Looking ahead: the macro big picture

How to position amid uncertain times. A long read. Enjoy!

Amidst all the weekly updates and competition tracking I realized I haven’t posted any long macro overviews for a while now. And these used to be the most read things on this newsletter. So, to amend this, here is a macro overview of markets during the past 4 months of 2023 and what can this tell us about the upcoming two months (end of Q2) and beyond.

What you’ll read about:

An overview of the macro environment thus far: inflation, Fed rate hikes/cuts

Correct interpretation of bond market signals

Are we in a new bull market or not?

Implications for the EUR/USD exchange rate

Portfolio positioning (NOTE: not financial advice)

These insights are partially the basis of our macro strategy for the fund, an allocation we have in addition to the more lucrative weekly options positioning (read more here).

I’ll be doing these insights more often. Monthly (or maybe even bi-monthly), just sharing our views and research results, putting them out there for transparency and further scrutiny. This way, it will be easy to go back and evaluate how we did on these. We invite you all to give feedback and/or challenge our ideas.

Let’s jump in.

The macro environment in 2023

At the start of 2023, I held a few talks and did a few public lectures where I expressed our view of the investing environment in the US and Europe in 2023 being contingent upon two factors:

(1) when and how quickly will inflation subside?

(2) how long will central banks keep interest rates high?

This was my conclusion/prediction:

The prevailing data indicates that inflation in the US (and to some extent the EU) is in a gradual decline. Higher interest rates in the US exerted negative pressure on demand, and in addition to easing supply chain effects and a steep rise in inventories over the previous year, prices are expected to ease. This puts additional pressure on central banks (the Fed in particular) to start reducing interest rates before the end of this year. Market expectations are that the Fed will lower rates much sooner than the Fed expects (by mid-2023). This, optimistic, scenario suggests that the economy will undergo a ‘soft landing’, in which inflation goes down back to its 2% target without triggering a recession. The pessimistic scenario sees the Fed keeping rates higher for longer, throughout the year, or until “something breaks”.

Additional uncertainty in markets over the upcoming quarter is related to company earnings and how they reacted to a lackluster 2022. A strong USD during the past year certainly hurt earnings, as will a decline in demand this year. If earnings disappoint, the probability of a soft landing diminishes significantly, and the probability of another market sell-off (the “second leg”) increases.

Finally, an additional factor that will affect markets this year is the post-COVID reopening in China, threatening to create further inflationary pressures over the year (similar to Western reopening during 2021).

Revisiting these conclusions, they all seem solid. Inflation has indeed gone down (pressures from both demand and supply), although the core rate remains sticky. The soft landing scenario is still possible, in fact, many are claiming that its probability has gone up. As for China, its economy grew stronger than expected after its reopening, however, its inflation rate is also down, contrary to my expectations, implying that the two reopening scenarios most likely will not have the same effects. I’ll say more on the potential impact of earnings in my next post.

Inflation

In the US, headline inflation is steadily decreasing (the peak was June 2022), although core inflation is still sticky. This makes sense as energy prices - the key driver of inflation last year - started to subside and are now back to where they were before the war in Ukraine, and some are even back to where they were before the price hikes started (like gas, lumber, steel). Even oil prices are in a down trend since their June 2022 high. Core inflation, as you might know, does not include food and energy costs, which is why it was lagging behind headline inflation growth during 2022:

However, core inflation is the type of inflation that tends to be more durable. The energy price spikes did their damage as the rest of the economy had to adapt.

Think about how firms react to this. Raw material producers first feel the supply and demand mismatch and start charging higher prices (this started already during the post-COVID surge of demand, as I wrote about before). Manufacturers are the first to feel this as their input prices start going up. This is also, in many cases, due to middlemen suppliers, who see an opportunity to increase their own margins as a consequence of the raw materials S&D mismatch. Manufacturers will shift their higher prices down to retailers, and soon enough every firm will start increasing prices, probably even more than necessary simply to offset the uncertainty, shifting them over to the end consumer. The end consumers are, coincidentally, employees, and they demand higher salaries, raising unit labor costs, and adding pressure on firms to keep raising prices. Again, more than necessary, as firms need to offset all future uncertainties over inflation. Think of it as a type of hedge.

This is econ 101. It is the reason why wages and prices tend to be sticky, particularly for all the core goods and services which adapted to the initial price hikes and will now keep these prices high for a while. Remember, inflation measures price change, meaning that any increase month-on-month is adding to higher prices. We are currently observing slower growth of prices, but not a decline.

However, even core inflation is likely to start growing more slowly due to the bullwhip effect of high inventories built up during 2021 and until mid 2022. A shortage is always followed by a glut. Therefore, we will keep noticing headline inflation going down, and core inflation will follow with a certain time lag. Only a major shock to the supply side could trigger a reversal in the inflation trend. Particularly when we know that the demand side is also getting restrained in a high interest rate environment. How long will that last?

How will the Fed react?

This is the key question for investors. Many updated their expectations over Fed interest rate hikes after the banking panic in March, when SVB failed (not really much of an event in the end, was it? See the figure below; VIX over the past 20 years. Hardly comparable to even the minor events during 2022, yet alone any of the major ones).

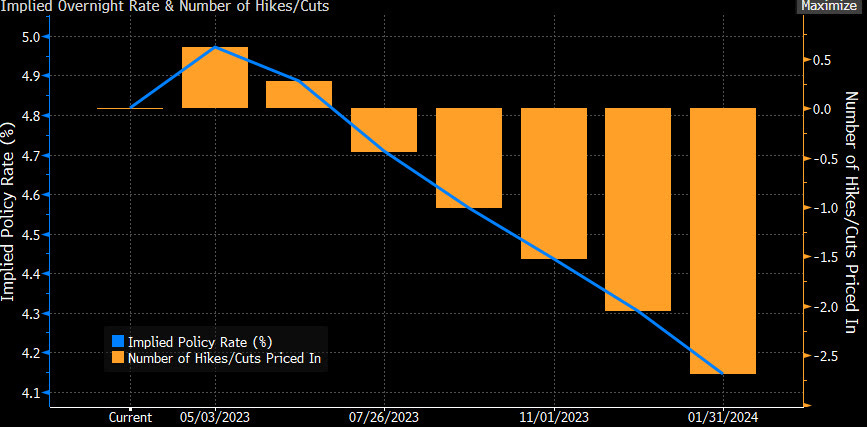

And yet, after the event, the market was heavily pricing in further rate cuts, expecting the Fed to cut several times this year already, seeing rates go down by a full percentage point before the end of this year. This was a reaction to the narrative that “something has broken, so now the Fed must stop the rate hikes and start cutting.”

This is still being priced in, despite the Fed communicating over and over again that they expect rates to stay “higher for longer” during this entire year, to see core inflation come down and stay down. But markets have lost a bit of confidence in the Fed over forward guidance. Why? Because the Fed was late in recognizing the inflation threat back in 2021 when bond markets were clearly signaling that inflation was not likely to be transitory (see figure in the next section). The same way, many investors are now saying the Fed has hiked too much and are entering into yet another policy mistake. Hence the feeling that the Fed is now basically chasing the bond market and will be forced to cut sooner than what they’ve communicated.

But the key conundrum remains: will the Fed cut rates in a soft-landing pivot (inflation down, labor markets resilient, no more headwinds for the economy), or will they cut rates because investors are pricing in a recession before the end of the year? The equity market, for now, seems to believe the first scenario. I disagree.

Bond market expectations

Let’s look at the bond market reaction. After the March banking panic, the 2-year yield fell down rapidly. More than a full percentage point (from 5% to less than 4%) in a matter of a few days. This was the bond market immediately pricing in expected rate cuts from the Fed (as per the previous figure).

The 2-year yield is typically an excellent predictor of the federal funds rate; the ultimate interest rate leading indicator. It correctly anticipated rate hikes and rate cuts over the years with almost perfect accuracy. Currently, it is pricing in rate cuts down to 4% before the end of the year.

Bond yields going down can be due to two things in this case: (1) Investors once again buying bonds because they no longer see inflation as a problem, so they are free to pile up on bonds, compressing their yields (remember, when inflation is high, bonds are unattractive due to lower relative returns, so they get sold more often, which pushes their prices down and yields up). Or (2) Investors buying bonds as a recession hedge, fearing that the Fed has gone too far in its rate hikes.

The first scenario is the “soft landing” that keeps equity investors riled up with narratives that we are at the beginning of a bull market since October last year. According to some technical and even momentum indicators, it sure looks like that (higher highs and lower lows, compressed volatility with VIX at 16, etc.).

In my opinion, this is a sideways market. It doesn’t have the price action momentum to classify for a longer duration bull market. SPX keeps bouncing between 3800 and 4200 since October, failing to penetrate 4200 on several occasions. And if you take out the 6 big tech stocks, SPX is actually in a down trend. The flight to tech has been happening ever since January and has continued in March as investors sold bank stocks and doubled down on big tech. There is still way too much uncertainty for a proper bull market.

New bull market of just a bunch of bear market rallies?

In fact, as of the end of April, it looks more likely that we’ll have another correction, another sideways leg down (perhaps not all the way to 3800, but some 4-5% correction could happen). The VIX is certainly positioned for it, and the VVIX (measuring the volatility of volatility, expected volatility on the 30-day VIX forwards) is sending a signal:

Whether or not this happens will depend on company earnings. A few major disappointments could act as a catalyst for a sell-off. More on that next time.

However, do keep in mind that one of the main reasons we are witnessing rallies so often is due to so many shorts out there. As volume is being suppressed, a small batch of buyers dominate the market, sending it up in brief but powerful rallies, forcing the shorts to close. Being short is not like being long, it’s much harder. You have to hedge constantly and maintain active risk management. So any longer duration rally will force you to close the shorts by buying stocks, thus extending the rally. The market won’t engage in a major sell-off until most shorts are squeezed out. During peak bearishness, this is highly unlikely.

Borrowing from George Soros (Alchemy of Finance, pg. 315):

"...financial markets constantly anticipate events, both on the positive and on the negative side, which failed to materialize exactly because they have been anticipated."

“…financial crashes tend to occur only when the are unexpected.”

This means we could go up even further, kill off even more shorts in the process, setting up the ultimate bull trap before a crash. During bear markets it is a common to see both bears and bulls lose money. Markets can and will be brutal.

Portfolio positioning

This situation makes it very difficult to position a portfolio for a longer trend. In these types of situations it makes more sense to be defensive (long cash, short risk), and look for short term trades that protect the portfolio during times of heightened uncertainty.

It comes down to the probabilities assigned to the macro scenarios.

The upper limit for SPX will only break in case of a soft landing (inflation on a clear trend back to 2%, labor markets resilient, no recession), and this scenario is still, in my opinion, of a low probability (p=10-15%). If it does happen, only then will we enter a sustainable bull market.

Even if higher for longer does not materialize for the entire year, and the Fed is forced to cut, this happens in a recession scenario (p=50-55%), triggered by a negative surprise in earnings, and all the headwinds facing the economy caused by higher interest rates. I feel that this is the scenario the bond markets are bracing for.

We could, however, go through the entire year in the same sideways regime, where the Fed does manage to keep interest rates high during the entire year (higher for longer, p=35%) without triggering a recession, but also with mounting uncertainty and more of the same of what we have seen over the previous two quarters (Q1 2023 and Q4 2022). A sideways market, sometimes going down due to unexpected bad news, but often going into extended short squeeze rallies.

If you believe the recession scenario, a temporary short equity position is warranted (although it has to be hedged, best with a low delta - i.e. cheap - call option), although it requires considerable effort to maintain, and is not recommended to take up a large part of the portfolio. Puts are too expensive at this point. Too much demand. Maybe after a bull trap they become attractive again. Unless you also go for low delta puts as a hedge for a long equity position.

On the other hand, a better option might be going long bonds, riding the trend of inflation going down even more and potentially a good bet in case the recession happens. Getting the best of the first two scenarios. But not really performing that well in the third. Gold is thus becoming an increasingly attractive alternative in the third scenario. Also, a good hedge in any case might be some exposure to China. Europe also looks attractive as its indices are pulling up all time highs, but I would be much more careful on Europe for now. Observe for a while.

The best suggestion would be to diversify and combine aspects of each scenario into a portfolio. Assigning the highest weight to the trade of a scenario you believe to be most likely, and be hedged in case of the other two occurring. The current trading environment is a “wait and see” kind of thing. So we’ll wait and see.

Currency hedge

Finally, what about a currency hedge? The euro has jumped up considerably against the dollar ever since November last year. This was in line with expectations that the Fed will start cutting rates before the ECB this year. With exchange rates its all about interest rates - look up covered interest rate parity condition to see what I mean. Briefly, if interest rates in country A are higher than in country B, the currency of country A will appreciate against the currency of country B. This was the case during most of 2022. The US Fed kept raising rates while the ECB (and most other CBs) kept lagging behind, which kept the dollar appreciation against the euro (and almost every other currency).

But now, ECB keeps on raising, while the Fed is expected to stop and reverse, so the EUR/USD exchange rate is reacting to this anticipation. If the Fed keeps higher for longer, the USD might reverse back up, but if a recession scenario is triggered, the USD will most likely decline further. If you hold only USD exposure, a USD/EUR short is a decent hedge to hold for now.

DISCLAIMER: None of the contents of this website can act as investment advice of any kind. Oraclum Capital, LLC (Henceforth ORCA) is a management company responsible for running the ORCA BASON Fund, LP, and for organizing a survey competition each week, where it invites the subscribers to its newsletter (this website) to participate in an ongoing prediction competition. The information presented on this website should under no circumstances be used to solicit any investment advice, nor is it allowed to be of commercial use to any of its readers. This website contains no information that a user may use as financial or investment advice. All rights reserved. Oraclum Capital LLC.

And, as always, don’t forget to share & subscribe!

Why do you think that gold is a good alternative for 3rd scenario?