFT, GOOGL, META, AMZN outperformed even though TSLA, in the week before, did not. AAPL came out yesterday, also outperforming. As of last week, 53% of SPX companies reported earnings, and 79% of them beat the EPS estimates, while 74% beat revenue estimates (these will get adjusted down after this week’s earnings but there are still a lot of companies beating earnings estimates). At first, this might be a bullish sign, especially given that earnings outperformed amidst a very uncertain macro environment, but caution is still advised. Earnings have been revised down, setting a low bar for companies to clear. Earnings overall are still in decline, and even though markets tend to bottom before earnings do, the macro conditions will be key in determining whether they keep recovering.

With interest rates at >5%, I don’t see a way for company earnings bouncing back that soon. A banking crash (looking at First Republic) triggering rate cuts is not the positive pivot scenario the bulls are hoping for. It’s still a wait and see type of environment. The sell-off this week (and particularly since FOMC) might have just been the market taking a breather instead of a beginning of a longer decline. It is still hard to tell.

To answer the question from the title; so far it has been growth (read: Big Tech). If considering entering Big Tech, do so with protection (hedging with puts, they got a bit cheaper now), and with a clear view of what’s happening in banking and what’s happening with the overall macro environment.

No better place to keep track of all that than on our newsletter :)

DISCLAIMER: None of the contents of this website can act as investment advice of any kind. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. This website contains no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to share & subscribe!